The data for the week ending 7th September 2024 provides a clear picture of the used car market for ICE vehicles. With 10,686 dealers and 14,481 rooftops, the market saw 891,845 total listings, a notable 4.5% increase compared to the previous week. The average price of used cars in this segment stands at £17,879, showing stability with a marginal dip of 0.09% from last week’s £17,895.

- Average days on market (DOM): Cars remained on sale for an average of 86 days, improving slightly from the previous week’s 87 days, signalling a marginally faster turnover for ICE cars.

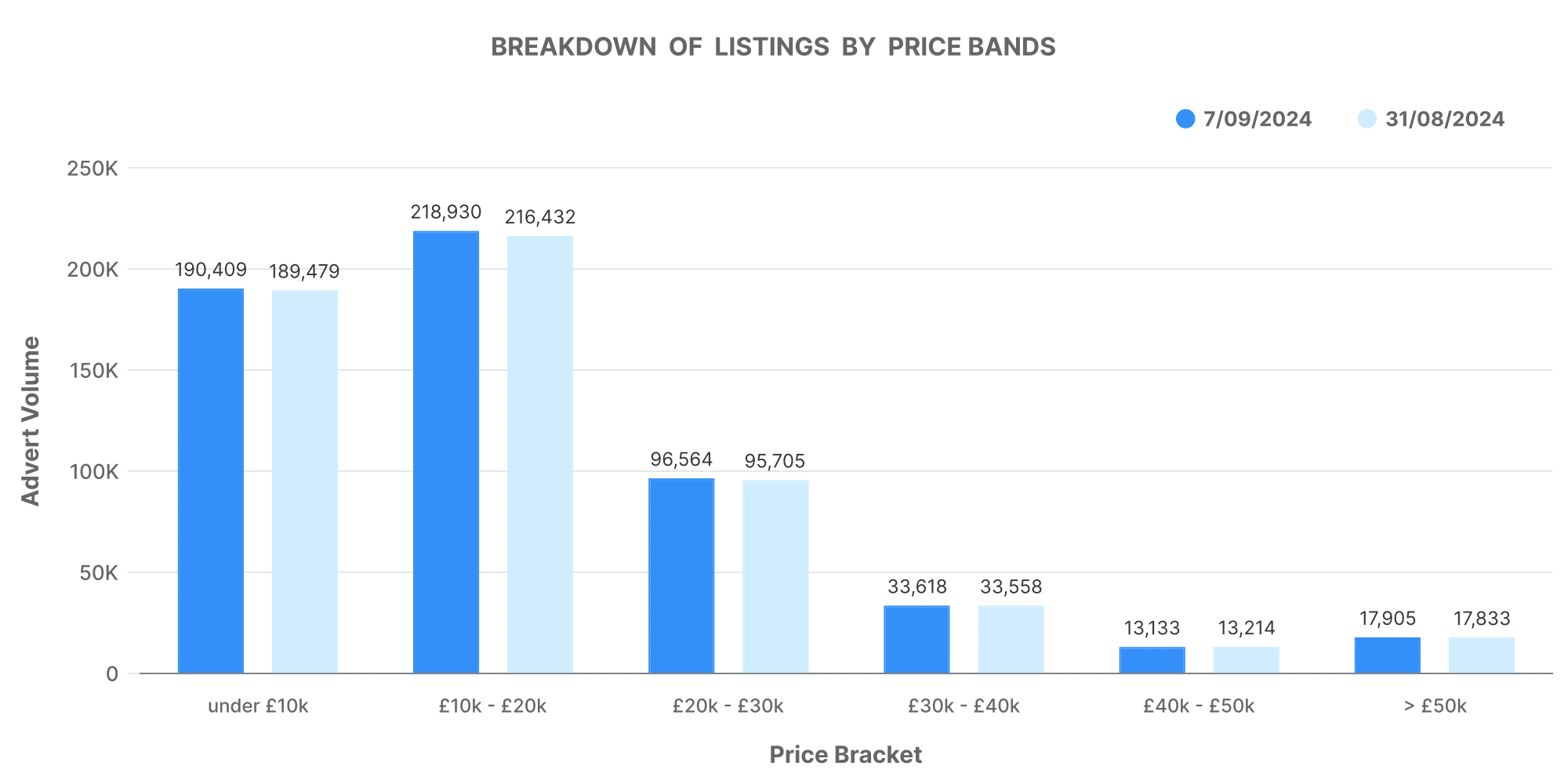

- Inventory breakdown by volume:

- 19,183 vehicles are priced below £10,000, catering to buyers in the budget range.

