Overview Of The Used Car Market In November 2025

The used car market remained active during November 2025, with strong participation from dealers across the UK. Marketcheck UK data shows sustained supply levels, wide dealer engagement, and clear structuring around pricing and stock volumes. Both internal combustion engine (ICE) vehicles and electric vehicles (EVs) continued to play defined roles within overall market activity.

This report reviews the used car market using proprietary Marketcheck UK listings data. It covers advert volumes, pricing structure, dealer behaviour, and the share held by the electric used car market. The analysis focuses on practical automotive market insights for dealers, lenders, insurers, auction groups, and investment teams that rely on market-backed intelligence rather than sentiment.

All figures refer to November 2025 unless stated.

ICE Used Car Market: Topline Performance

ICE vehicles remained the backbone of the used car market. During November 2025:

- Total listings: 833,428

- Total dealers: 10,758

- Total rooftops: 15,480

- Average days on market: 75 days

- Average advertised price: £18,606

Stock levels reflected a stable flow of used cars entering the market. Dealer participation expanded slightly, with more rooftops active than the previous month. Average pricing settled below £19,000, maintaining accessibility across core consumer segments.

Average days on market edged upward, indicating longer retail cycles for ICE vehicles. This pattern aligns with broader UK car price trends, where buyers show higher price sensitivity in mid-market vehicles.

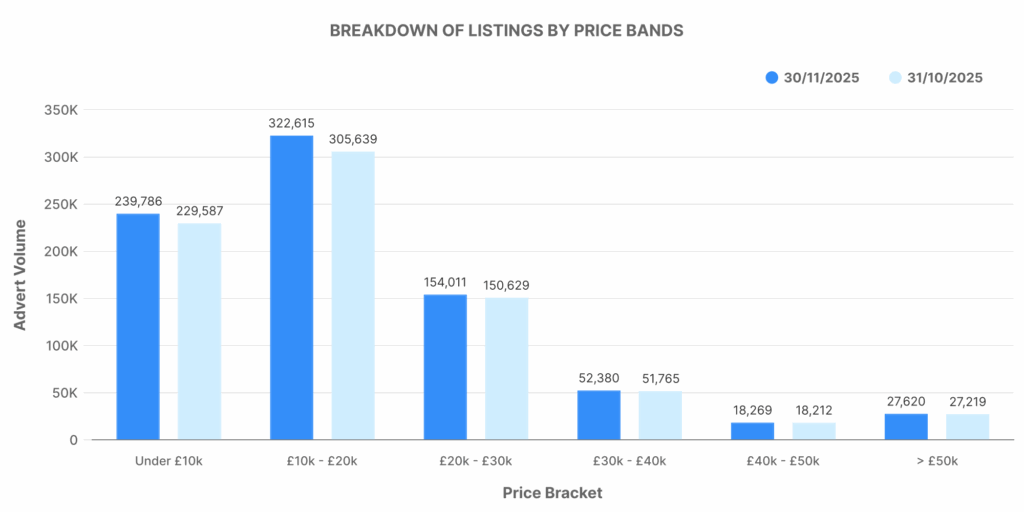

Breakdown Of ICE Listings By Price Bands

The price band structure shows how supply concentrates across affordability tiers. The largest portion of ICE listings fell within the £10,000 to £20,000 band.

Key observations from the price band graph:

- £10,000–£20,000: 322,615 listings

- £0–£10,000: 239,786 listings

- £20,000–£30,000: 154,011 listings

- £30,000–£40,000: 52,380 listings

- £40,000–£50,000: 18,269 listings

- £50,000+: 27,620 listings

Sub-£20,000 vehicles formed the bulk of available stock. This pricing range continues to represent the most liquid part of the used car market, supporting dealer forecourts focused on volume turnover.

Higher price bands remained relatively limited. Listings above £40,000 accounted for a small share of total inventory, reflecting controlled supply and narrower demand pools in premium ICE segments.

