Understanding the trends and patterns in the UK’s used car market is an ongoing necessity for all associated businesses. Subsequently, this analysis will highlight the key insights into the UK’s used car market. The focus will be on both electric used cars (EV) and combustion engine vehicles (ICE).

The State of Electric in the Used Car Market

The electric used car market has been witnessing steady growth, marking a decisive shift in buying preferences.

For the week ending on 25th October 2025, the market reported a total of 36,588 used electric vehicles (EV) listed across 2,706 dealers. This further underscores the gaining momentum of the electric vehicle market.

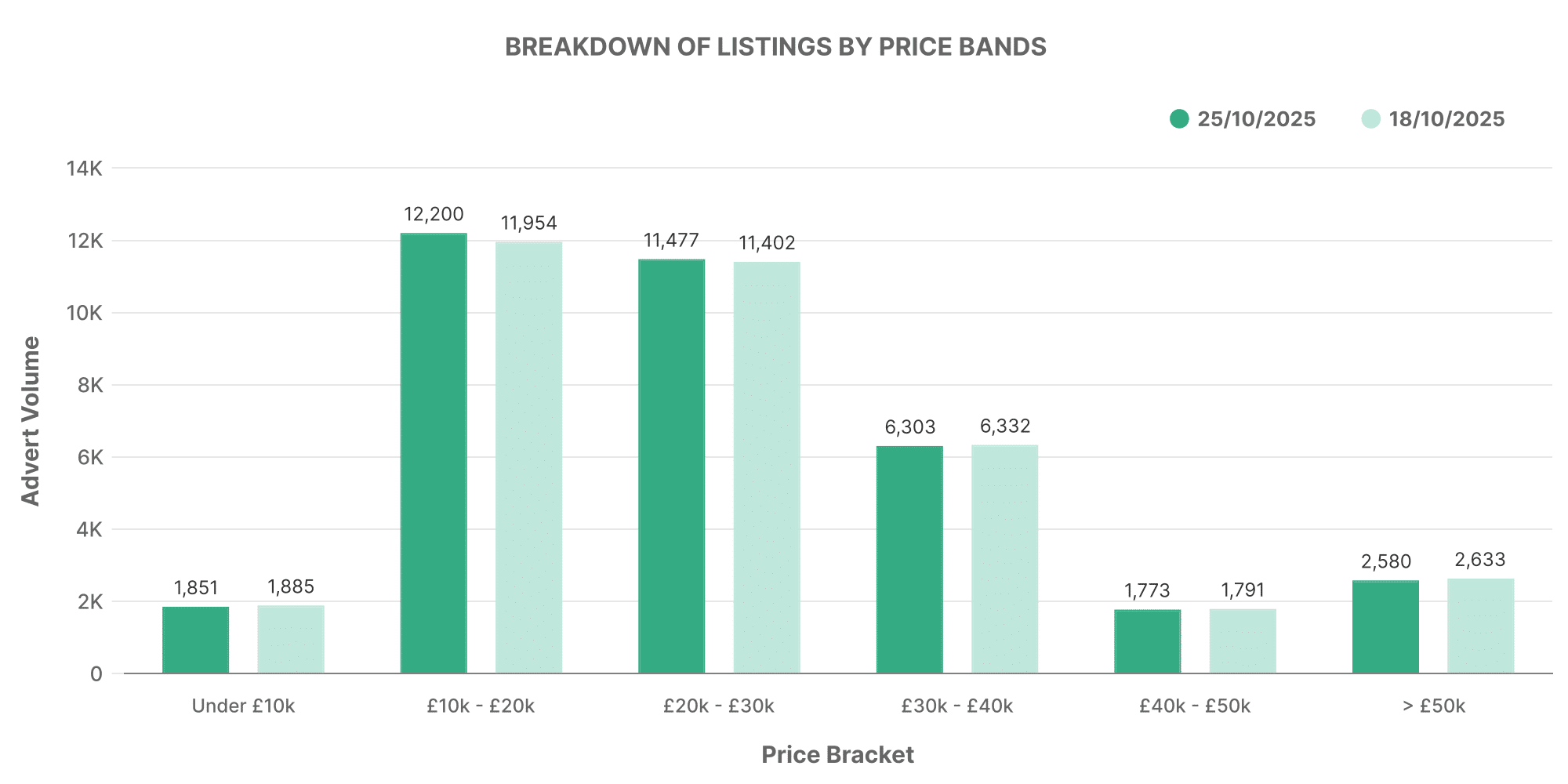

The graph above segregates EV listings by price bands. A substantial number of the listed EVs fall within the £10,000 – £20,000 price range. However, the electric used car market looks promising, and is attracting vehicles of various models, makes and functionalities to meet diverse customer needs.

