Monitoring the shifts, patterns, and precedent-setting trends in the used car market is a founding principle for automotive dealers. With volatile consumer purchasing patterns and an automotive industry that’s rapidly evolving, keeping a close eye on current data can guide thought-out and better strategised plans for expansion. This report provides an analysis of the UK used car market, focusing not only on conventional internal combustion engine vehicles (ICE), but also on the fast-evolving electric used car market (EV).

Exploring the Findings: ICE Vehicles

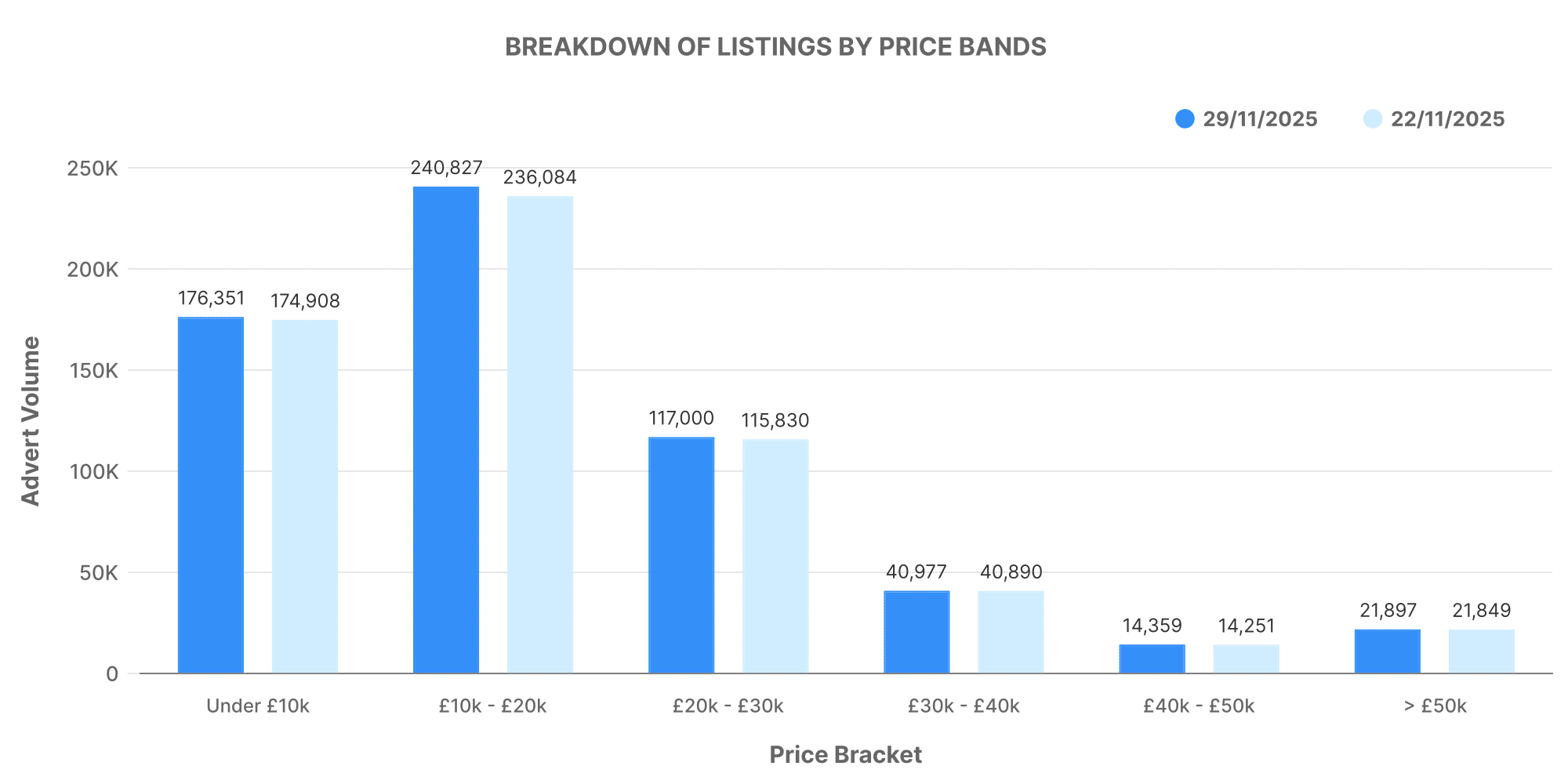

For the week concluding on 29th November, the used ICE car market saw 623,151 listings from 10,554 dealers. A panorama of cars at various price points were on offer, attracting a diverse swath of potential buyers.