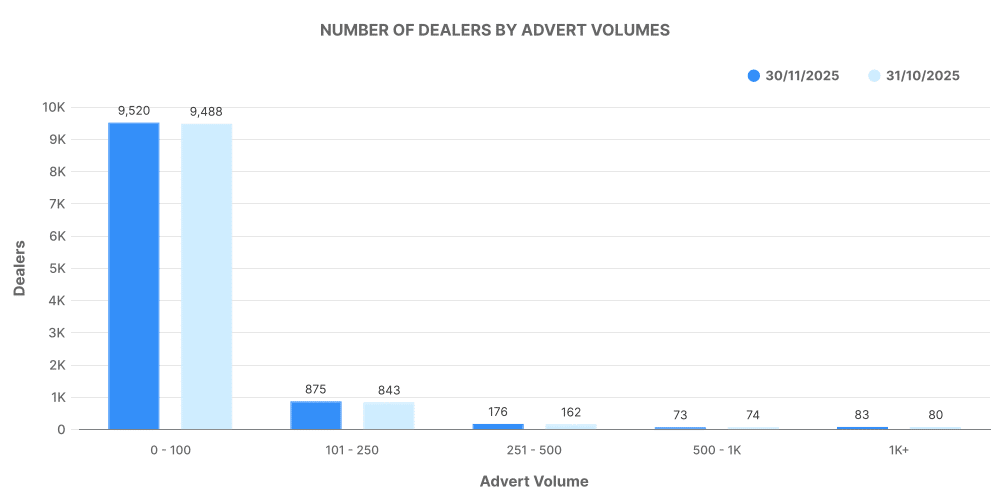

ICE Dealer Inventory Volumes

Dealer stock distribution provides insight into operational scale across the market. Most ICE dealers operated with modest inventory levels.

Inventory volume bands revealed:

- 0–100 vehicles: 9,520 dealers

- 101–250 vehicles: 875 dealers

- 251–500 vehicles: 176 dealers

- 500–1,000 vehicles: 73 dealers

- 1,000+ vehicles: 83 dealers

Smaller dealer operations dominated the market. High-volume groups remained active but represented a limited proportion of total participating rooftops. For finance providers and auction groups, this split highlights a long tail of independents alongside national dealer networks.

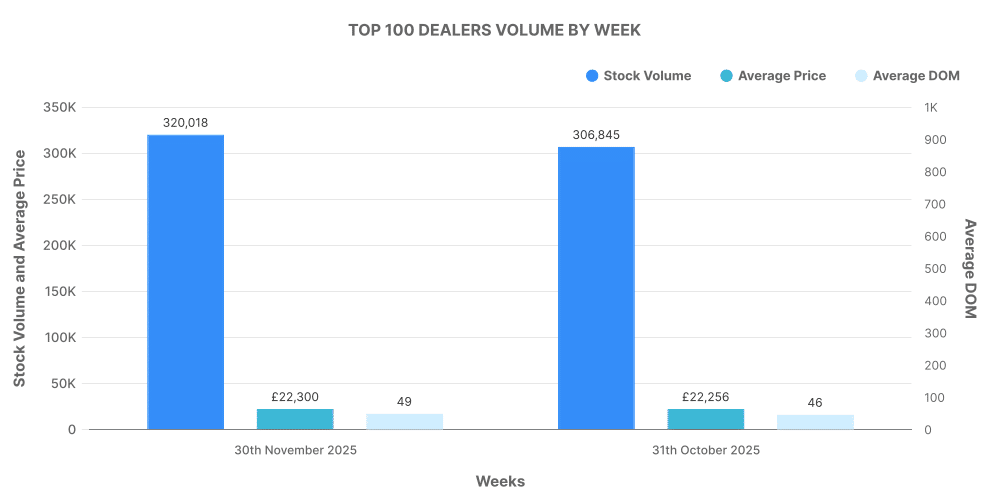

Top 100 ICE Dealers By Volume

Large dealer groups continued to shape pricing behaviour at the upper end of the market.

For November:

- Top 100 stock volume: 320,018 vehicles

- Average days on market (Top 100): 49 days

- Average price (Top 100): £22,300

Outside the top 100 dealers:

- Stock volume: 513,410 vehicles

- Average days on market: 91 days

- Average price: £16,243

Top dealers achieved faster stock movement and higher pricing. Shorter days on market suggest stronger pricing discipline, retail confidence, and more advanced stock management processes. Smaller dealers carried lower-priced vehicles and faced longer retail cycles.

Price movement metrics showed active repricing among both groups, supporting a market driven by demand-led adjustments rather than static valuation.

Electric Used Car Market: Topline Performance

The electric used car market continued to grow its footprint within total used listings during November 2025.

Headline EV figures:

- Total EV listings: 51,886

- Total EV dealers: 3,077

- Electric rooftops: 6,634

- Average days on market: 63 days

- Average advertised price: £25,218

EV stock volumes increased compared with the prior month at a level exceeding short-term volatility thresholds. Dealer adoption broadened, with more rooftops listing electric inventory. Average days on market remained lower than ICE vehicles, reflecting more decisive buyer behaviour in defined EV segments.