- The largest price band, £10,000 to £20,000, contains 218,930 vehicles—offering a broad selection in the mid-tier price range.

- Vehicles priced above £50,000 make up a smaller but still significant portion with 17,905 listings, showing robust demand in the luxury segment.

Breakdown of Listings by Price Bands

The majority of used ICE car listings fall within the £10,000 to £20,000 price range, which continues to be the most active section of the market. This segment is particularly attractive to dealers due to its balance between affordability and profitability. On the other end of the spectrum, high-end vehicles priced above £50,000 still attract a niche buyer base, although they represent only about 2% of the total listings.

For dealers, understanding these price trends can inform purchasing strategies. If you specialise in mid-range or premium vehicles, aligning your inventory with market demand is essential to maximise your turnover and profit margins.

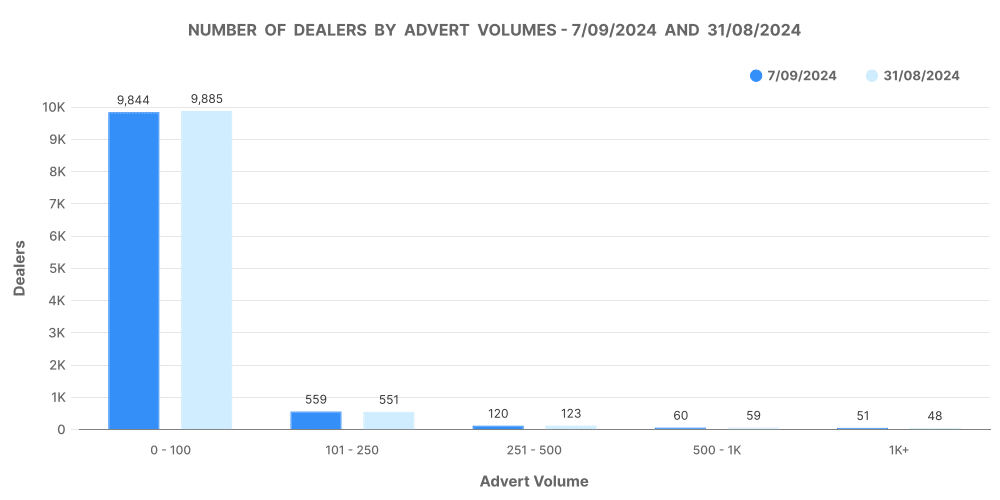

Dealer Inventory Analysis

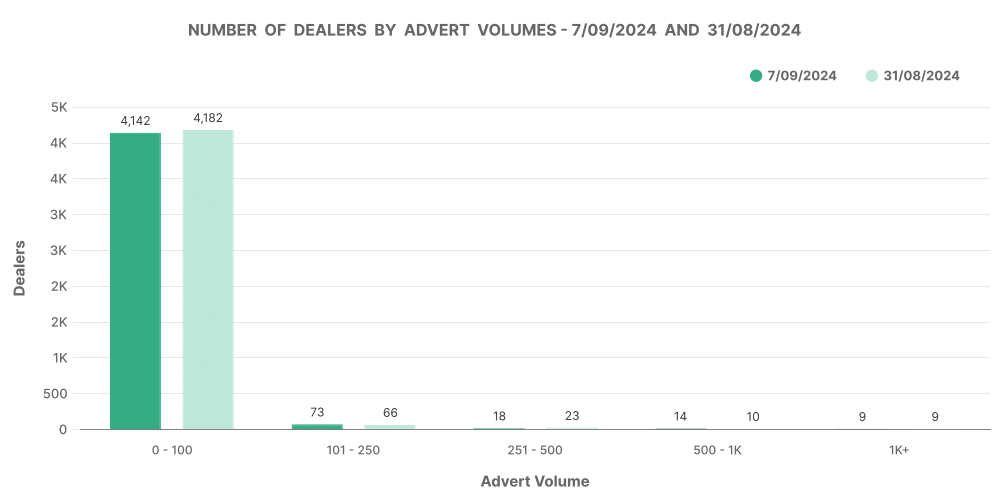

When we examine dealer volumes, smaller dealerships with inventory levels below 100 vehicles remain the most common, accounting for 9,844 dealers. However, larger dealers with stock volumes over 1,000 units make up an important part of the landscape, with 51 dealerships operating in this category. For those managing larger inventories, a key metric to track is the average days on market, which remains similar across different dealer sizes.