The Tale of Combustion Engine Vehicles (ICE)

Contrastingly, for conventional Internal-combustion engine vehicles, the market dynamics were somewhat different. For the same week, a total of 619,586 used ICE cars were listed across 10,544 dealers, highlighting the established nature of this market.

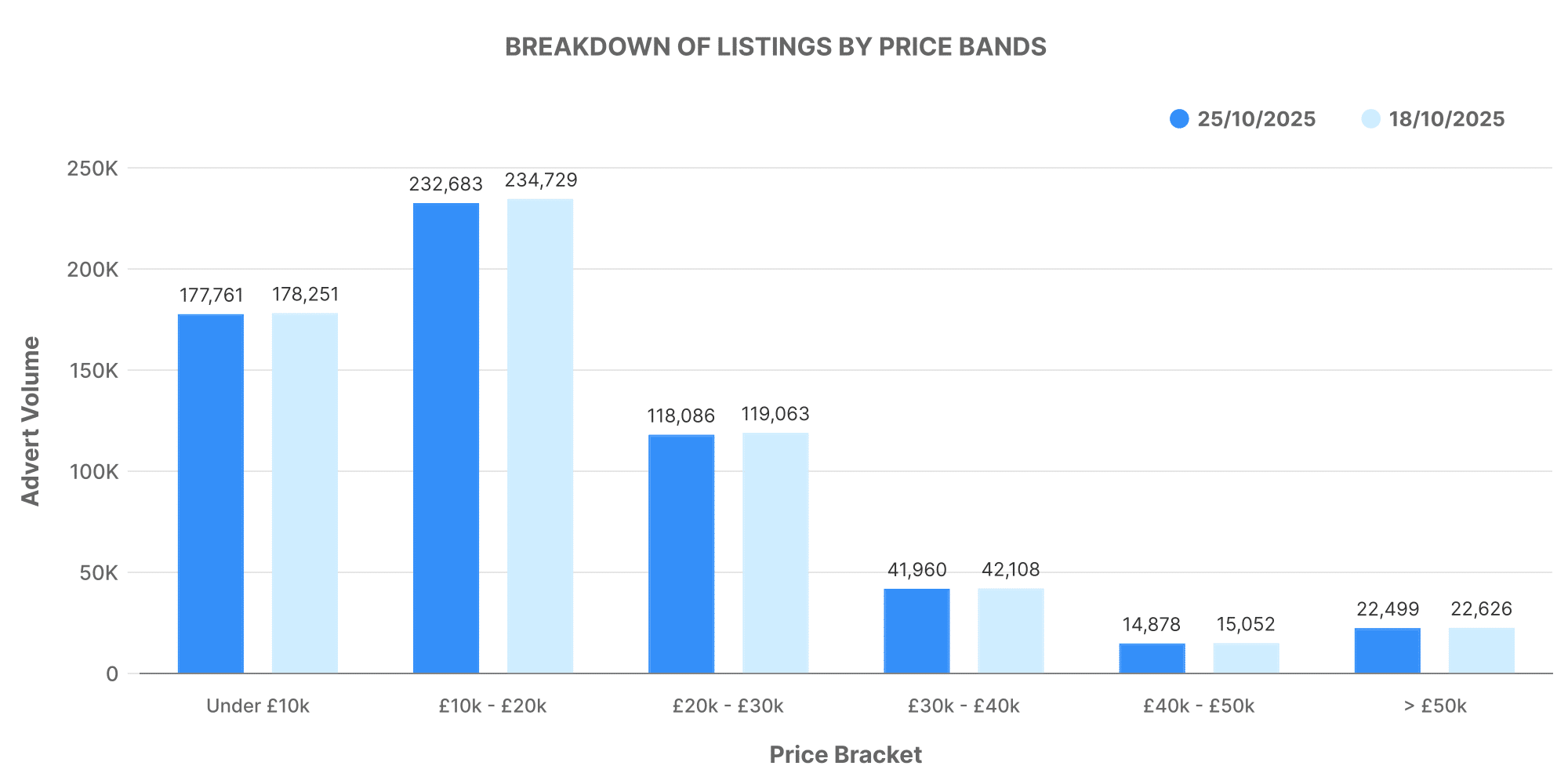

Observing the ICE vehicle price bands, we see that most cars fall within the £10,000 – £20,000 range, similar to the EVs. However, the average price of listed ICE cars (£19,107) was noticeably lower compared to EVs (£26,628).

Dealer Volume Analysis

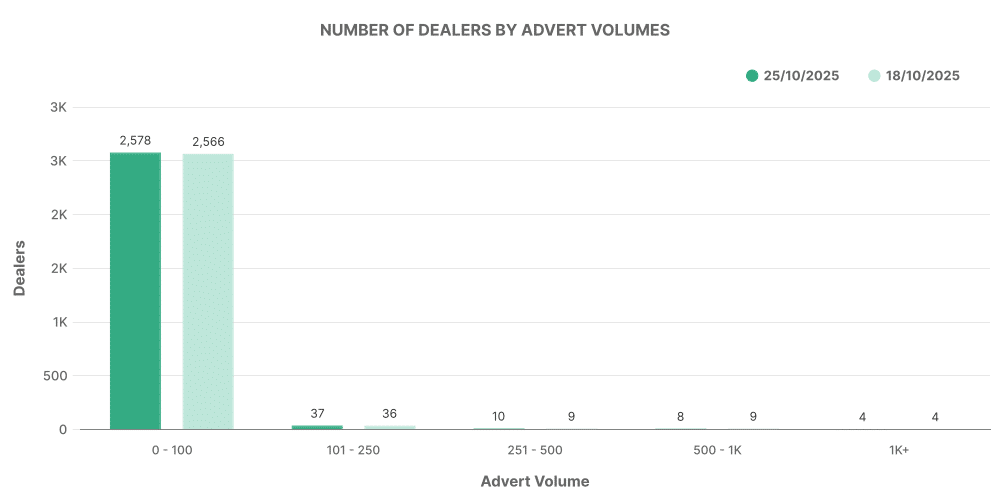

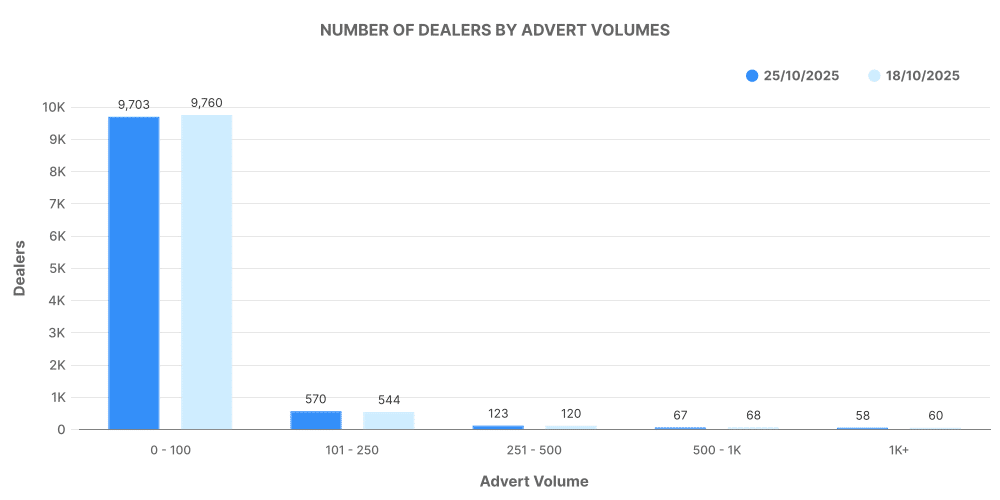

Next, we dive into the volume data for each type of vehicle.

For EVs, the majority of dealers listed between 0-100 vehicles, reflecting the emerging nature of this market.

