Understanding trends in the used car market is essential for automotive dealers, finance providers, and insurers. Tracking vehicle listings, pricing, and dealer activity provides key automotive market insights. This analysis covers the latest figures for both internal combustion engine (ICE) and electric used car market (EV) trends, offering a clear view of UK car price trends and stock availability.

Used Car Market Overview (ICE)

The used car market in the UK remained stable, with 616,353 listings recorded for the week ending 14th December 2024. The average days on market (DOM) was 88 days, with an average price of £18,413.

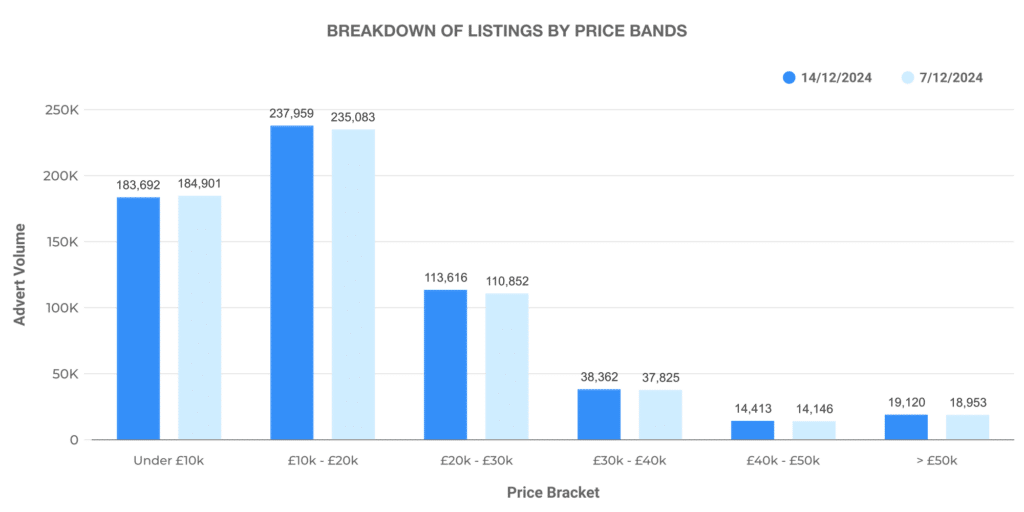

Breakdown of Listings by Price Bands:

- £0 – £10K: 183,692 listings

- £10K – £20K: 237,959 listings

- £20K – £30K: 113,616 listings

- £30K – £40K: 38,362 listings

- £40K – £50K: 14,413 listings

- £50K+: 19,120 listings

Most listings were in the £10,000 – £20,000 range, reflecting consistent affordability in the market. Vehicles priced above £50,000 accounted for a small but stable segment.

