As we dive into this week’s used car market data, it’s clear that both the traditional internal combustion engine (ICE) and electric vehicle (EV) markets are evolving. Dealers are actively adjusting prices and inventory, creating opportunities for buyers and sellers alike. In this analysis, we’ll break down the trends in the UK’s used car market and offer insights into how Marketcheck UK’s data can help automotive dealers navigate this ever-changing landscape.

Don’t have time to read? Listen using the link while you work

Overview of the Used Car Market (ICE)

The internal combustion engine used car market remains robust with a total of 905,638 listings across 10,702 dealers in the week ending 14th September 2024. The average price of used cars is £17,959, showing a slight increase from the previous week’s average of £17,879. Notably, the average days on market (DOM) for vehicles dropped to 85 days from the previous 86 days, indicating that cars are moving a little quicker.

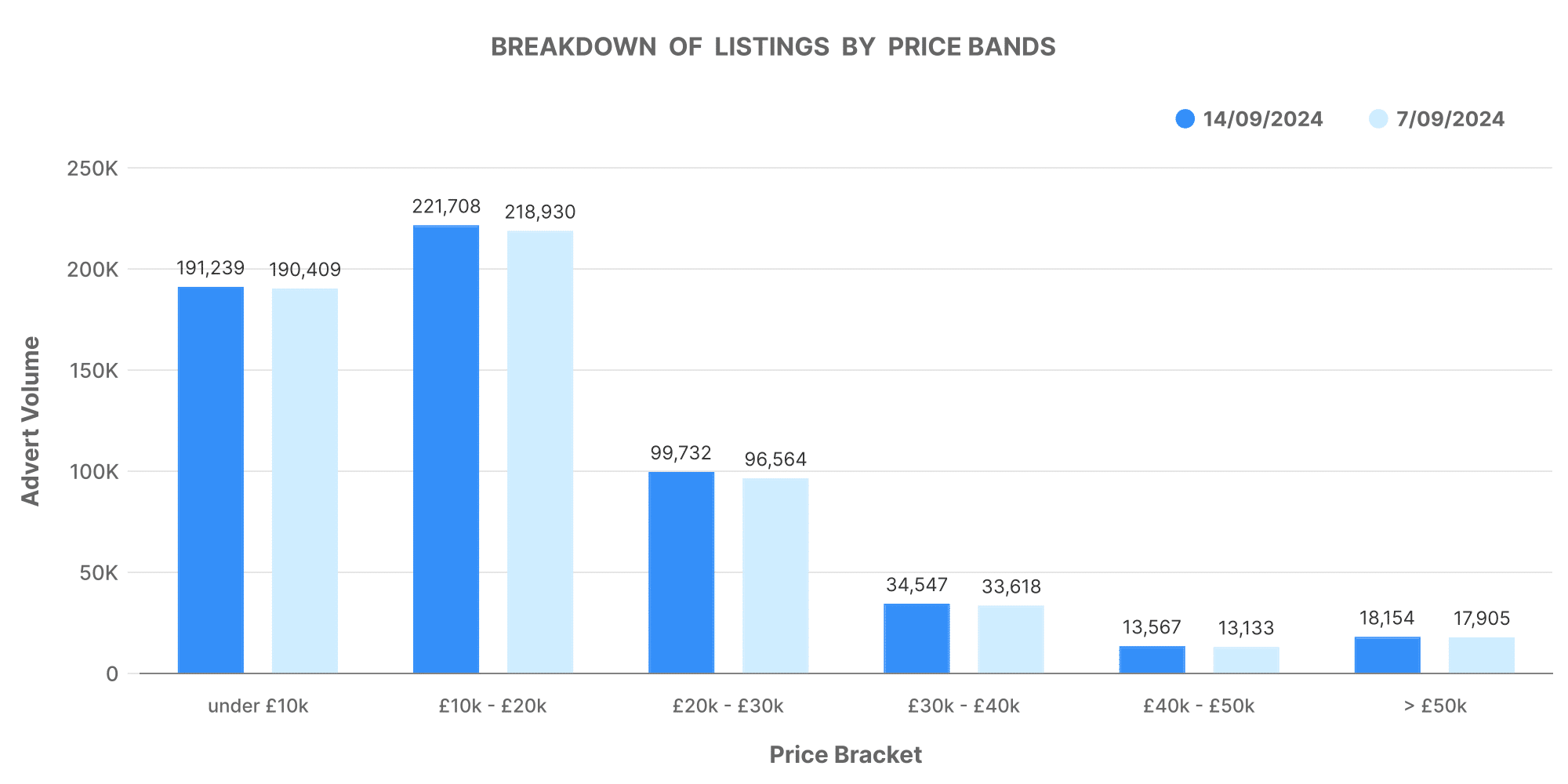

Here’s a breakdown of car listings by price bands:

- £0-£10K: 191,239 cars listed

- £10K-£20K: 221,708 cars listed

- £20K-£30K: 99,732 cars listed

- £30K-£40K: 34,547 cars listed

- £40K-£50K: 13,567 cars listed

- £50K+: 18,154 cars listed

This data shows a strong presence in the £10K-£20K and £20K-£30K price bands, suggesting that mid-range vehicles are still the most popular among buyers. Dealers looking to capitalise on this should consider increasing their stock in these bands, as demand appears to be steady.

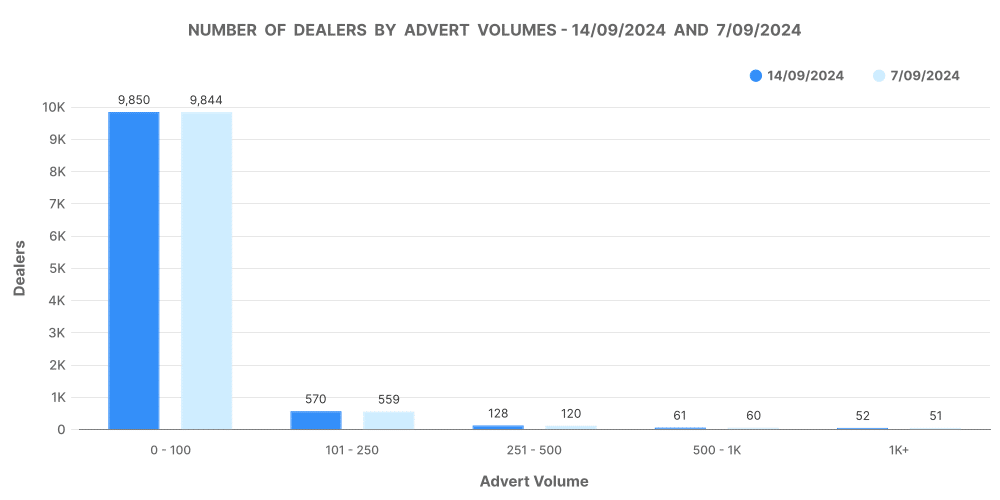

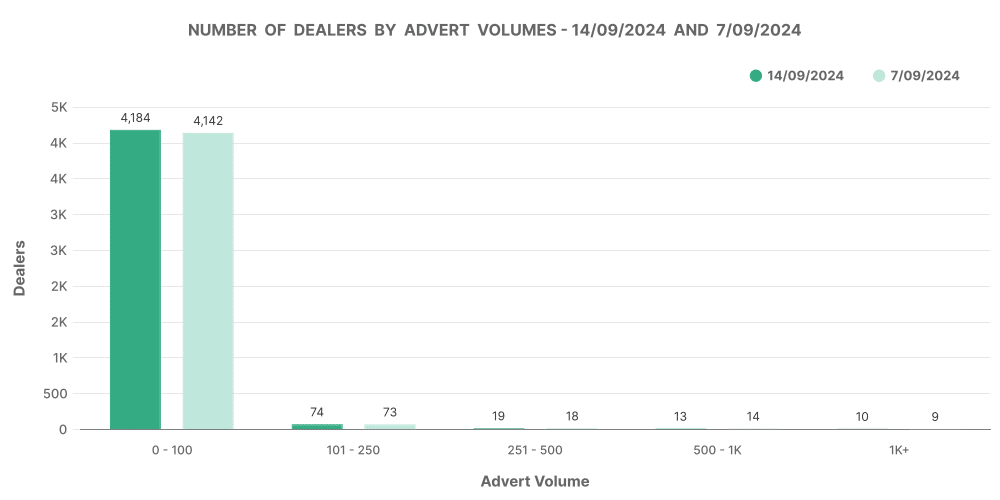

In terms of dealer inventory sizes, smaller dealerships (those with 0-100 cars in stock) dominate the market with 9,850 dealers fitting this category. Larger dealerships with 1,000+ cars in inventory, however, only account for 52 dealers, but these larger dealers often move higher-priced vehicles more swiftly, thanks to larger marketing budgets and higher visibility.

