For any stakeholder involved in the UK automotive sector, understanding the trajectory of used car market trends – along with the nuances of their e-counterparts – can serve as a crucial cornerstone for making informed decisions. Our analysis focusing on integral used car market data and specially highlighting the electric used car market will empower dealerships, insurance companies, investment organisations and car finance businesses with these market insights.

The Automotive Market’s Dual Tale

In a week ending on 22nd November 2025, the realm of conventional used cars (ICE) witnessed listings from 10,591 dealers. With a strong emphasis on diversity in price and models, used ICE listings totalled 615,666. The used electric domain, on the other hand, kept up with its steady growth, listing 37,947 vehicles via 2,776 dealers.

Let’s delve into the specifics starting with Internal Combustion Engine vehicles (ICE).

Pricing Trends and Dealer Volume: ICE

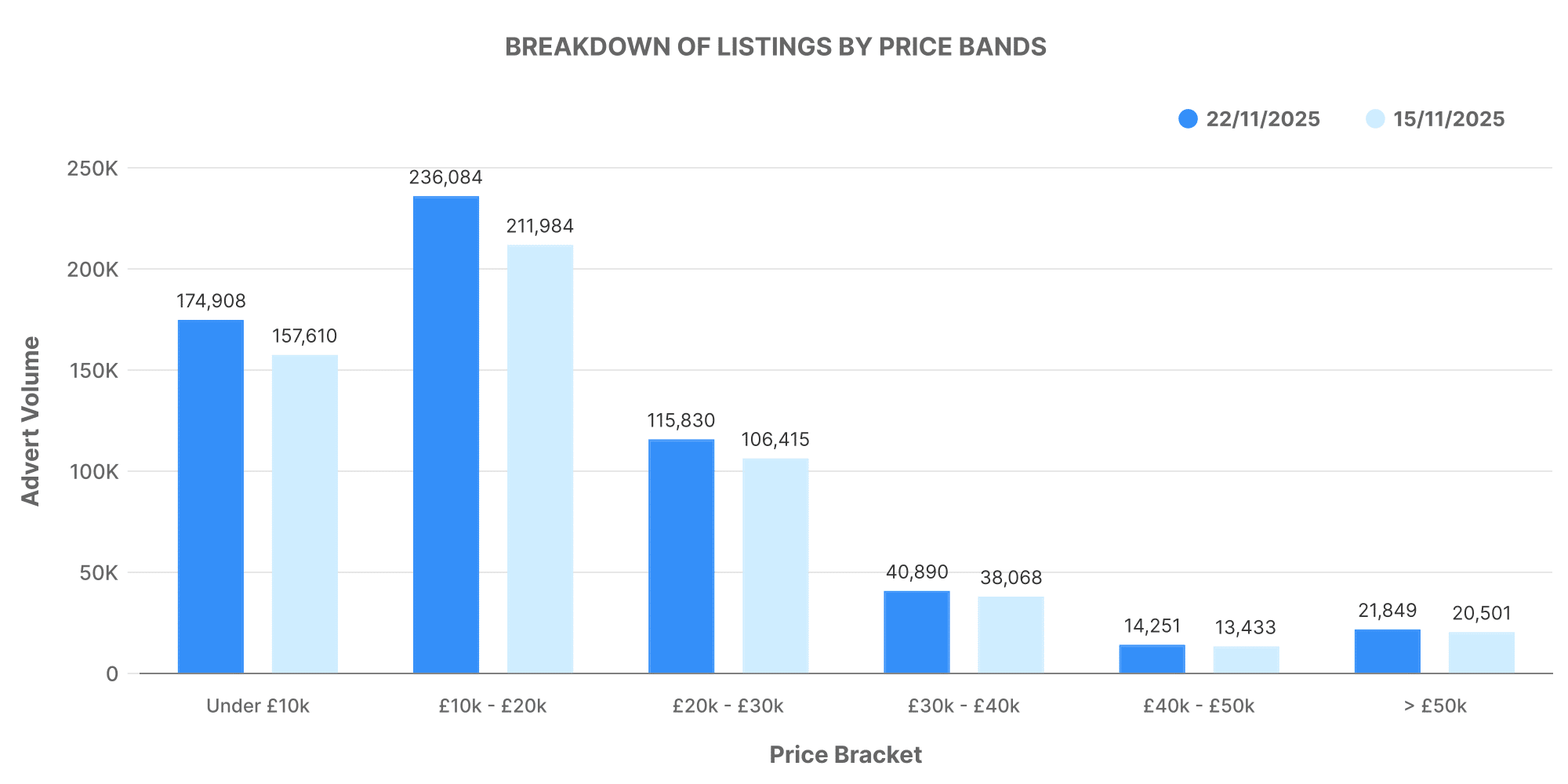

The used ICE vehicle market retained a balanced distribution with significant activity in the £10,000 – £20,000 price band, followed by the £20,000 – £30,000 price band. This is shown in the graph below:

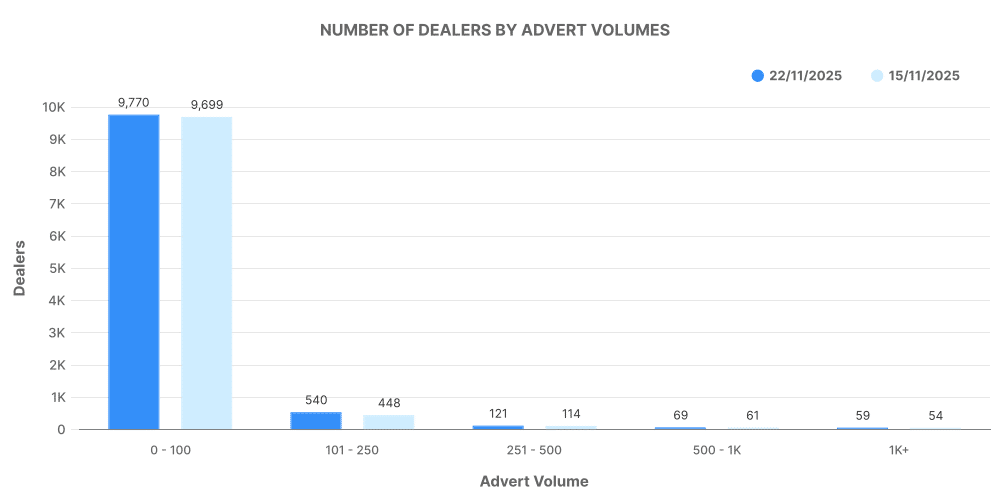

Observing the dealer volume, it becomes evident that the used ICE market’s nature is robust with dealers of various capacities participating evenly.

This diversity can be linked to the average listing price of £18,996, catering to varying customer demands and budgets.