For ICE vehicles, the dealer volume was well-distributed, revealing a mature market with participating dealerships of different capacities.

Top 100 Dealers: ICE vs EV

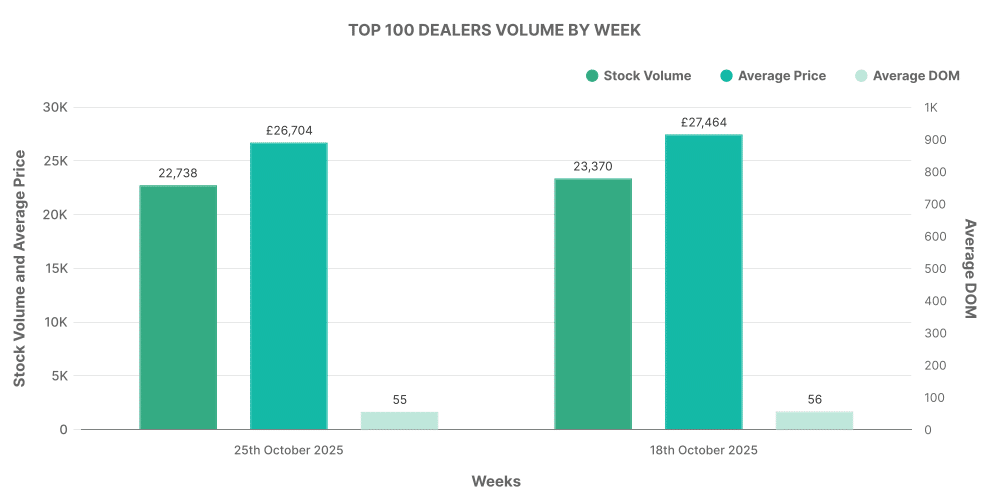

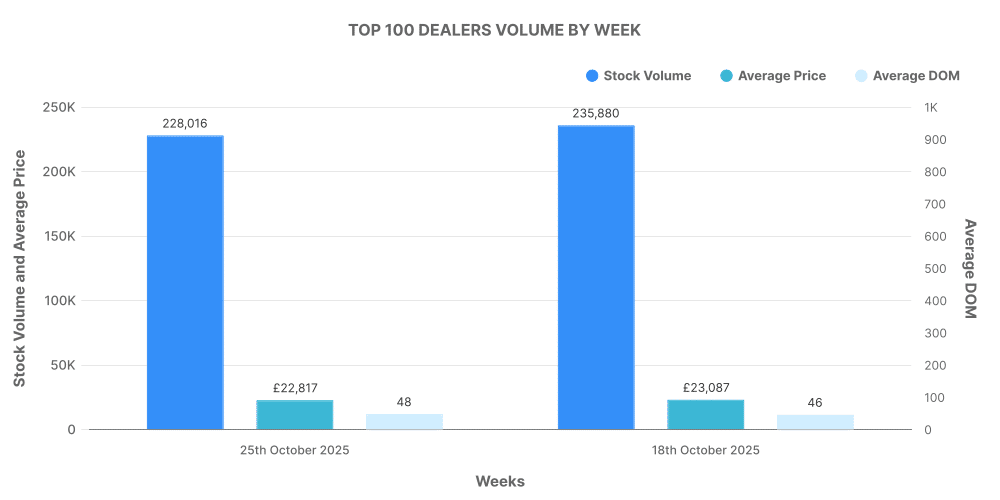

In an interesting comparison, this analysis looked at the top 100 dealerships by listing volume for both EVs and ICE vehicles.

For EVs, the top 100 dealers accounted for about 20.3% of the total EV listings, a promising indication of market consolidation.

In contrast, the top 100 ICE vehicle dealers accounted for 16.8% of total listings.

Comparison: ICE vs EV

From the insights provided, it’s clear the electric used car market is on the upswing, with an increase in EV sales week on week. Meanwhile, the ICE market remains steady but has seen less significant growth. As more customers lean toward sustainable vehicle purchases, it’s expected that these trends continue, with EVs assuming a more significant portion of the UK used car market in the coming years. Automotive businesses must bear these insights in mind while strategizing for growth.