This week’s used car market report covers the period from 22nd June to 6th July 2024, offering insights into both internal combustion engine (ICE) vehicles and electric vehicles (EVs) UK trends.

Overview of the Used Car Market (ICE)

The data for ICE vehicles reveals a comprehensive picture of the current market landscape. Between the weeks starting 22nd June and ending 6th July 2024, there were slight fluctuations in the number of total listings, average days on market (DOM), and average prices.

Key Metrics for ICE Vehicles

- Total Listings: There was an increase from 867,784 to 902,047 listings.

- Average Days on Market: A small decrease from 83 days to 82 days.

- Average Price: Marginal rise from £18,003 to £18,086.

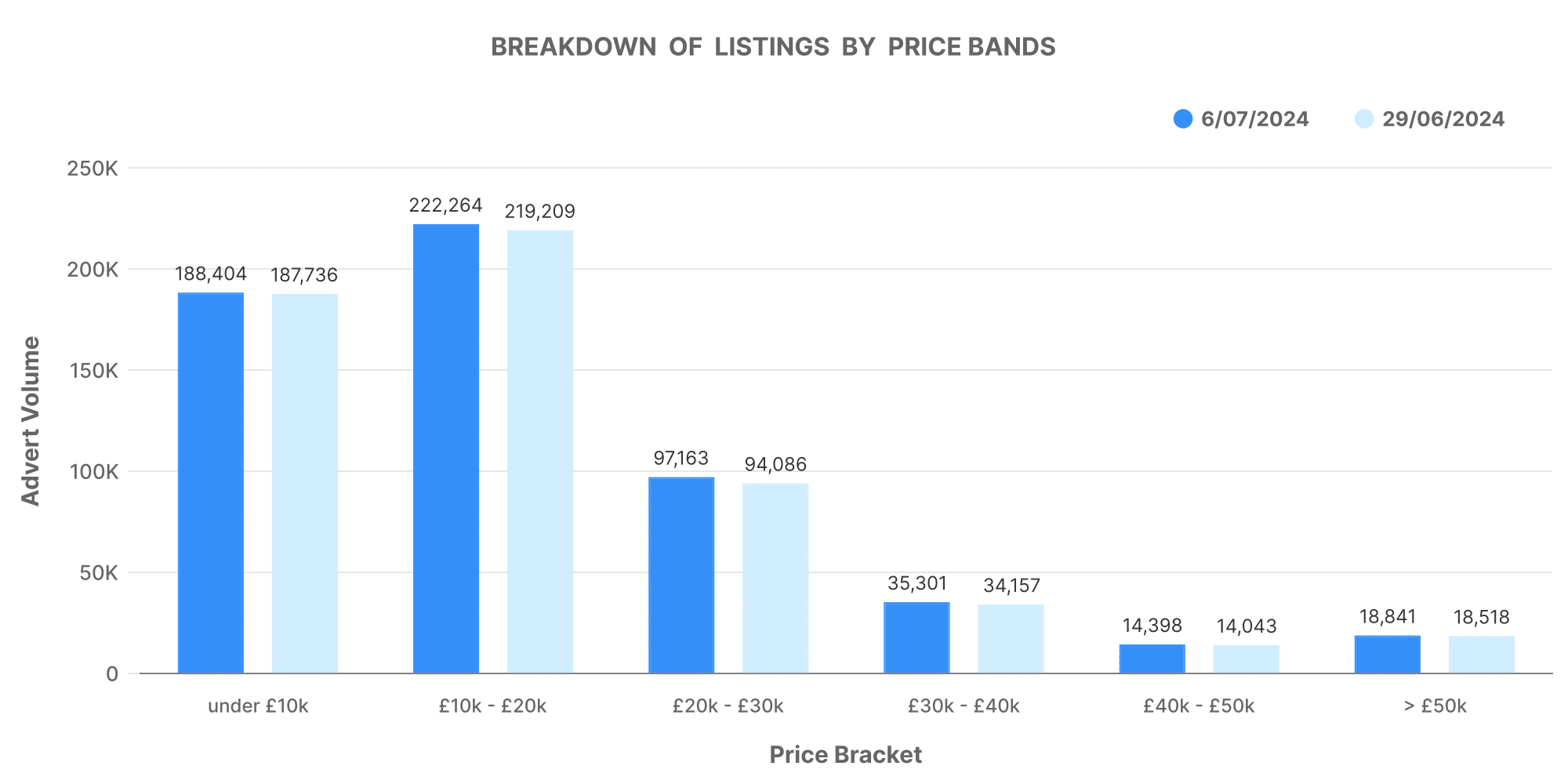

Breakdown of Listings by Price Bands

The price band analysis shows how listings are distributed across different price ranges:

- £0-10K: Increased from 187,736 to 188,404.

