This report delves into the latest weekly data from Marketcheck UK, providing valuable insights into the used car market, including both internal combustion engine (ICE) vehicles and electric vehicles (EVs). We’ll examine key metrics, compare ICE and EV segments, and explore how Marketcheck UK’s comprehensive data can aid in optimising your business strategies.

Key Metrics Overview

Internal Combustion Engine (ICE) Vehicles

In the week starting 22nd June 2024, the UK used car market for ICE vehicles recorded a total of 867,784 listings. The average price of these vehicles was £18,003, with an average “days on market” (DOM) of 83 days.

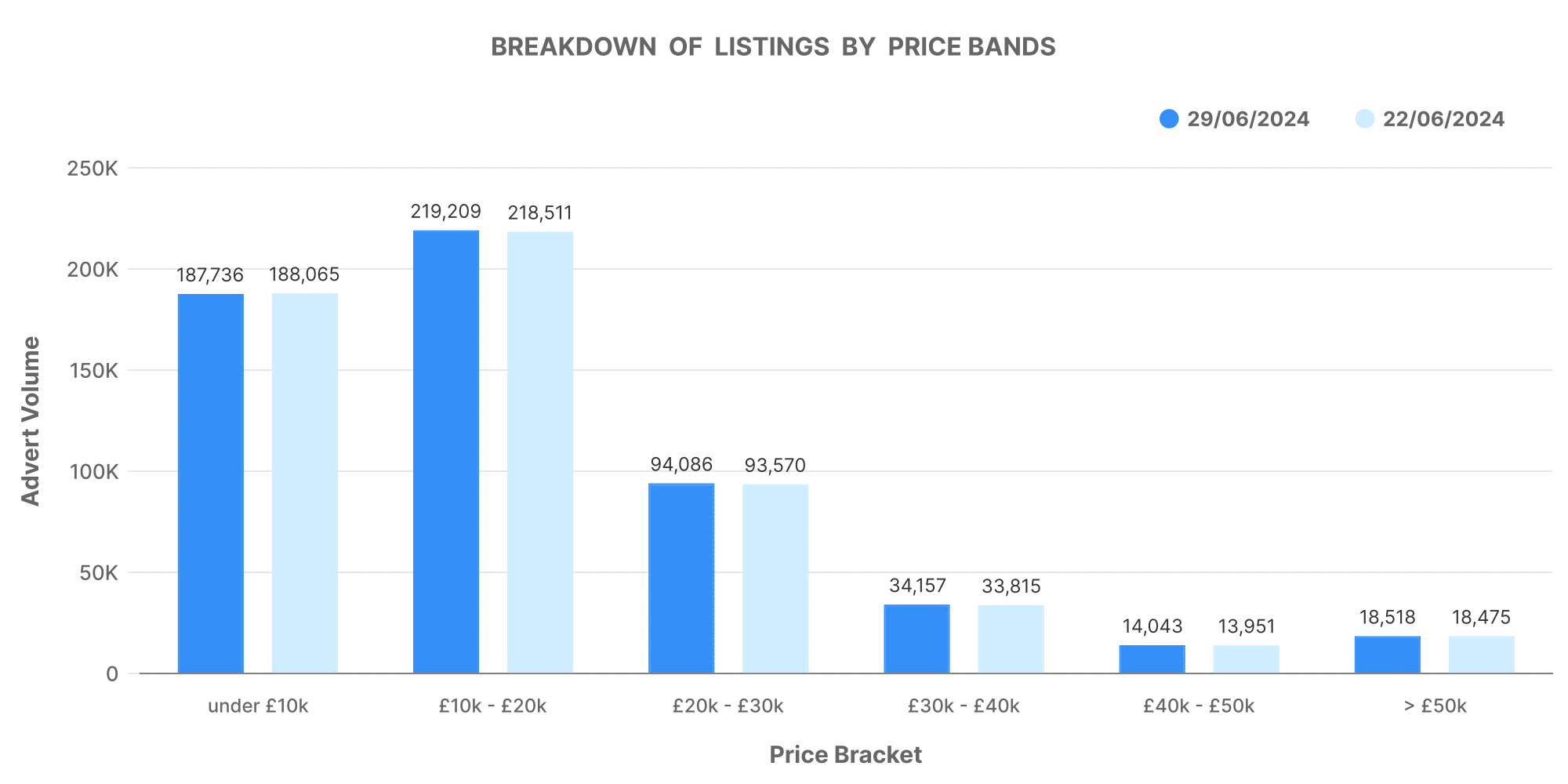

Breakdown of Listings by Price Bands

- 0-10K: 187,736 listings

- 10-20K: 219,209 listings