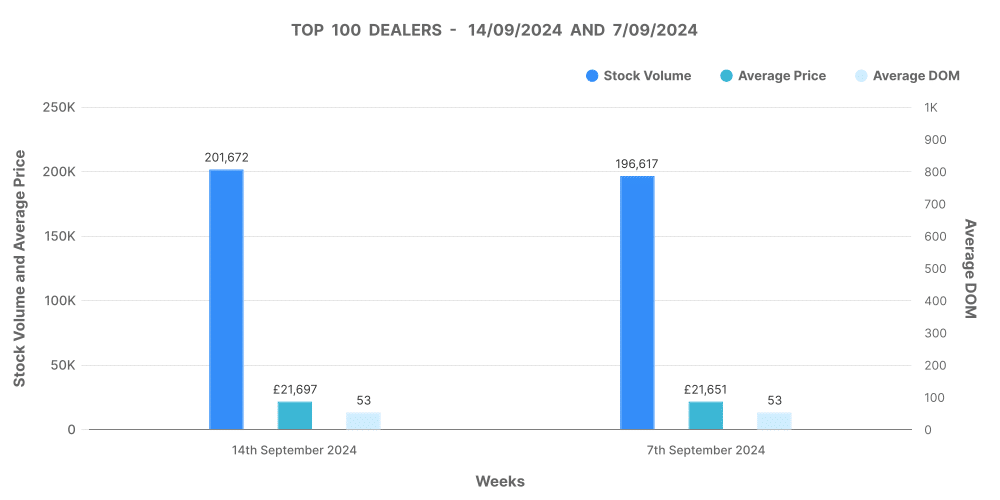

Performance of the Top 100 Dealers (ICE)

The top 100 dealers by volume continue to dominate with a stock volume of 201,672 cars. These dealers maintain a similar average price to the market at £21,697 but outperform the average in terms of days on market, moving cars in an impressive 53 days.

Price adjustments are a common tactic among these top-performing dealers. This week, there were 22,608 price increases and 64,176 price decreases, showing the dynamic pricing strategies that top dealers employ to attract buyers. For automotive dealers looking to replicate this success, Marketcheck UK’s data feed can provide real-time pricing trends, helping to adjust your stock pricing effectively.

Breakdown of the Electric Vehicle Market (EV)

The EV sector is gaining ground, with a total of 125,809 listings across 4,424 dealers. The EV insights shows that they still represent a smaller share of the overall UK used car market, but their significance continues to grow. This week, EVs made up 12.04% of total listings, a slight uptick from the previous week’s 12.01%.

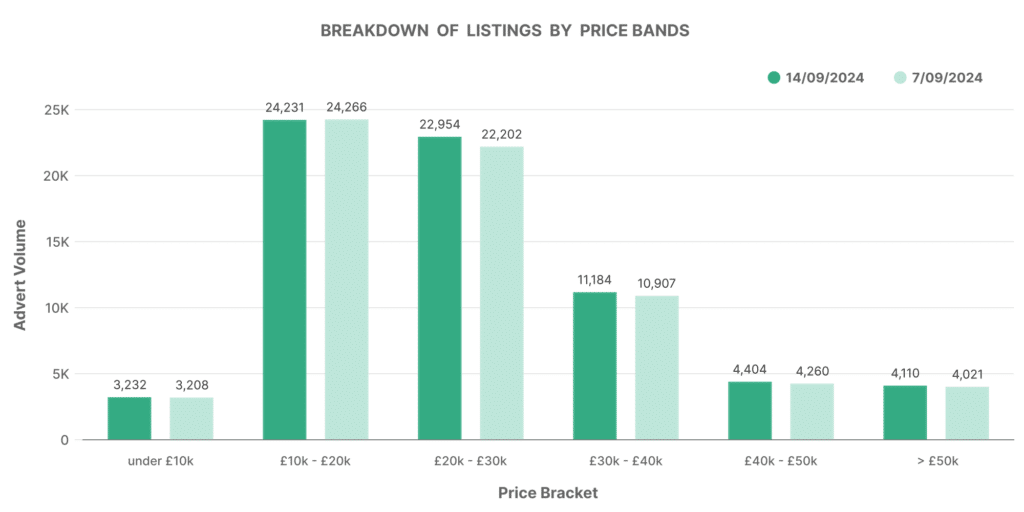

Here’s how the EV listings break down by price bands:

- £0-£10K: 3,232 cars listed

- £10K-£20K: 24,231 cars listed

- £20K-£30K: 22,954 cars listed

- £30K-£40K: 11,184 cars listed

- £40K-£50K: 4,404 cars listed

- £50K+: 4,110 cars listed

Mid-range EVs priced between £20K-£30K are the most common in the market, similar to ICE vehicles, highlighting a trend where consumers are drawn to electric vehicles that offer both value and performance. Dealers should take note of this as it provides opportunities to increase EV stock within these price bands to meet growing demand.