- £10-20K: Increased from 219,209 to 222,264.

- £20-30K: Increased from 94,086 to 97,163.

- £30-40K: Increased from 34,157 to 35,301.

- £40-50K: Increased from 14,043 to 14,398.

- £50K+: Increased from 18,518 to 18,841.

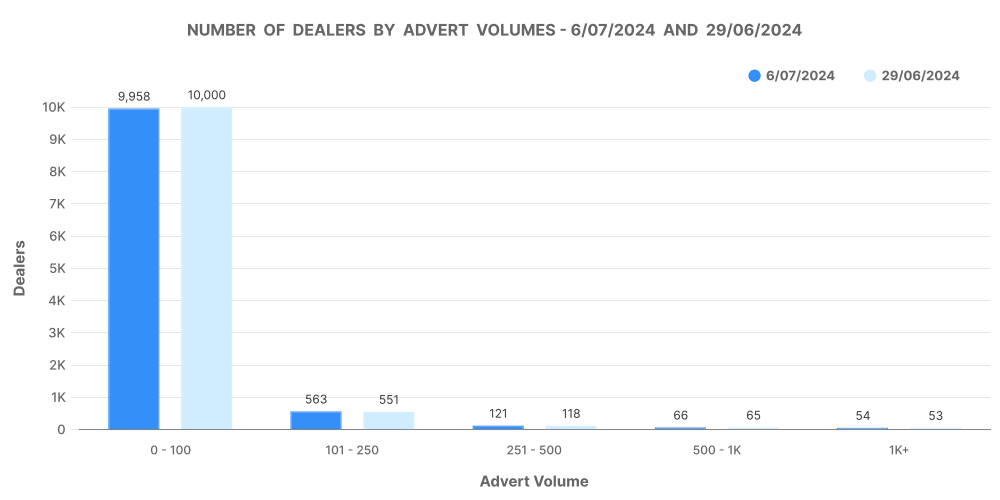

Number of Dealers by Advert Volumes

- 0-100: Slight increase from 10,000 to 9,958 dealers.

- 101-250: Increase from 551 to 563 dealers.

- 251-500: Small rise from 118 to 121 dealers.

- 500-1K: Increased from 65 to 66 dealers.

- 1K+: Increased from 53 to 54 dealers.

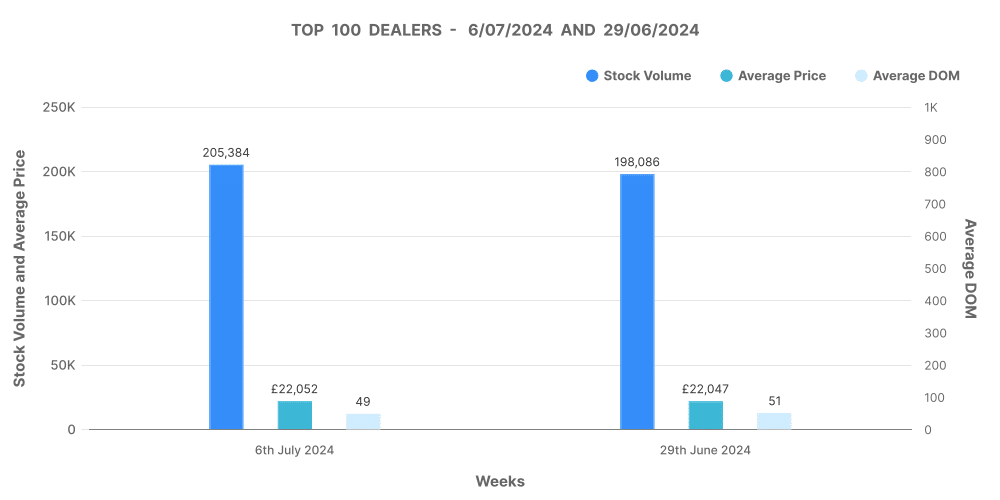

Analysis of Top 100 Dealers by Volume

The top 100 dealers showed consistent performance, with slight changes in inventory and pricing:

- Stock Volume: Increased from 198,086 to 205,384.