- 20-30K: 94,086 listings

- 30-40K: 34,157 listings

- 40-50K: 14,043 listings

- 50K+: 18,518 listings

The most significant volume is found in the 10-20K price band, indicating a strong demand for mid-priced vehicles. The 0-10K and 20-30K bands also show substantial activity, reflecting diverse consumer preferences and budget constraints.

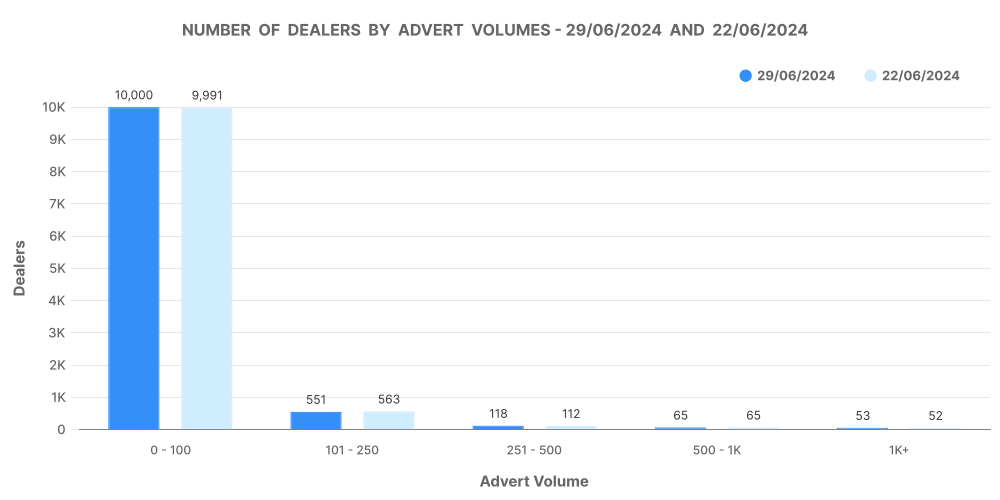

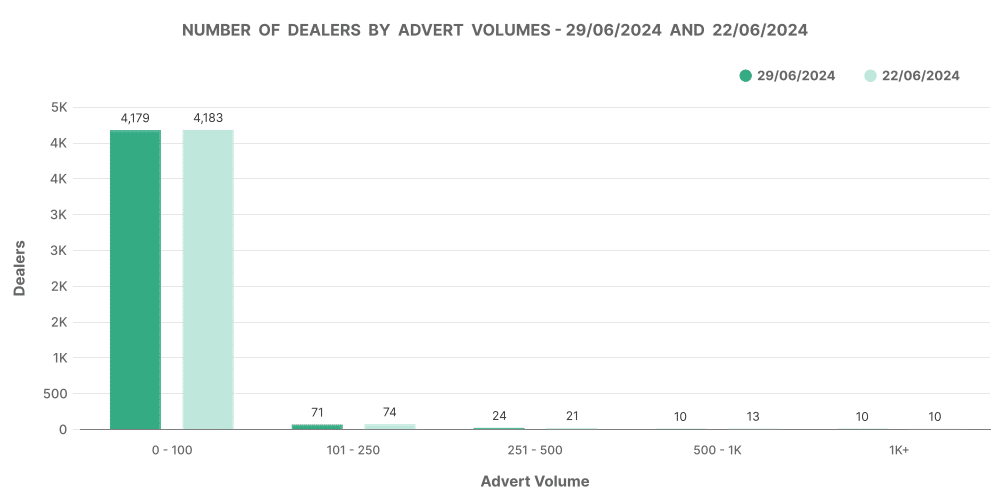

Number of Dealers by Advert Volumes

- 0-100 adverts: 10,000 dealers

- 101-250 adverts: 551 dealers

- 251-500 adverts: 118 dealers

- 500-1K adverts: 65 dealers

- 1K+ adverts: 53 dealers

Most dealers have fewer than 100 adverts, but there are significant contributions from larger dealerships, emphasising the importance of both small and large players in the market.

