In this post, we will delve into the intricacies of the UK used car market, focusing on both traditional Internal Combustion Engine (ICE) vehicles and the emerging electric vehicle (EV) segment. As experts in automotive data with tools tailored to provide comprehensive insights, Marketcheck UK is uniquely positioned to guide automotive dealers on getting the best returns on investment. Let’s unpack this week’s trends and analyse the key market indicators.

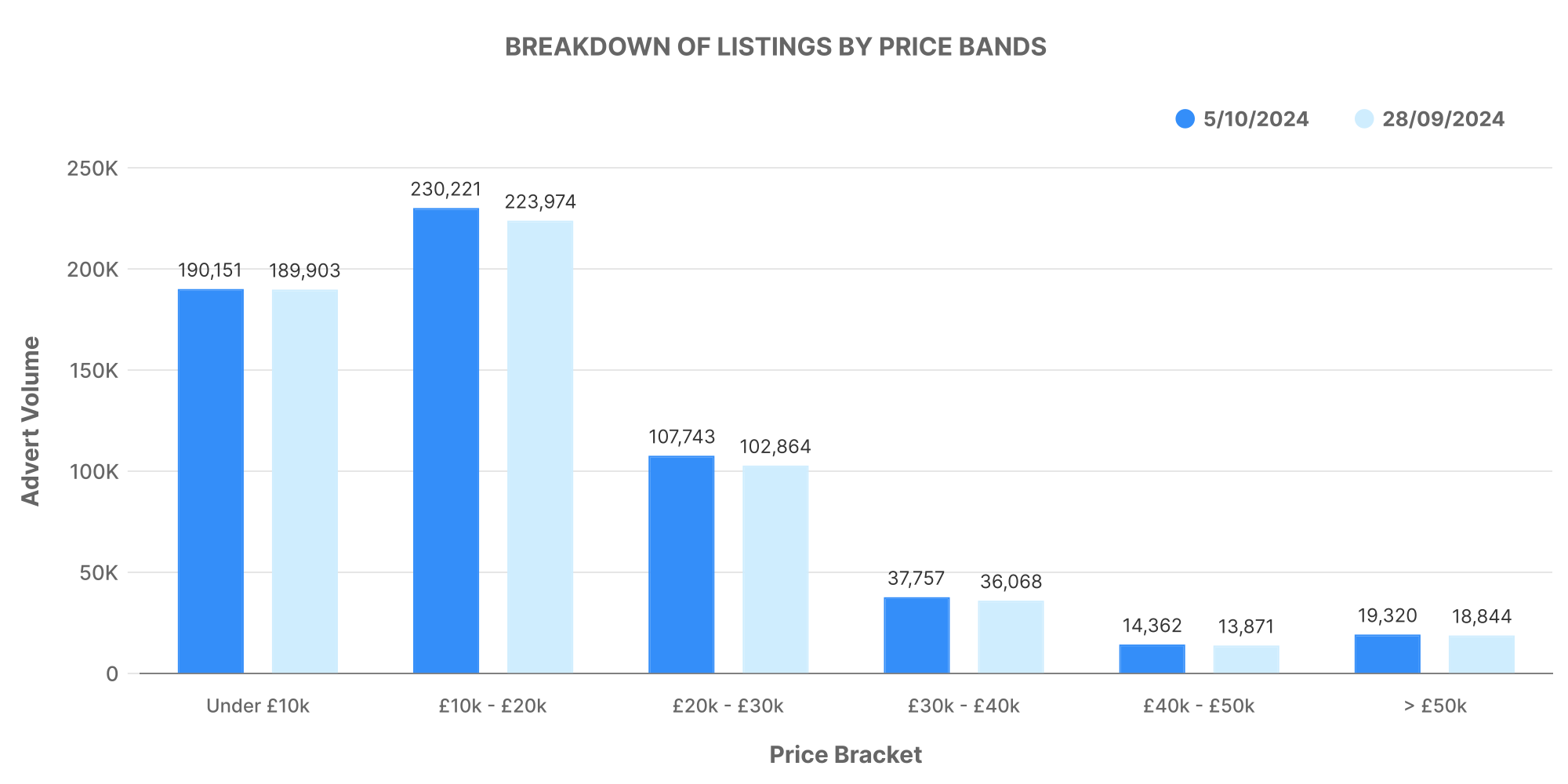

Breakdown of Used Car Listings by Price Bands (ICE)

From the graph, it’s evident that the most prominent price band in the used car market is the £10-20K range, followed closely by the £0-10K range, confirming that buyers are still leaning heavily towards affordable used cars. Price bands above £30K are less populated, showing a slight shift towards more affordable options.