- Average DOM: Decreased from 51 to 49 days.

- Average Price: Slight increase from £22,047 to £22,052.

- Price Increases: Significant rise from 17,297 to 22,831.

- Price Decreases: Notable increase from 59,371 to 65,131.

Electric Used Car Market (EV)

The EV segment continues to grow, reflecting a shift in consumer preferences and industry trends. Here’s a detailed look at the key metrics and market dynamics for electric vehicles.

Key Metrics for EVs

- Total Listings: Increased from 124,236 to 132,144 listings.

- Average Days on Market: Reduced from 69 days to 67 days.

- Average Price: Slight rise from £27,327 to £27,367.

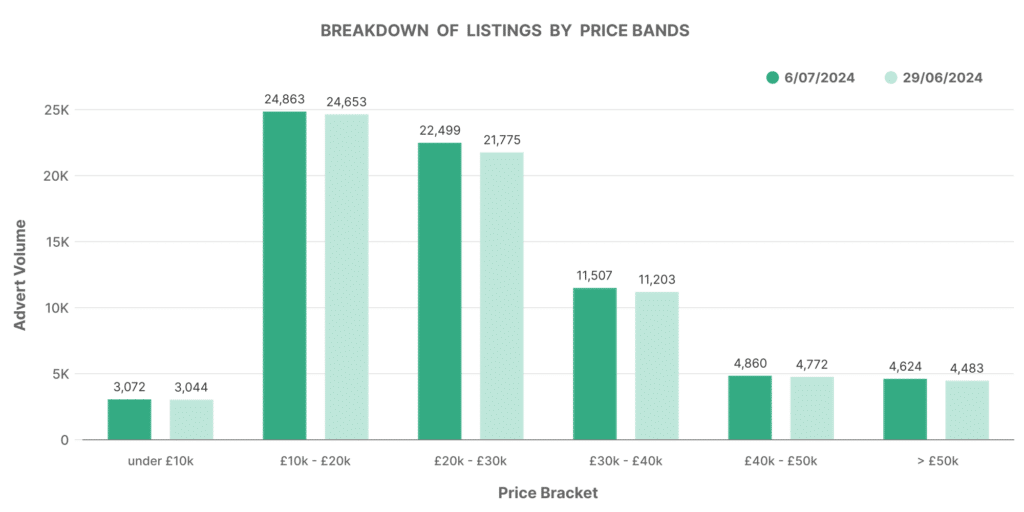

Breakdown of Listings by Price Bands

The distribution of EV listings across price bands shows interesting trends:

- £0-10K: Increased from 3,044 to 3,072.

- £10-20K: Increased from 24,653 to 24,863.

- £20-30K: Increased from 21,775 to 22,499.

- £30-40K: Increased from 11,203 to 11,507.

- £40-50K: Increased from 4,772 to 4,860.

- £50K+: Increased from 4,483 to 4,624.