For dealers managing between 500 and 1,000 vehicles, there’s a slight increase in listings from 48 last week to 51 this week. Meanwhile, larger dealerships (1,000+ units) have maintained their stock levels, a sign of market stability for high-volume traders.

Weekly Overview of the Electric Used Car Market (EV)

In comparison to the ICE market, the electric vehicle sector shows both similarities and key differences. There were 4,383 EV dealers in the week ending 7th September 2024, a small decline from last week’s 4,404, while the total listings increased to 126,567, up by 6.3%.

- Average days on market (DOM) for EVs: The average DOM for electric vehicles sits at 70 days, which is lower than the ICE average, indicating that EVs are turning over quicker in the used market. This is an encouraging sign for dealers specialising in electric vehicles, as it shows growing demand and quicker sales cycles.

- Average price of EVs: The average price for used electric vehicles is £26,932, which is considerably higher than the ICE market average of £17,879. Despite this price premium, the data shows consistent demand for electric cars, particularly in the £20,000 to £40,000 range.

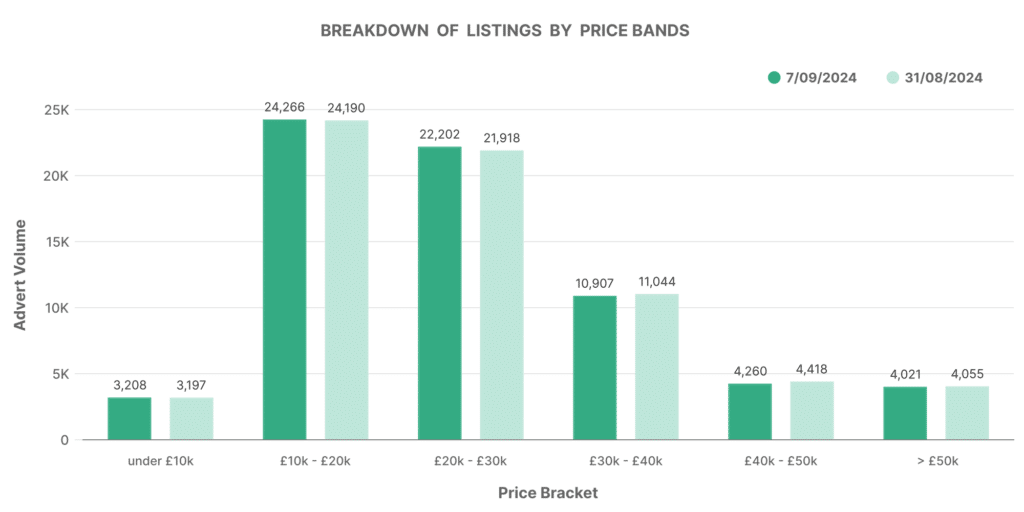

Breakdown of EV Listings by Price Bands

EVs priced between £20,000 and £30,000 account for 24,266 listings, followed by the £10,000 to £20,000 price band with 32,208 listings. The premium segment, featuring vehicles priced above £50,000, shows 4,260 listings, offering a variety of high-end models. Interestingly, this mirrors the ICE market where luxury vehicles are also a smaller but important segment.

For dealers, the key takeaway here is the continued growth in the mid-tier EV price bands, suggesting that electric vehicles are becoming more accessible to a wider audience. If you’re looking to expand your stock, focusing on vehicles within the £20,000 to £30,000 price range could be highly profitable.