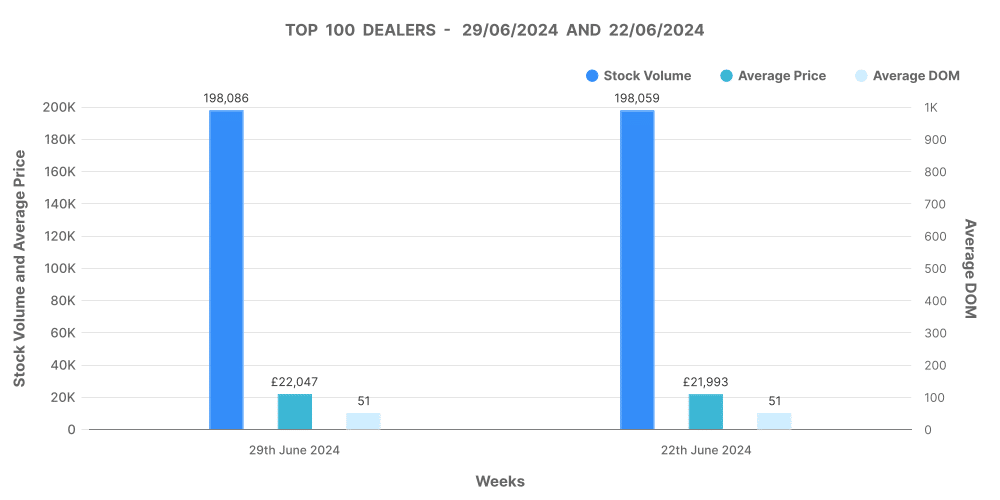

Analysis of Top 100 Dealers by Volume

- Stock volume: 198,086

- Average DOM: 51 days

- Average price: £22,047

- Price increases: 17,297

- Price decreases: 59,371

Top dealers tend to have a faster turnover, with an average DOM of just 51 days and a higher average price, suggesting efficient sales strategies and premium inventory.

Electric Vehicles (EVs)

The EV segment, while smaller, shows notable trends. There were 124,236 EV listings with an average price of £27,327 and an average DOM of 69 days.

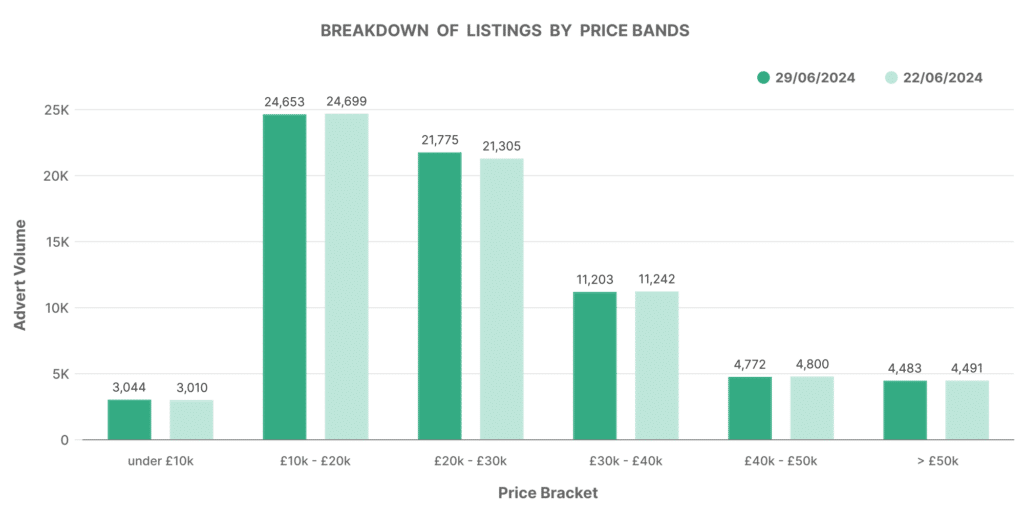

Breakdown of Listings by Price Bands

- 0-10K: 3,044 listings

- 10-20K: 24,653 listings

- 20-30K: 21,775 listings

- 30-40K: 11,203 listings

- 40-50K: 4,772 listings

- 50K+: 4,483 listings

The EV market is more concentrated in the 10-30K range, indicating a growing interest in mid-priced electric cars.