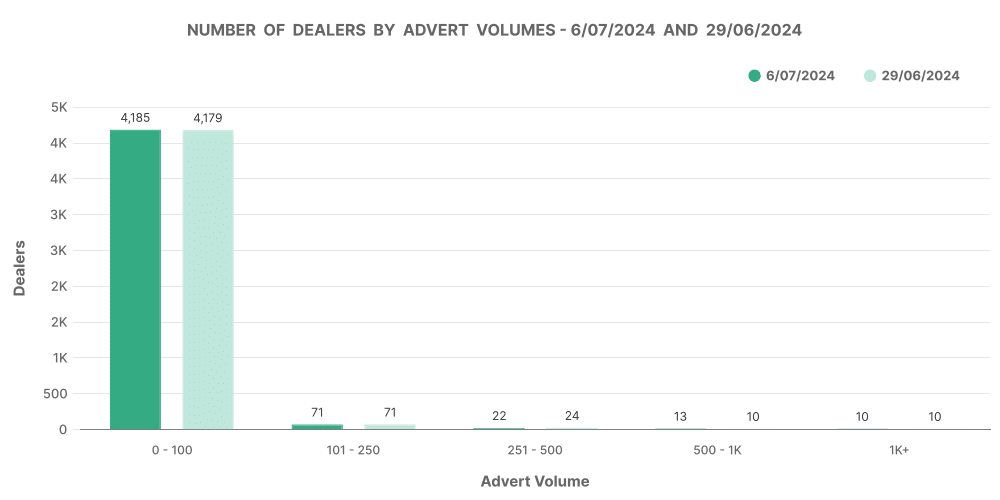

Number of Dealers by Advert Volumes (EVs)

- 0-100: Decreased from 4,483 to 4,179 dealers.

- 101-250: Increased from 71 to 71 dealers.

- 251-500: Decreased from 24 to 22 dealers.

- 500-1K: Increased from 10 to 13 dealers.

- 1K+: Remained stable at 10 dealers.

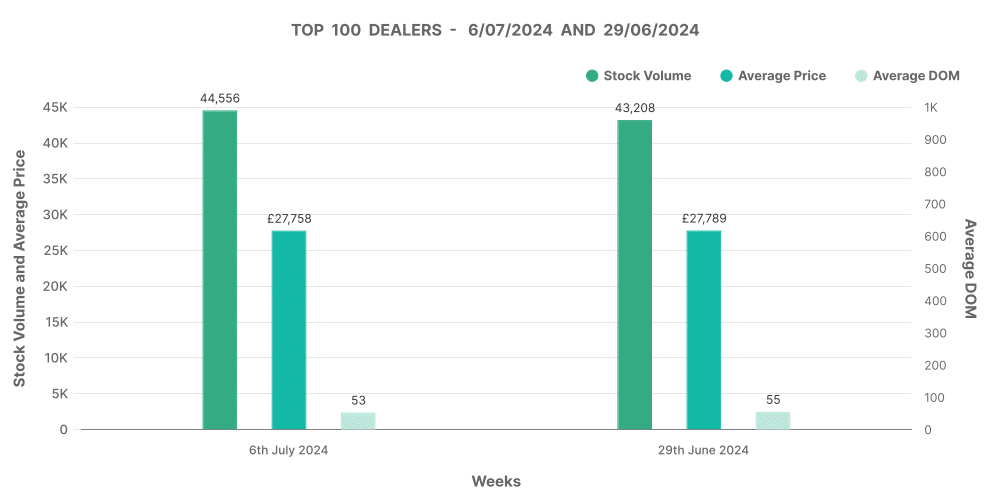

Analysis of Top 100 EV Dealers by Volume

The top 100 EV dealers also showed robust performance:

- Stock Volume: Increased from 43,208 to 44,556.

- Average DOM: Decreased from 55 to 53 days.

- Average Price: Slight decrease from £27,789 to £27,758.

- Price Increases: Notable rise from 3,272 to 4,139.

- Price Decreases: Increased from 13,405 to 15,345.

Comparison of EVs to ICE Vehicles

The percentage share of EVs in the used car market is growing but remains significantly lower than ICE vehicles. For the week ending 6th July 2024:

- EV Share: Increased slightly from 12.32% to 12.39%.

- ICE Share: Decreased slightly from 87.68% to 87.61%.

Average Prices

- Average Price of EVs: £27,367.

- Average Price of ICE Vehicles: £16,773.

Relevance of Marketcheck UK

Marketcheck UK provides automotive dealers with the tools they need to navigate these dynamic markets. Our comprehensive data on every current and historical used car advert listing in the UK allows dealers to:

- Optimise Inventory: By understanding which price bands and vehicle types are performing well, dealers can adjust their stock accordingly.

- Set Competitive Prices: Access to real-time pricing data helps in setting competitive prices that attract buyers.

- Monitor Market Trends: Our data helps in tracking market trends, such as the growing share of EVs and changing consumer preferences.

By leveraging Marketcheck UK’s data, dealers can make data-driven decisions that enhance their sales strategies and improve profitability.