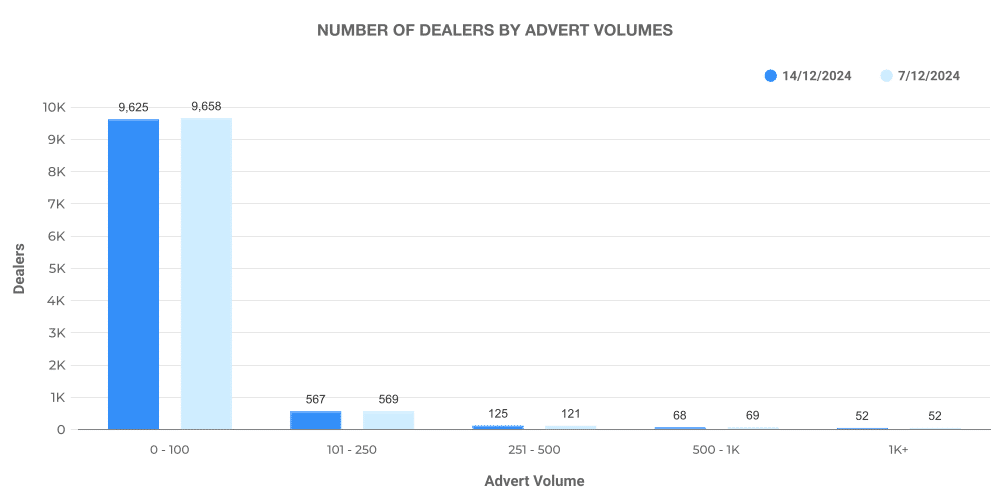

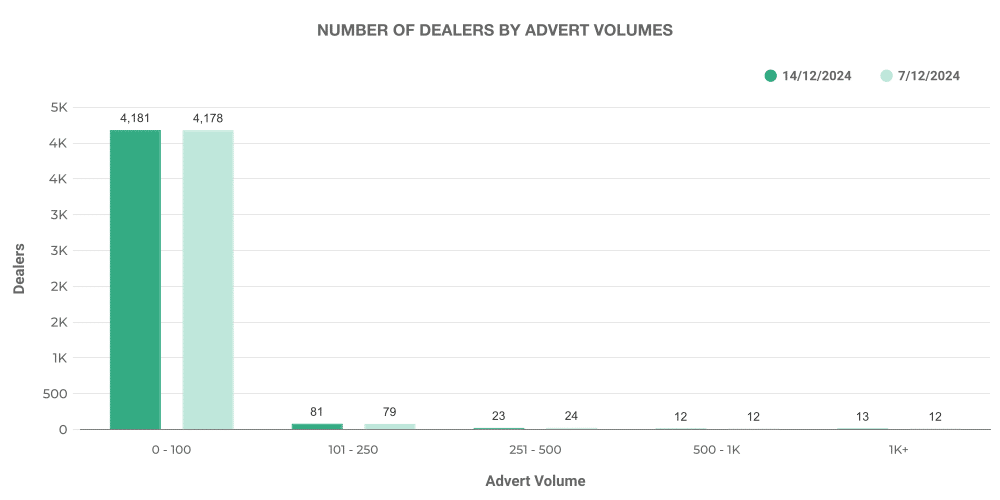

Number of Dealers by Advert Volumes:

- 0-100 vehicles: 9,625 dealers

- 101-250 vehicles: 567 dealers

- 251-500 vehicles: 125 dealers

- 500-1,000 vehicles: 68 dealers

- 1,000+ vehicles: 52 dealers

Smaller dealerships continue to dominate the market, with the majority listing fewer than 100 vehicles.

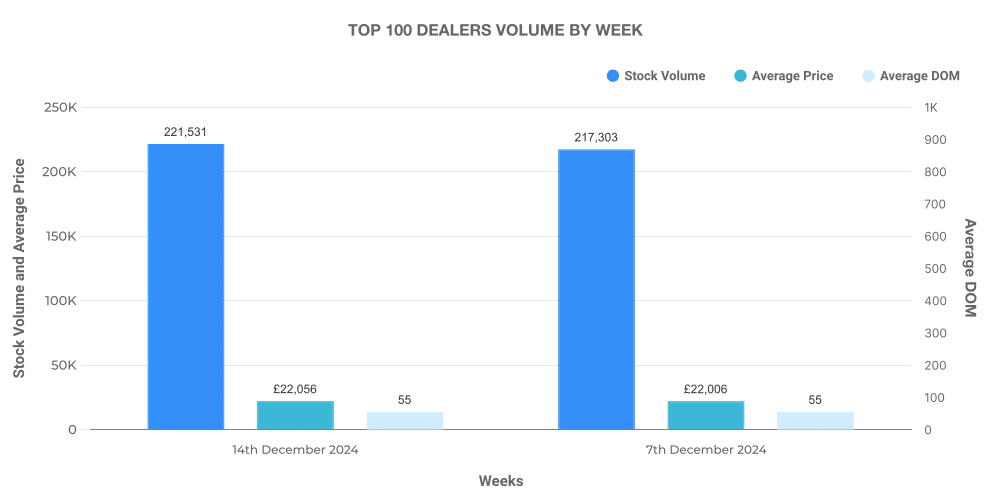

Dealer Volume Analysis for ICE Vehicles

The top 100 dealerships accounted for 221,531 listings, maintaining a steady market presence. The average DOM for these dealerships was 55 days, significantly lower than the market average, indicating stronger turnover rates. The average price among top dealers was £22,056, exceeding the overall market average.

Electric Used Car Market Overview (EV)

The electric used car market continued its gradual expansion, reaching 82,724 listings, up from 80,059 the previous week. The average DOM increased slightly to 68 days, while the average price remained steady at £26,639.