Number of Dealers by Advert Volumes

- 0-100 adverts: 4,179 dealers

- 101-250 adverts: 71 dealers

- 251-500 adverts: 24 dealers

- 500-1K adverts: 10 dealers

- 1K+ adverts: 10 dealers

Most EV dealers have fewer than 100 adverts, showing that the market is still in a relatively nascent stage with significant room for growth.

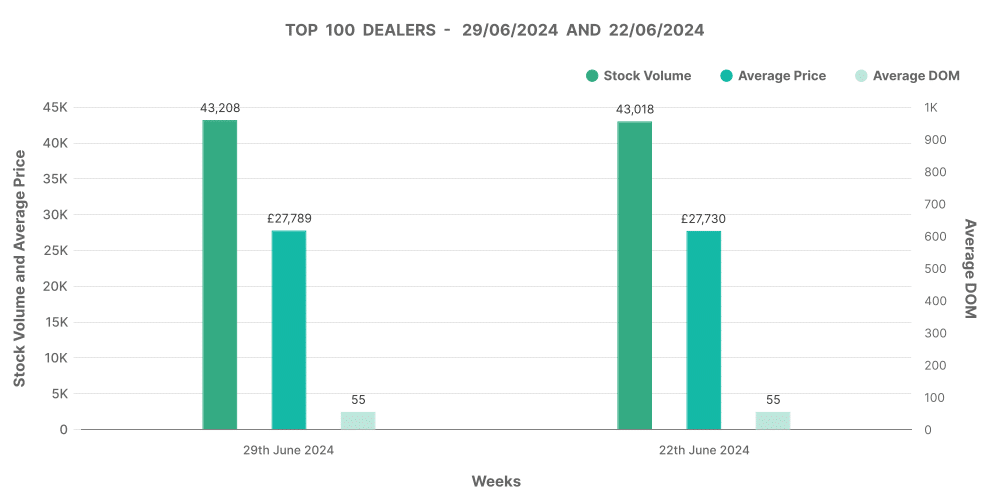

Analysis of Top 100 Dealers by Volume

- Stock volume: 43,208

- Average DOM: 55 days

- Average price: £27,789

- Price increases: 3,272

- Price decreases: 13,405

Top EV dealers also exhibit efficient sales with a lower DOM and higher prices, suggesting that well-managed inventories can lead to quicker sales and better margins.

ICE vs. EV Comparison

Inventory and Pricing

The ICE market is significantly larger, with over 867,784 listings compared to 124,236 EV listings. However, the average price for EVs is notably higher at £27,327 versus £18,003 for ICE vehicles. This price difference reflects the higher production costs and perceived value of electric technology.

Dealer Distribution

Both markets are dominated by smaller dealers with less than 100 adverts, but there is a noticeable presence of larger dealerships in the ICE market. In contrast, the EV market shows a more even distribution among smaller and mid-sized dealers.

Days on Market

EVs tend to sell faster, with an average DOM of 69 days compared to 83 days for ICE vehicles. This trend suggests a growing consumer preference for electric cars and potentially more aggressive pricing and sales strategies in the EV market.

Market Share

EVs currently hold a 12.32% share of the UK used car market in June, with ICE vehicles occupying the remaining 87.68%. This share is gradually increasing as more consumers adopt electric vehicles, influenced by environmental concerns and government incentives.

Marketcheck UK’s Role

Marketcheck UK provides invaluable data that helps automotive dealers make informed decisions. By offering comprehensive insights into current and historical used car listings, Marketcheck enables dealers to:

- Optimise Pricing Strategies: With real-time data on market trends and pricing, dealers can set competitive prices to attract buyers and maximise profits.

- Manage Inventory Efficiently: Understanding which cars sell faster and at higher prices helps in managing stock more effectively.

- Identify Market Opportunities: Recognise trends in consumer preferences and adjust inventory to meet demand, especially with the growing interest in EVs.

- Enhance Sales Strategies: Data on DOM and price adjustments provide insights into effective sales tactics and promotional strategies.