Average pricing sat above ICE levels, reinforcing the structural price gap between powertrains.

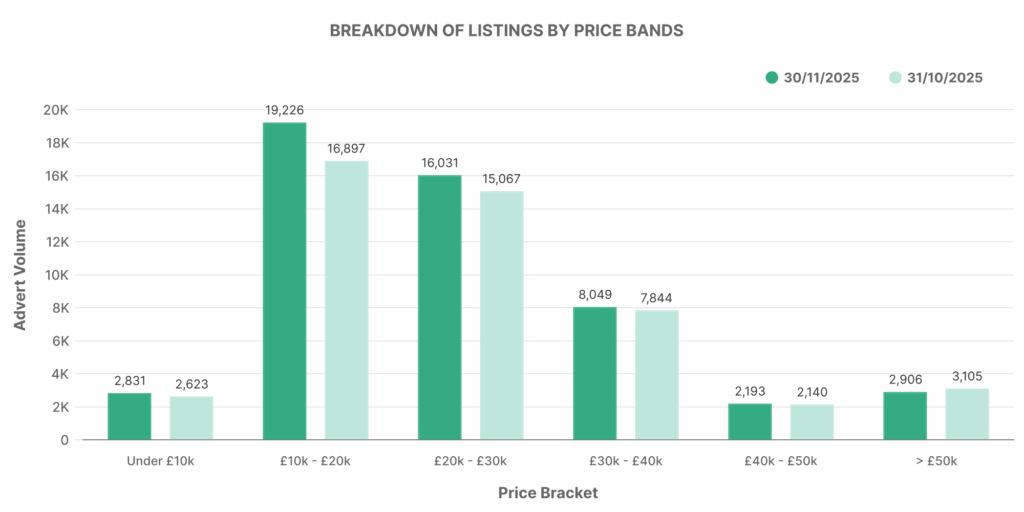

Breakdown Of EV Listings By Price Bands

EV pricing shows a distinct distribution pattern compared with ICE listings.

November price bands:

- £10,000–£20,000: 19,226 listings

- £20,000–£30,000: 16,031 listings

- £30,000–£40,000: 8,049 listings

- £0–£10,000: 2,831 listings

- £40,000–£50,000: 2,193 listings

- £50,000+: 2,906 listings

The £10,000–£30,000 range accounted for the majority of EV availability. Entry-level pricing below £10,000 remained limited, reflecting slower depreciation curves for many electric models.

Premium EV stock above £50,000 retained a visible presence, supported by models such as Tesla, Audi, Porsche, and Polestar.

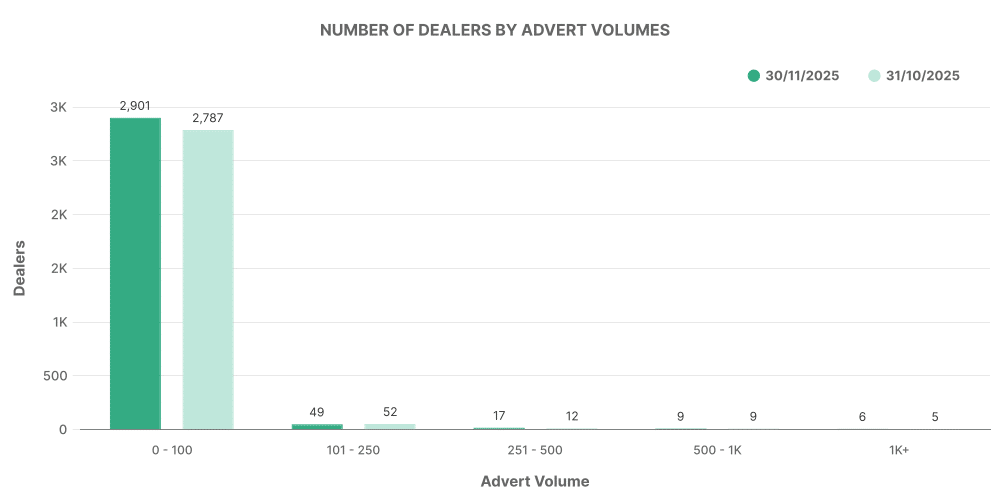

EV Dealer Inventory Volumes

EV dealer inventory patterns indicate that electric stock remains more concentrated than ICE.

Inventory volume breakdown:

- 0–100 EVs: 2,901 dealers

- 101–250 EVs: 52 dealers

- 251–500 EVs: 17 dealers

- 500–1,000 EVs: 9 dealers

- 1,000+ EVs: 6 dealers

Most EV listings sat with dealers holding limited electric stock alongside ICE inventory. Only a small number of operators carried EV volumes comparable to large ICE dealers. This outlines an opportunity for structured EV sourcing and remarketing services.

