The UK used car market continues to evolve with diverse trends across various vehicle categories, particularly with a noticeable rise in the electric vehicle (EV) market. This report analyses the data for the week ending 18th January 2025, focusing on the used car market (ICE) and electric used car market (EV).

Used Car Market Insights (ICE)

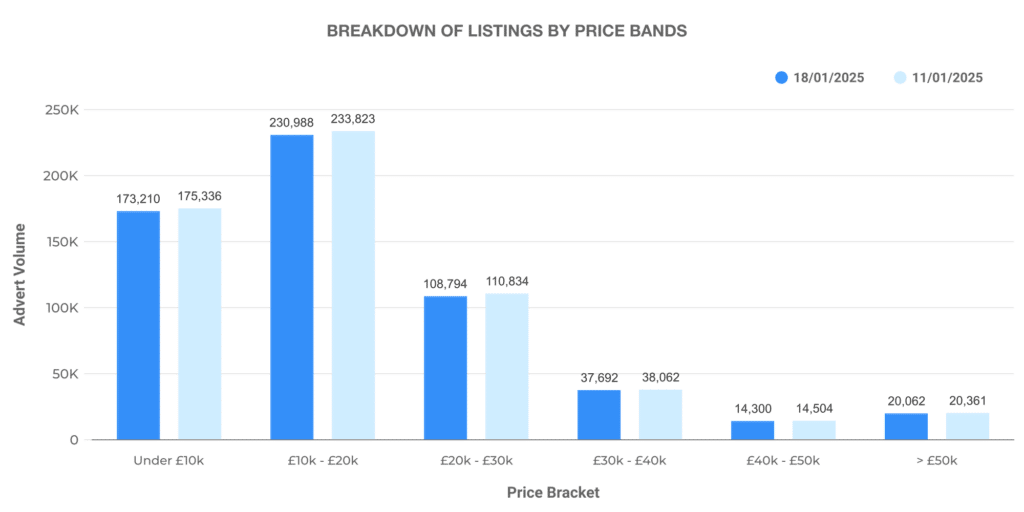

The week saw 10490 dealers listing 597,076 used internal combustion engine (ICE) vehicles. The average price of these listings was £18,715, with a notable distribution across different price bands. The majority of ICE vehicles fell within the £10,000 to £20,000 range, followed by listings in the £20,000 to £30,000 and £30,000 to £40,000 price brackets.

- Price Bands for ICE Listings:

- 0-10K: 17,536 vehicles

- 10-20K: 175,336 vehicles

- 20-30K: 233,823 vehicles

- 30-40K: 110,834 vehicles

- 40-50K: 38,062 vehicles

- 50K+: 14,504 vehicles

The majority of listings were in the 10K-30K price range, reflecting the demand for mid-range vehicles. The higher-end segments (above £50,000) also showed substantial activity, indicating a strong market for luxury cars.

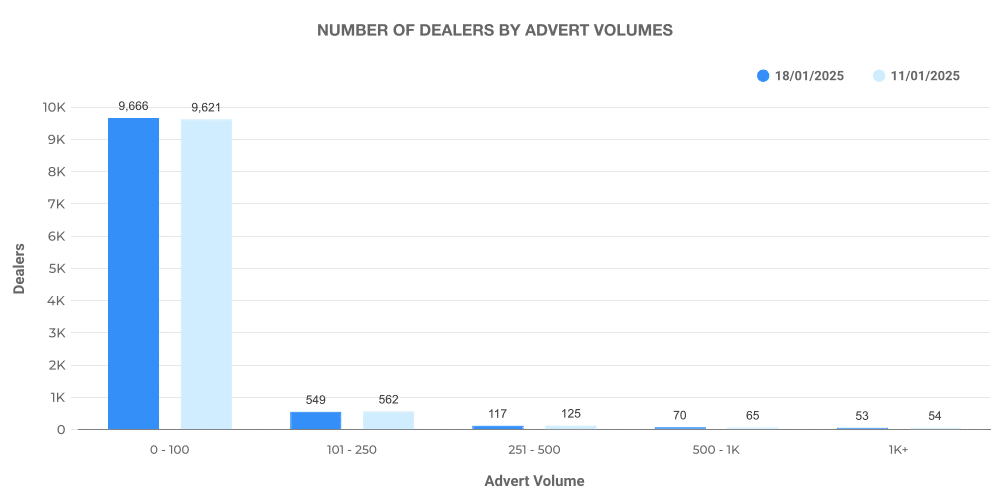

- Dealer Volume Distribution:

- Dealers with 0-100 listings: 216,662

- Dealers with 101-250 listings: 64,822

- Dealers with 251-500 listings: 17,955

- Dealers with 500-1K listings: 7,543

- Dealers with 1K+ listings: 3,640

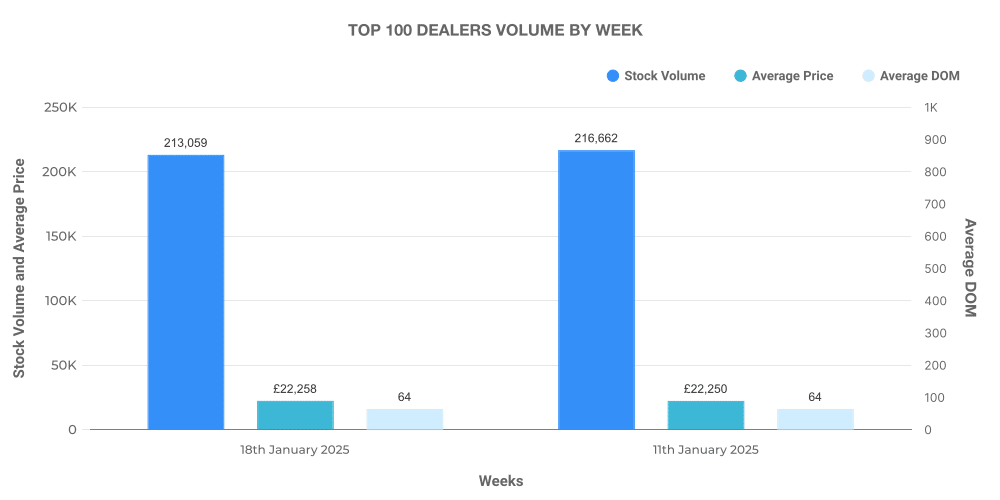

The market is highly fragmented, with most dealers holding smaller volumes of stock. However, the top 100 dealers represented a significant portion of the total listings, with their stock volumes averaging higher than non-top 100 dealers.

- Top 100 Dealers:

- Total Stock: 125,655 vehicles

- Average Price: £22,250

- Average Days on Market (DOM): 64 days

The top 100 dealers are crucial players in this market, maintaining a higher average price and quicker stock turnover compared to smaller dealers.

Electric Used Car Market Insights (EV)

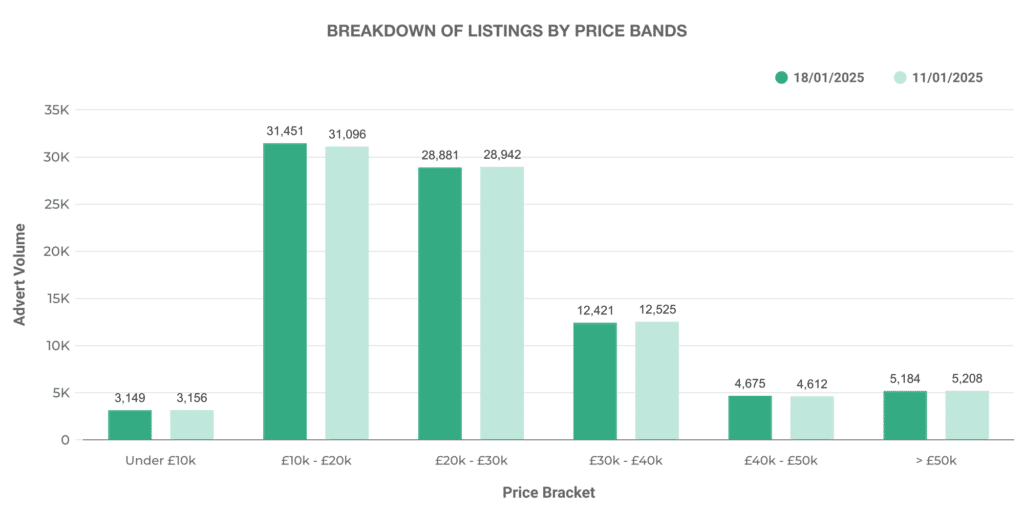

The electric vehicle market also continues to show growth, with 4,451 dealers listing 87,016 used electric cars in the week ending 18th January 2025. The average price of these listings was £26,769, reflecting the premium nature of many electric vehicles.

- Price Bands for EV Listings:

- 0-10K: 3,149 vehicles

- 10-20K: 31,451 vehicles

- 20-30K: 28,881 vehicles

- 30-40K: 12,421 vehicles

- 40-50K: 4,675 vehicles

- 50K+: 1,762 vehicles

Similar to ICE vehicles, the bulk of electric cars were listed in the £10,000 to £30,000 price range, although fewer vehicles were listed in the premium categories above £50,000.