For automotive dealers looking for the broadest market, traditional ICE cars in the £10-20K range are highly likely to sell quickly. For dealers seeking to maximise profit margins, offerings in the higher price bands can provide worthwhile returns, albeit with potentially lower sales volumes.

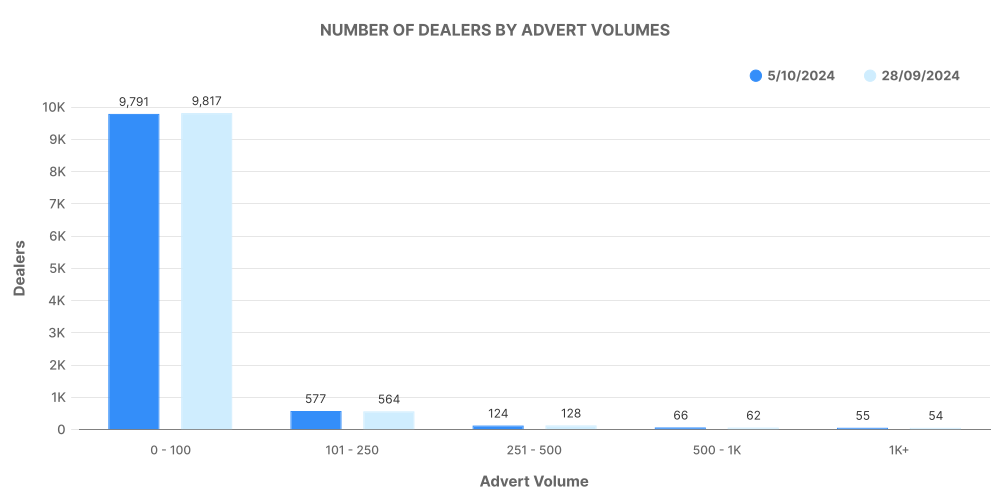

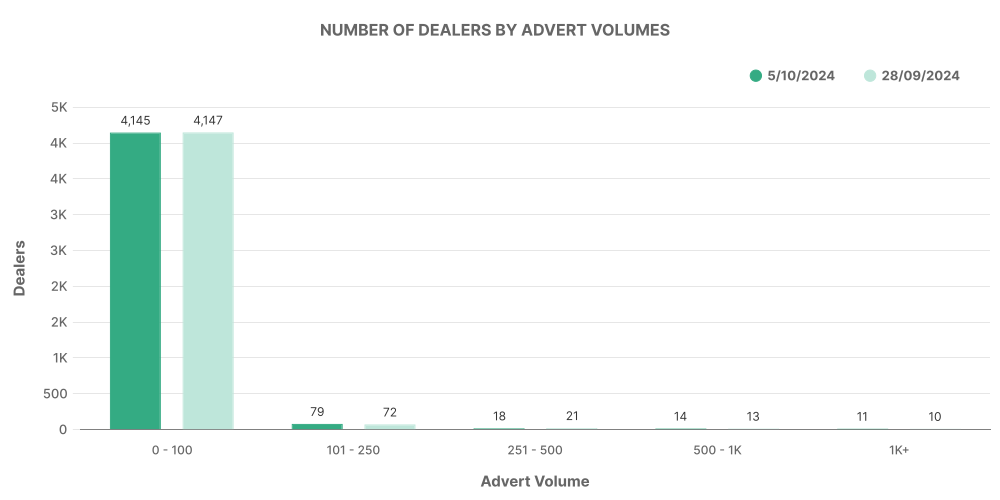

Number of Dealers by Advert Volumes (ICE)

The chart indicates a substantial number of dealers with inventory volumes in the 0-100 range. This dominance by small-to-medium sized dealers is likely due to a combination of factors, including lower capital requirements and a more cautious approach to risk in the current marketplace.

For automotive dealers looking to optimise their operations, considering these market dynamics, bolstering online engagement and streamlining processes can help provide a competitive edge.