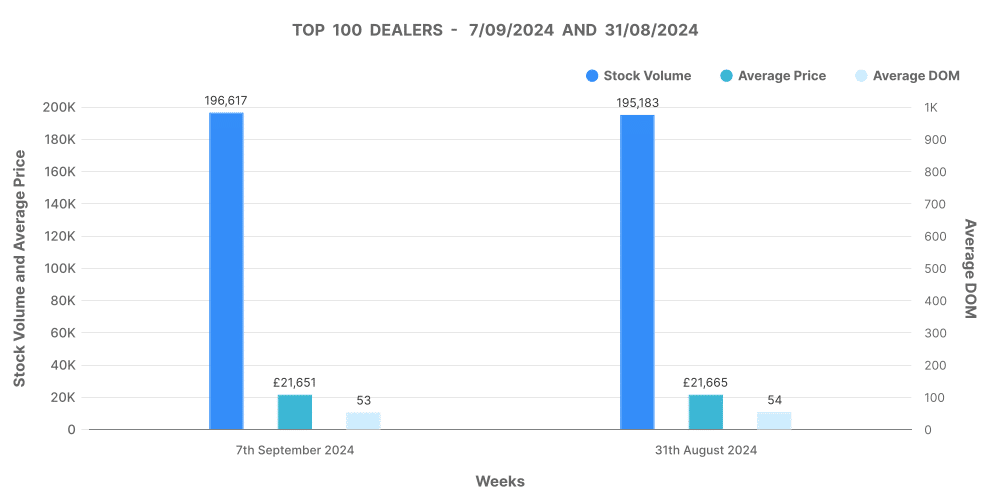

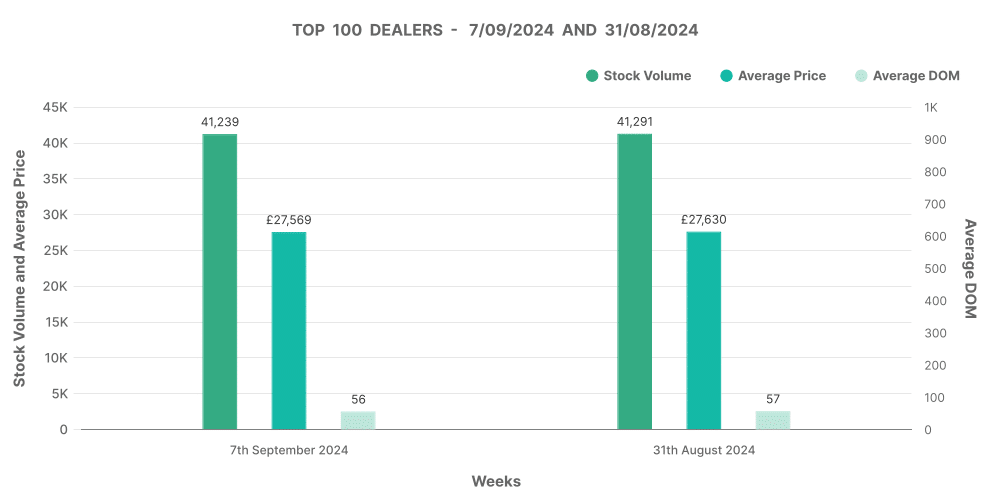

Analysis of Top 100 Dealers by Volume

Among the top 100 electric vehicle dealers within the used car market in September, there has been a slight drop in stock volume, with 56 dealers carrying top-tier inventory compared to 57 last week. The average DOM for these dealers is 56 days, which is shorter than the overall market average. The top 100 dealers are also selling at a higher average price point of £27,569—highlighting that premium EVs are still in demand among high-volume traders.

For dealers operating outside the top 100, the average DOM for electric vehicles remains competitive at 89 days. These dealers are also seeing substantial price movements, with 3,802 price increases recorded this week compared to 3,175 last week, signalling fluctuations in pricing strategies as demand shifts.

Percentage of EVs Compared to ICE

Electric vehicles now make up 12.01% of the total used car listings in the UK, slightly down from last week’s 12.08%. In contrast, ICE vehicles represent the remaining 87.99%, reflecting a stable but growing presence for EVs in the used market.

- EV percentage share: 12.01%

- ICE percentage share: 87.99%

Though EVs currently account for a smaller portion of the overall market, their share continues to grow year-on-year. The lower DOM for EVs compared to ICE cars is a promising indicator for dealers considering an expansion into the electric vehicle sector.

Average Price of EVs vs. ICE Vehicles

The price difference between EVs and ICE vehicles remains significant. The average price for an EV this week stands at £26,932, compared to £17,879 for ICE vehicles. This price gap reflects both the newer technology and the higher initial costs of electric vehicles. However, as more used EVs enter the market, it’s expected that the price gap may gradually close, offering more affordable options to budget-conscious buyers.

For automotive dealers, this data presents opportunities to strategically diversify inventory. Offering a mix of both ICE and EV vehicles within the used car market in September allows you to cater to a broader range of customers while tapping into the growing demand for electric vehicles.

Next week: 14th September | Previous week: 31st August