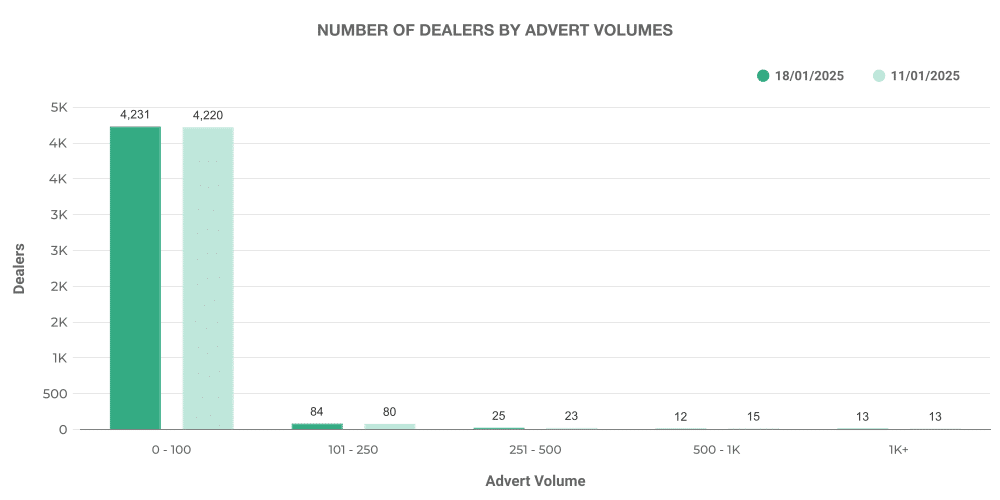

- Dealer Volume Distribution:

- Dealers with 0-100 listings: 52,865

- Dealers with 101-250 listings: 15,679

- Dealers with 251-500 listings: 4,684

- Dealers with 500-1K listings: 1,937

- Dealers with 1K+ listings: 811

The electric vehicle market is less fragmented than the ICE market, with fewer dealers holding larger stock volumes. The top 100 dealers played a key role in driving the EV market.

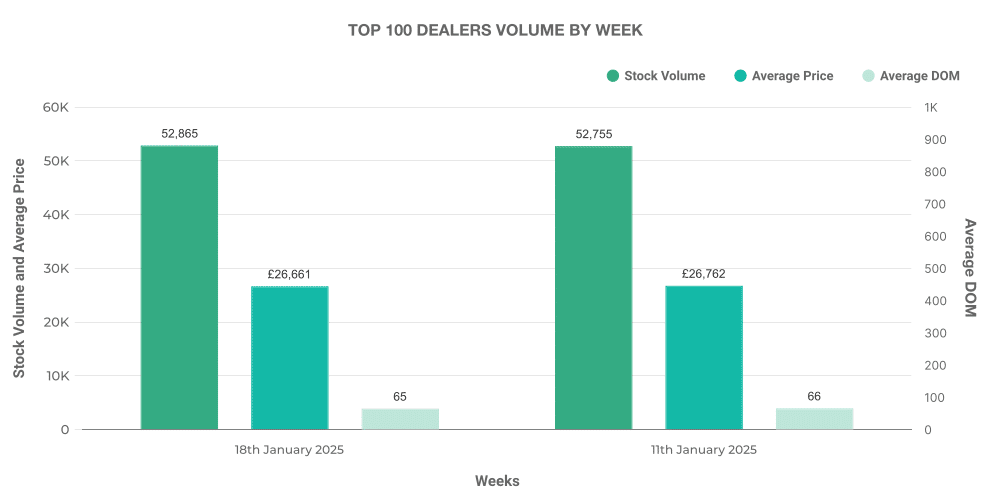

- Top 100 EV Dealers:

- Total Stock: 52,865 vehicles

- Average Price: £26,661

- Average Days on Market (DOM): 65 days

The top 100 EV dealers similarly represented a significant proportion of the stock, with vehicles priced higher than the overall market and an average turnover time comparable to that of ICE dealers.

Comparison of EV vs ICE Listings

As of the week ending 18th January 2025, the electric used car market represents approximately 14.57% of the total used car listings, with 85.43% of listings belonging to internal combustion engine vehicles. While the proportion of electric vehicles remains a fraction of the overall used car market, it continues to grow steadily, with a 0.22% increase in EV listings compared to the previous week.

The average price of electric vehicles listed was significantly higher (£26,768) than that of ICE vehicles (£18,715). This reflects the higher cost of many EV models, driven by their newer technology and premium features.

Price Trends for ICE vs EV

The UK used car market remains dynamic, with the electric used car market steadily gaining share. The high average price of EVs indicates strong demand for newer, high-quality vehicles, particularly in the £20,000 to £30,000 range. On the other hand, ICE vehicles continue to dominate the market, with more affordable options available in the sub-£20,000 categories, appealing to a broader range of buyers.

Next week: 25th January | Previous week: 11th January