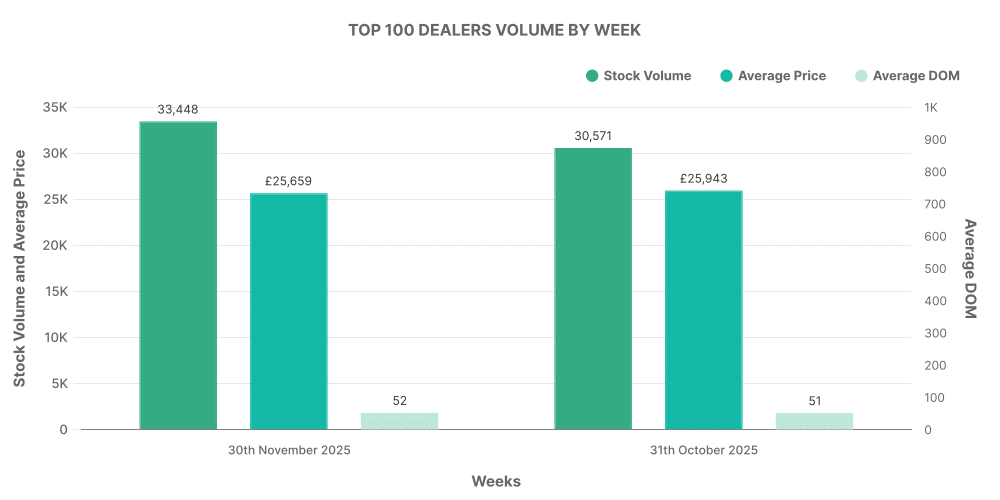

Top 100 EV Dealers By Volume

High-volume EV operators demonstrated clearer pricing and turnover strength.

November EV topline:

- Top 100 EV stock volume: 33,448 vehicles

- Average days on market: 52 days

- Average price: £25,659

Outside the top 100 EV dealers:

- Stock volume: 18,438 vehicles

- Average days on market: 82 days

- Average price: £24,398

Leading EV dealers moved vehicles faster at marginally higher prices. This aligns with stronger access to supply, better charging infrastructure positioning, and clearer buyer messaging.

Leading EV Models By Advert Volume

The most listed electric models reveal buyer familiarity and dealer confidence.

Top listed EVs in November:

- Tesla Model 3

- Tesla Model Y

- Nissan Leaf

- Polestar 2

- Volkswagen ID.3

- Hyundai Kona

- Audi Q4 e-tron

- Kia Niro

- Vauxhall Mokka

- Mini Hatch

Tesla retained strong representation across fleet sales, finance returns, and part-exchange pipelines. Legacy brands continued to gain traction in mid-range pricing bands.

EV Share Compared With ICE

Electric vehicles accounted for a growing but contained portion of the used car market.

November 2025 shares:

- EV listings: 6.23%

- Non-EV listings: 93.77%

ICE vehicles continued to dominate overall stock levels. The EV share increased beyond earlier 2025 averages, signalling progressive adoption rather than abrupt disruption.

Average prices showed a clear differential:

- Average EV price: £25,217.81

- Average ICE price: £18,162.62

This pricing spread affects residual risk modelling, finance structuring, and insurance valuation.

Pricing Dynamics Across Powertrains

ICE pricing stayed anchored around affordability-driven demand. EV pricing reflected higher capital exposure but shorter days on market. Dealers balancing both powertrains faced differing risk and margin profiles.

Key contrasts:

- ICE stock offered broader price access and slower turnover

- EV stock carried higher ticket prices with faster movement

- Larger dealers outperformed independents across both categories

These characteristics highlight how automotive market insights derived from listings data can guide buying policies, loan-to-value thresholds, and remarketing timing.

Why Marketcheck UK Data Matters

Understanding the used car market requires depth beyond headline figures. Marketcheck UK captures every current and historical advert across platforms, enabling:

- Accurate pricing benchmarks

- Dealer volume tracking

- Stock ageing analysis

- EV versus ICE market segmentation

- Model-level supply intelligence

This data supports lenders managing residual exposure, dealers refining stock mix, insurers pricing risk, and investors assessing market direction.

Marketcheck UK supplies this intelligence through:

- API feeds

- CSV data delivery

- Spreadsheets

- Analytical dashboards

Access to structured listings data underpins decisions across the automotive value chain.