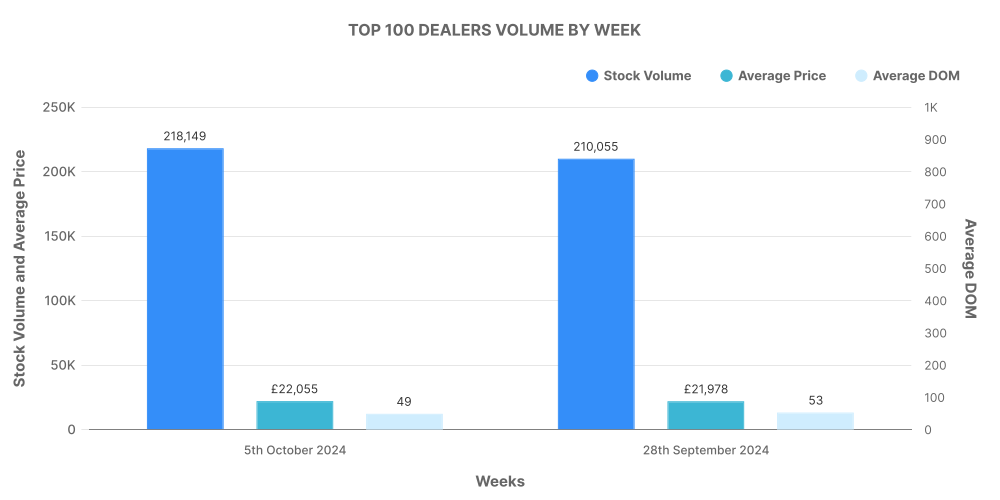

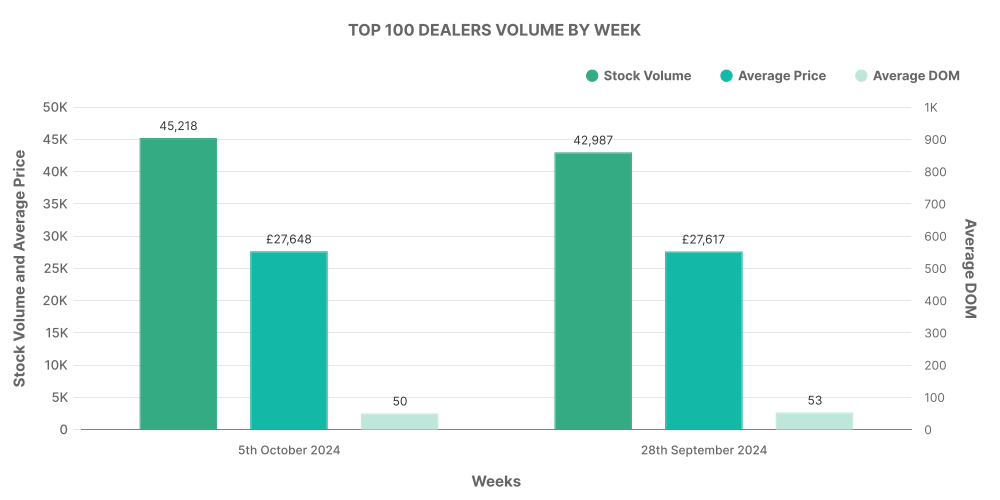

Analysis of Top 100 Dealers by Volume (ICE)

The top 100 dealers, as shown in the graph, hold a significant volume of listings, underscoring their impact in shaping market dynamics. The high average Days on Market (DoM) and rapid rate of price changes reflect how they are adapting to changing consumer demand and market conditions.

Navigating the dynamics that move automotive dealers into the top 100 requires comprehensive market insights, like those provided by Marketcheck UK. Let’s now turn our attention to the EV market.