Performance of the Top 100 Dealers (EV)

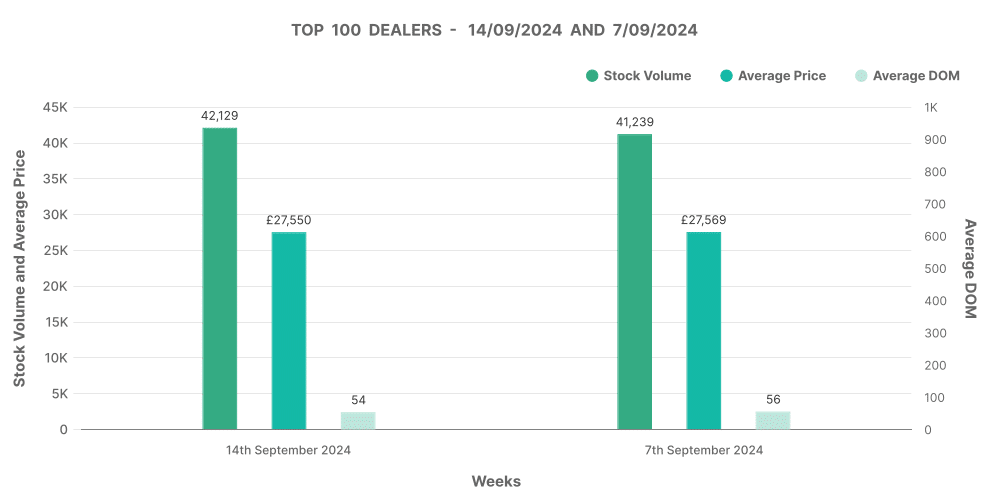

For EVs, the top 100 dealers have 42,129 cars in stock and are selling them even faster than their ICE counterparts, with an average DOM of 54 days. The average price of an EV sold by the top 100 dealers is £27,550, higher than the overall market average of £27,065, reflecting the premium placed on electric vehicles.

In terms of price changes, the top 100 dealers adjusted their prices significantly this week, with 4,110 price increases and 13,157 price decreases. This indicates that while dealers are increasing prices in response to demand, they are also willing to drop prices to move older stock or less popular models.

ICE vs EV: Key Comparisons

When comparing the ICE and EV markets, some clear trends emerge:

- Average Price: The average price for EVs is £27,065, while for ICE vehicles it’s lower at £17,959. This price gap reflects the higher cost of electric vehicles but also hints at their increasing popularity as more consumers are willing to invest in cleaner technology.

- Days on Market: EVs are moving faster, with an average DOM of 68 days compared to 85 days for ICE vehicles. This suggests growing interest in EVs, especially among eco-conscious buyers or those looking to save on fuel costs.

- Inventory: ICE vehicles still dominate the market with 905,638 listings, while EVs account for 125,809 listings, just over 12% of the market. However, this share is gradually increasing, and dealers may want to consider expanding their EV offerings to stay ahead of the curve.

Marketcheck UK’s Role in the Automotive Industry

For automotive dealers looking to optimise their pricing, stock management, and sales strategies, Marketcheck UK provides invaluable tools. Our comprehensive insights cover every aspect of the UK used car market, from real-time listing data to pricing trends and dealership performance. Whether you’re focused on ICE or EV vehicles, our data allows you to track market shifts, adjust your pricing strategies, and stay competitive.

For example, by using Marketcheck UK’s APIs and data feeds, dealers can:

- Access real-time market trends, helping to adjust pricing in response to competitor movements.

- Analyse inventory across different price bands to ensure they are stocking the right mix of vehicles.

- Gain insights into days on market metrics, helping to understand which vehicles are in demand and which are lingering on the forecourt.

- Track price increases and decreases to fine-tune promotional strategies and stay ahead of competitors.

As electric vehicles continue to carve out a larger slice of the market, dealerships need to be equipped with the right data to make informed decisions. Whether you’re expanding your EV offerings or fine-tuning your ICE vehicle sales, Marketcheck UK offers the insights you need to succeed.

Next week: 21st September | Previous week: 7th September