Marketcheck, the UK’s most significant source of data on the used UK market, has today published an analysis of sales figures so far in 2025.

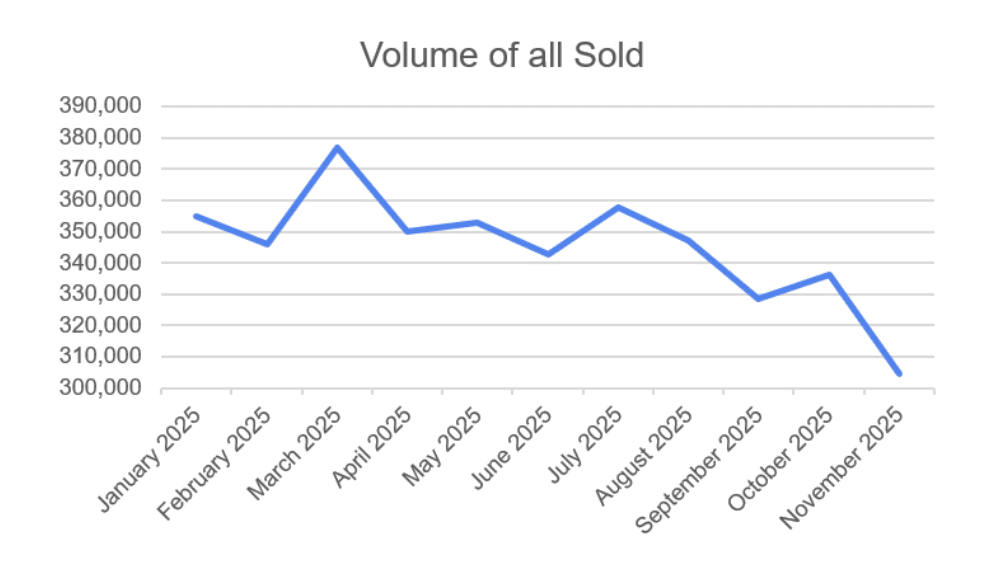

Marketcheck’s analysis of all used cars sold this year found a significant fall in sales last month. In January 354,946 used cars, across all makes, models, and fuel types, were sold throughout the UK, reaching their peak in March with 376,780 sold.

Last month, only 304,732 used cars were sold, representing a drop of 19.27% (72,048) when compared with their peak in March. When compared with October, sales dropped by 9.52% (31,502), with 336,234 used cars sold that month.

| Month | Volume of all Sold |

|---|---|

| January 2025 | 354,946 |

| February 2025 | 346,049 |

| March 2025 | 376,780 |

| April 2025 | 350,208 |

| May 2025 | 352,907 |

| June 2025 | 342,716 |

| July 2025 | 357,823 |

| August 2025 | 347,358 |

| September 2025 | 328,325 |

| October 2025 | 336,234 |

| November 2025 | 304,732 |

Alastair Campbell, Marketcheck UK, commented:

“After a strong start to the year, the UK’s used car market has clearly slowed, with sales in November falling to their lowest level since January. Volumes are down over 19% from the March peak, and nearly 10% on last month alone – signalling a period of stagnation as consumer confidence weakens and economic uncertainty takes hold.

This drop-off suggests many buyers may be delaying big-ticket purchases heading into winter, especially with higher living costs continuing to squeeze household budgets. The next few months will be critical in showing whether this is a seasonal dip or the start of a broader market cooling.”

ENDS

Notes to Editor:

| Month | Volume of all Sold | Avg. Last Listed Price |

|---|---|---|

| May 2023 | 268,650 | £17,848.21 |

| June 2023 | 265,025 | £17,957.03 |

| July 2023 | 257,946 | £17,458.42 |

| August 2023 | 276,786 | £17,466.97 |

| September 2023 | 270,002 | £17,375.27 |

| October 2023 | 270,039 | £17,188.43 |

| November 2023 | 273,038 | £16,633.39 |

| December 2023 | 222,225 | £16,969.44 |

| January 2024 | 337,170 | £16,284.79 |

| February 2024 | 302,691 | £16,291.04 |

| March 2024 | 329,237 | £16,066.26 |

| April 2024 | 297,494 | £17,061.26 |

| May 2024 | 321,717 | £16,264.20 |

| June 2024 | 312,291 | £16,039.05 |

| July 2024 | 328,432 | £15,727.45 |

| August 2024 | 339,863 | £16,149.27 |

| September 2024 | 336,504 | £16,049.55 |

| October 2024 | 344,789 | £16,004.93 |

| November 2024 | 286,270 | £16,471.63 |

| December 2024 | 238,206 | £16,418.96 |

| January 2025 | 354,946 | £16,510.32 |

| February 2025 | 346,049 | £16,371.19 |

| March 2025 | 376,780 | £16,768.57 |

| April 2025 | 350,208 | £16,473.81 |

| May 2025 | 352,907 | £16,408.29 |

| June 2025 | 342,716 | £16,512.50 |

| July 2025 | 357,823 | £16,464.34 |

| August 2025 | 347,358 | £16,413.93 |

| September 2025 | 328,325 | £16,962.72 |

| October 2025 | 336,234 | £16,848.88 |

| November 2025 | 304,732 | £16,565.20 |

About Marketcheck:

We are the leading source of UK automotive data. We collate, enhance and manage more data on the UK used car sector than any other provider. For automotive businesses we bring unprecedented access to live data to power analysis, pricing, reporting and AI agents on the UK used car market.

We track over 650,000 cars and 11500 dealers across 16k locations daily.

Contact:

Alistair Harrison

[email protected]