The price bands of listed ICE vehicles suggest a healthy supply of affordable to mid-range models, with the majority of cars within the £10,000-£20,000 range, followed by a substantial number listed within the £20,000-£30,000 bracket.

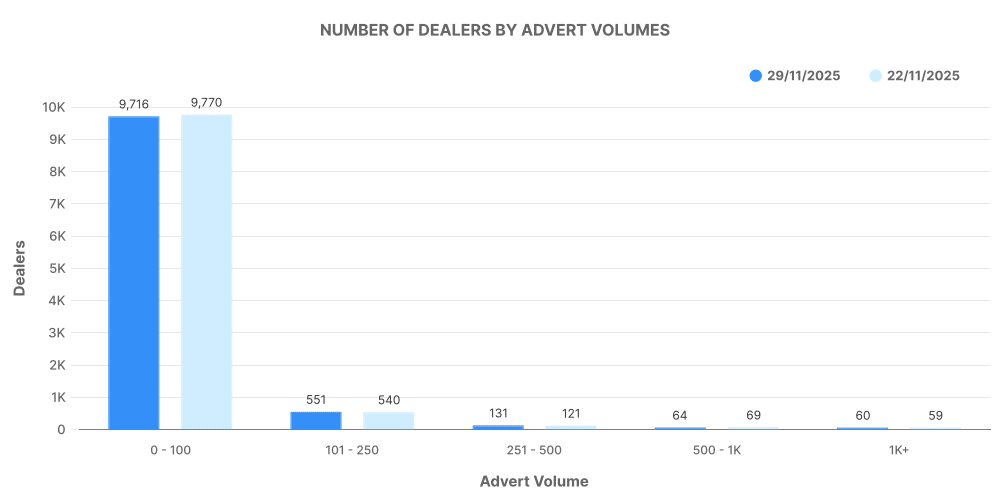

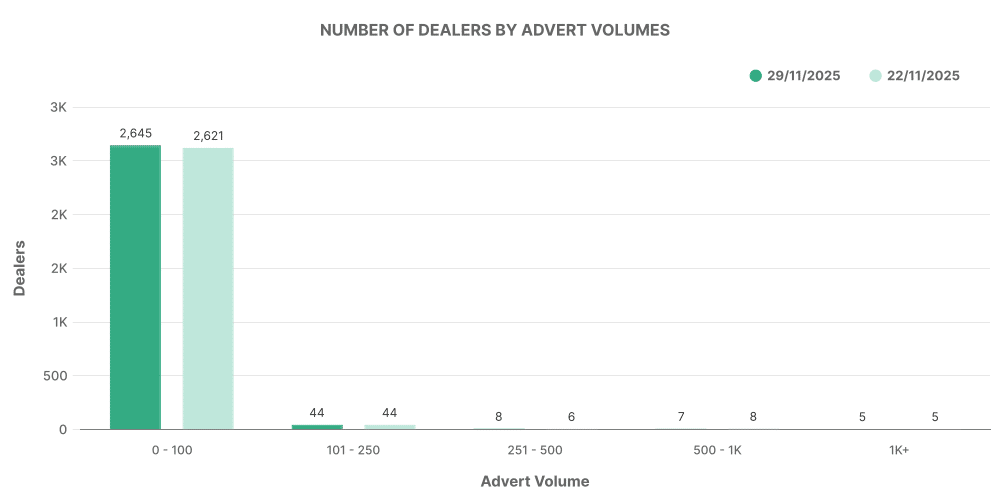

According to this graph, there’s a balanced distribution of ICE vehicle listings among the participating dealerships, a clear indicator of the solidity of this sector.