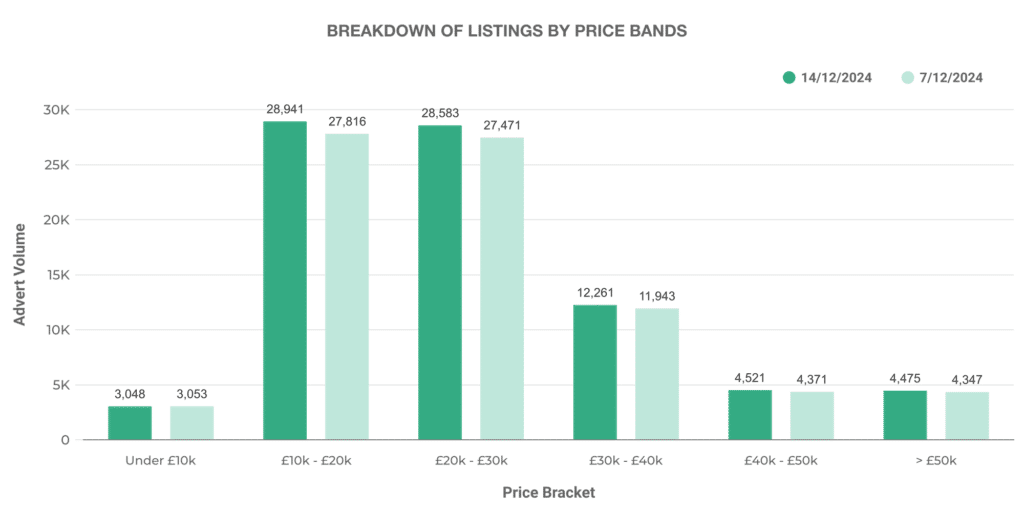

Breakdown of EV Listings by Price Bands:

- £0 – £10K: 3,048 listings

- £10K – £20K: 28,941 listings

- £20K – £30K: 28,583 listings

- £30K – £40K: 12,261 listings

- £40K – £50K: 4,521 listings

- £50K+: 4,475 listings

Listings in the £20,000 – £30,000 range made up the largest proportion of the EV market, highlighting strong demand for mid-priced models.

Number of Dealers by Advert Volumes:

- 0-100 vehicles: 4,181 dealers

- 101-250 vehicles: 81 dealers

- 251-500 vehicles: 23 dealers

- 500-1,000 vehicles: 12 dealers

- 1,000+ vehicles: 13 dealers

Compared to ICE, fewer dealers list EVs in high volumes, but the number of large-volume EV dealers is growing.

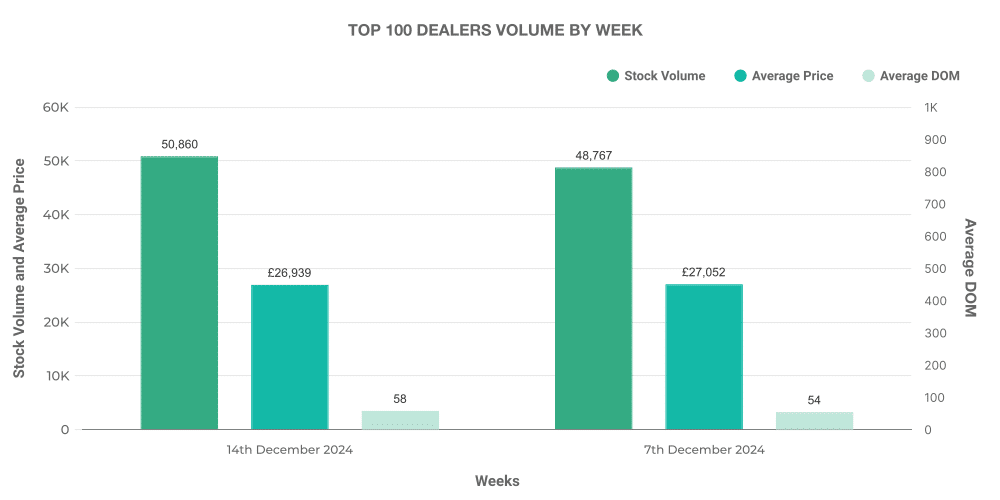

Dealer Volume Analysis for EVs

The top 100 EV dealers accounted for 50,860 listings, maintaining a significant market share. The average DOM for these dealers was 58 days, and the average price was £26,939.

EV vs ICE Market Share

- EV share of total used car market: 13.42%

- ICE share of total used car market: 86.58%

- Average price of EVs: £26,639

- Average price of ICE vehicles: £17,131

Electric vehicles continue to account for a growing share of the market. Although ICE vehicles remain dominant, the increasing diversity in EV pricing is making them more accessible.

Most Advertised EV Models

The top 10 advertised electric models included:

- Toyota Yaris (4,078 listings)

- Toyota C-HR (3,034 listings)

- KIA Niro (2,904 listings)

- Toyota Corolla (2,660 listings)

- BMW 3 Series (2,033 listings)

- Ford Kuga (1,862 listings)

- Tesla Model 3 (1,844 listings)

- Hyundai Kona (1,734 listings)

- Toyota RAV4 (1,682 listings)

- Hyundai Tucson (1,569 listings)

Toyota models remain the most frequently advertised EVs, reinforcing their popularity in the market.

Key Takeaways

- The used car market remained stable, with ICE listings totalling 616,353 and EV listings reaching 82,724.

- ICE vehicles accounted for 86.58% of the market, with an average price of £17,131, while EVs made up 13.42% at an average price of £26,639.

- Dealer activity remained consistent, with smaller dealers dominating both ICE and EV segments.

- The Toyota Yaris was the most advertised EV model, followed by the Toyota C-HR and KIA Niro.

For in-depth data on used car market trends, access Marketcheck UK’s automotive insights today.

Next week: 21st December | Previous week: 7th December