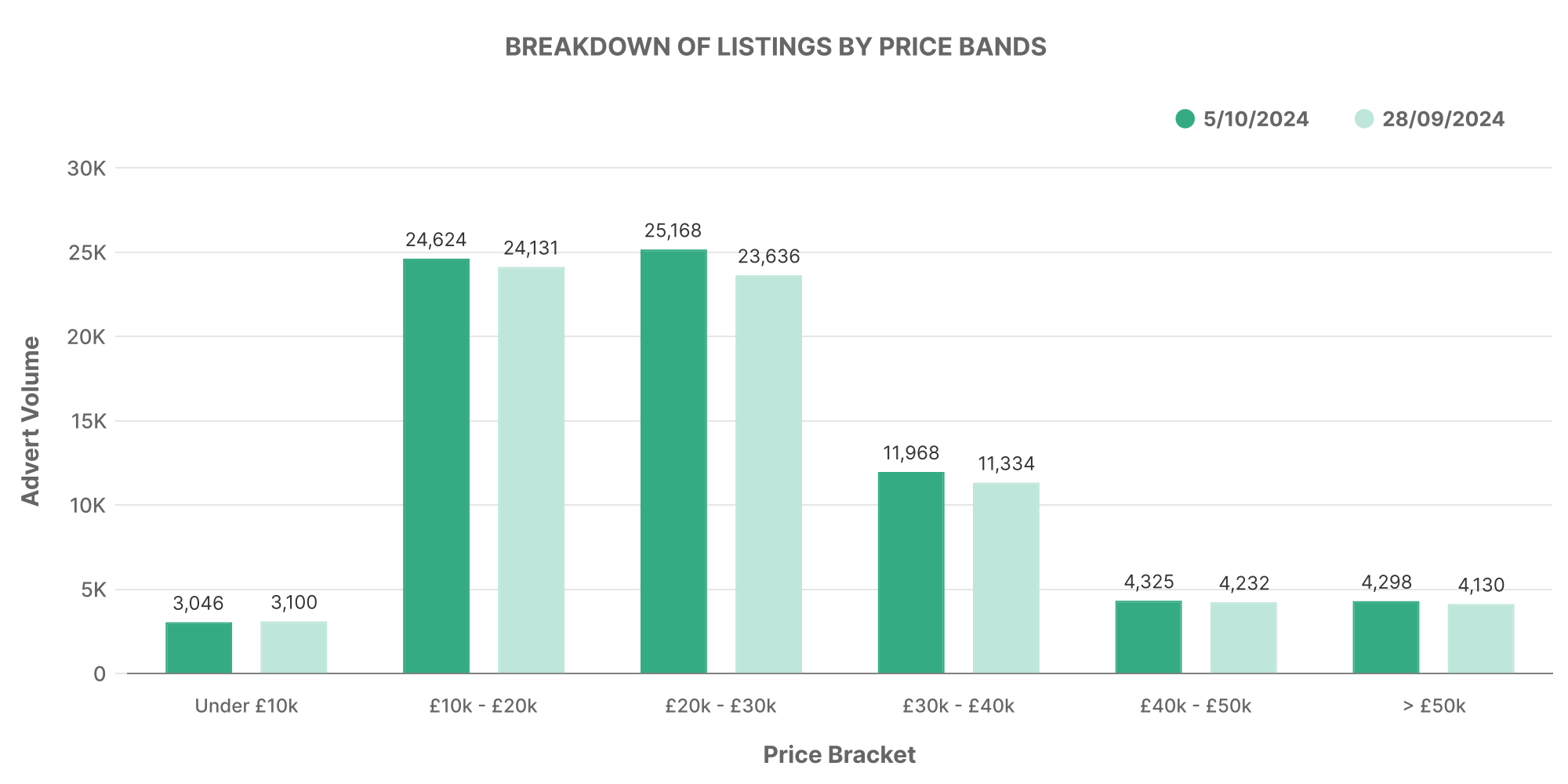

Breakdown of Used Car Listings by Price Bands (EV)

It’s clear that the most populated price band for EVs is the £10-20K range, mirroring the trends in the ICE used car market. This suggests that affordability remains a critical consideration for customers looking to transition to electric vehicles.

Given the apparent customer sensitivity to price points, understanding pricing trends with data comprehensive data like provided by Marketcheck UK, is crucial for devising profitable strategies. This factor is key for dealers looking to tap into the EV market trends.

Number of Dealers by Adverts Volume (EV)

The graph shows that the significant number of EV listings are held by smaller dealerships with an inventory volume of 0-100. Perhaps showing a cautious approach to this emerging market segment, or simply due to the still-limited supply of used electric vehicles.

As the EV market continues to mature and customer interest surges, we expect larger dealerships to increase their inventory in line with demand.

Analysis of Top 100 Dealers by Volume (EV)

Among the top 100 dealers by volume in the used EV market, we see a lower average DoM than in the ICE market. Additionally, unlike their ICE counterparts, top EV dealers show a more controlled rate of price changes.

As the market for electric vehicles continues to grow, it will become increasingly pivotal for dealers to stay informed. Accessing comprehensive, real-time data through tools like those offered by Marketcheck UK, could be the key to thriving in this evolving market.

Marketcheck UK’s Role in the Automotive Industry

Marketcheck UK provides crucial market insights to help dealers navigate the increasingly competitive and digitally-driven landscape. We collect and analyse data on every current and historical used car listing in the UK. This vast, ever-updated repository allows us to guide clients to informed, data-driven strategies.

We provide this indispensable data to end customers via CSV feeds, APIs, website tools, spreadsheet and Looker analysis tools, and third-party APIs, providing various access methods suited to our clients’ preferences.

Next week: 19th October | Previous week: 5th October