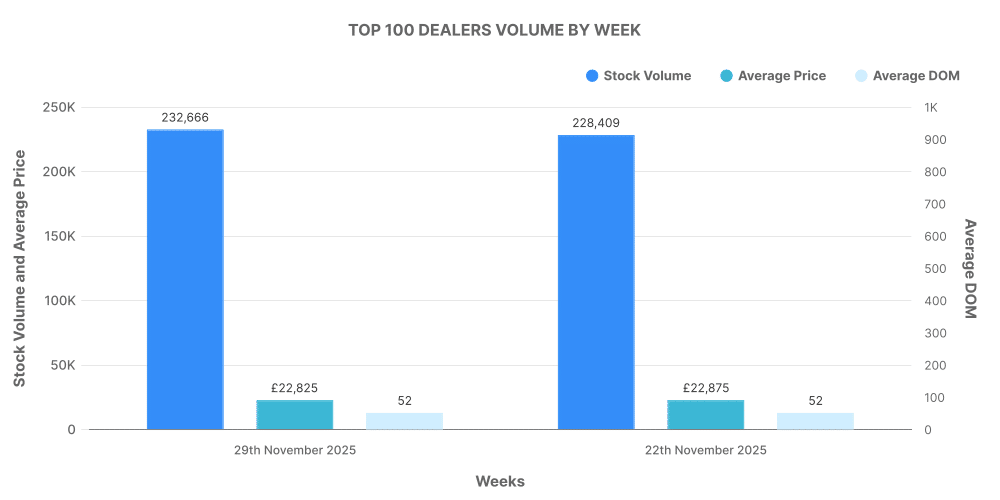

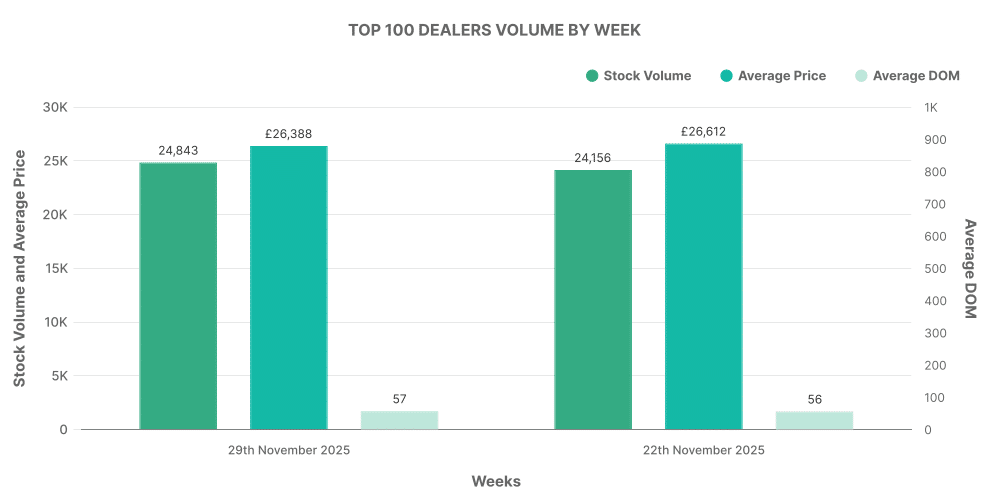

The top 100 dealers accounted for 37.6% of the total ICE vehicle listings, often offering cars priced above the market average.

Analysing the electric used car market (EV)

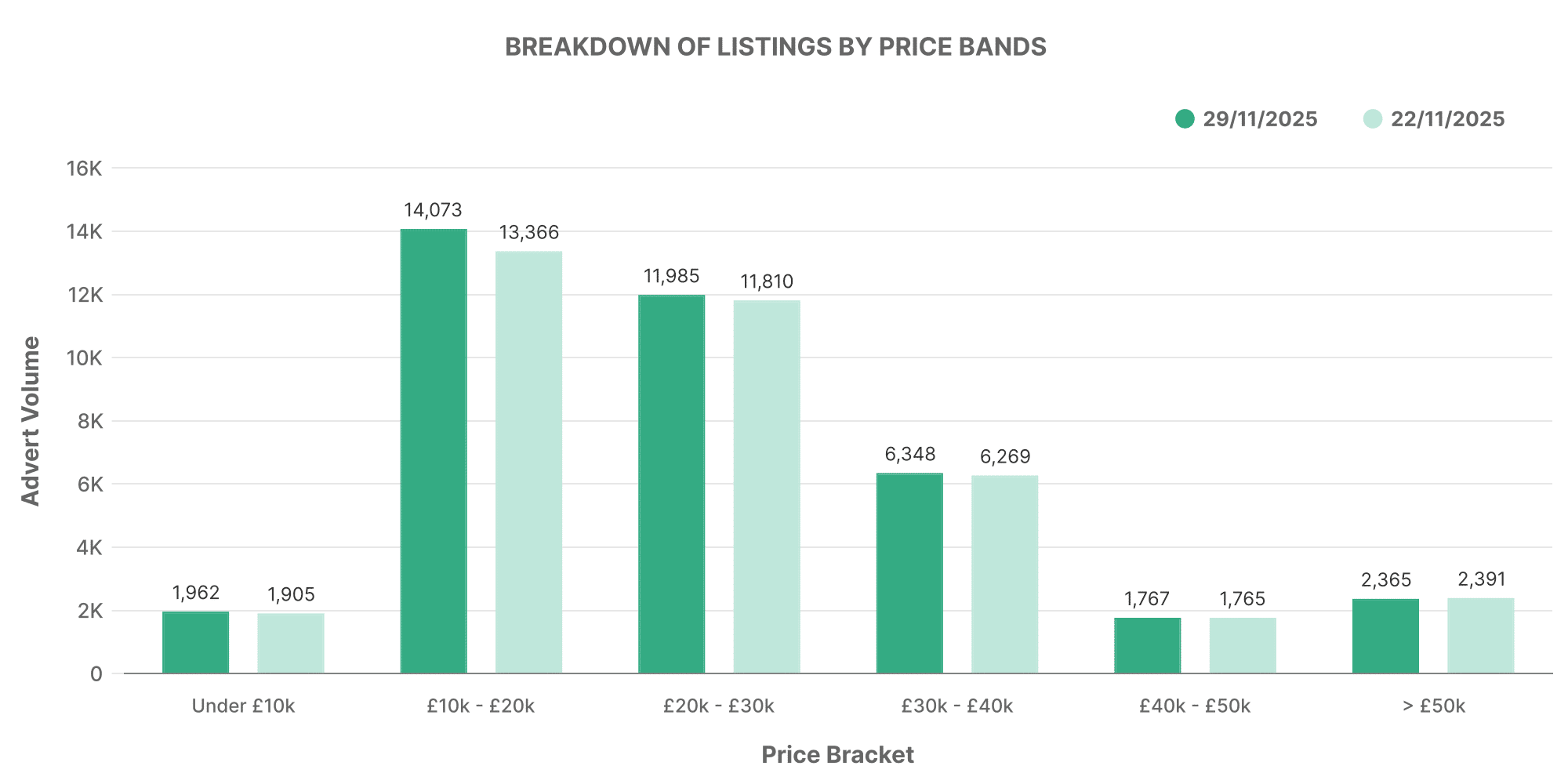

For the week ending on 29th November, the market witnessed 38,930 used EV listings from 2,797 dealers. This represents an overall market share of 6.25%.

This graph, which provides a breakdown of listings by price bands, reveals an upward trend in the £10,000-£20,000 band. The availability of premium models, with prices above £50,000, serves to underscore the fact that the EV market is catering to a diverse range of consumer needs.

Focusing on the top tier of the EV market, the top 100 dealerships accounted for a sizable chunk of total listings, emphasising the importance of this group in the flourishing EV sector.

Contrasting ICE and EV: A Comparative Study

Both the ICE and EV markets show enhanced activity among the top 100 dealerships. This group of dealerships is leading the way by quoting prices above the market average, likely due to offering a selection of vehicles that represent the higher end of the market.

Taking a closer look at the EV market, it’s clear that despite it being relatively newer compared to the established ICE market, it is undergoing rapid development. With a larger proportion of affordable units on the market compared to premium priced models, growth potential is evident. The data also indicates that an increasing number of dealerships are focusing on expanding their EV inventory, signalling confidence in this sector’s future growth.