The Electric Counterpart: EV Market Insights

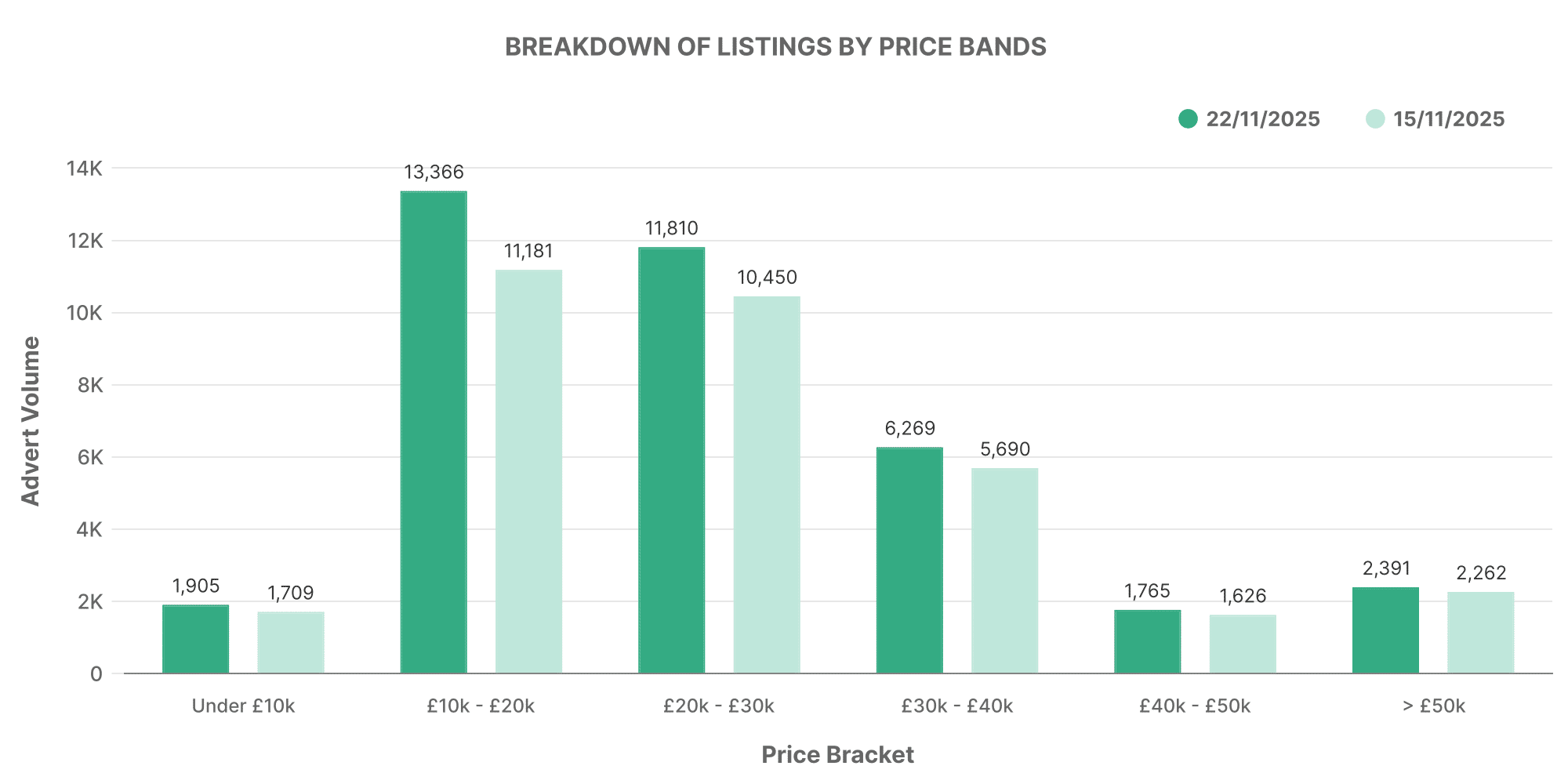

The price band distribution of used electric vehicles (EV) revealed a similar pattern to ICE, with a dominant presence in the £10,000 – £20,000 range. However, the average price for EV listings was significantly higher (~£26,022), reflective of the technology’s relative novelty and demand factors.

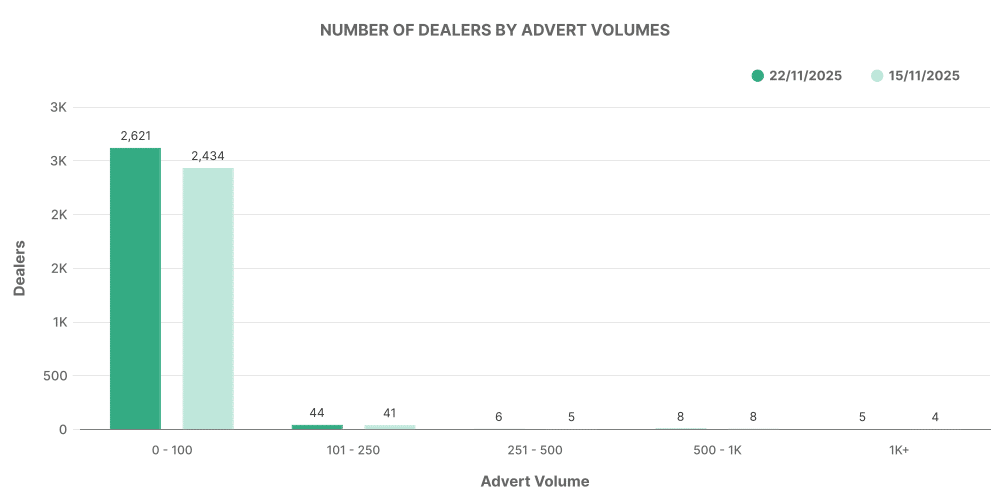

In terms of dealership volumes for EVs, the listings were primarily concentrated between 0-100 vehicles. This could be a marker of the emerging nature of the used electric market in contrast to ICE vehicles.

Top 100 Dealers: ICE vs EV

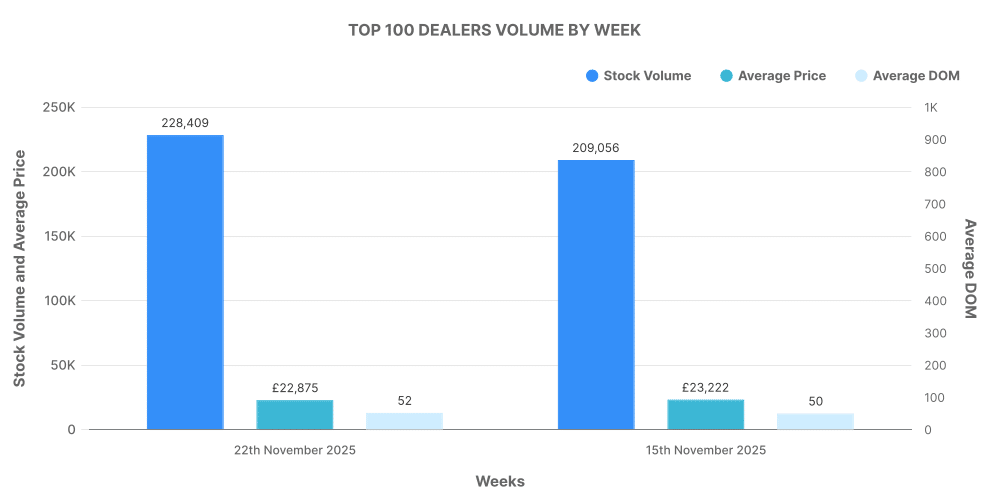

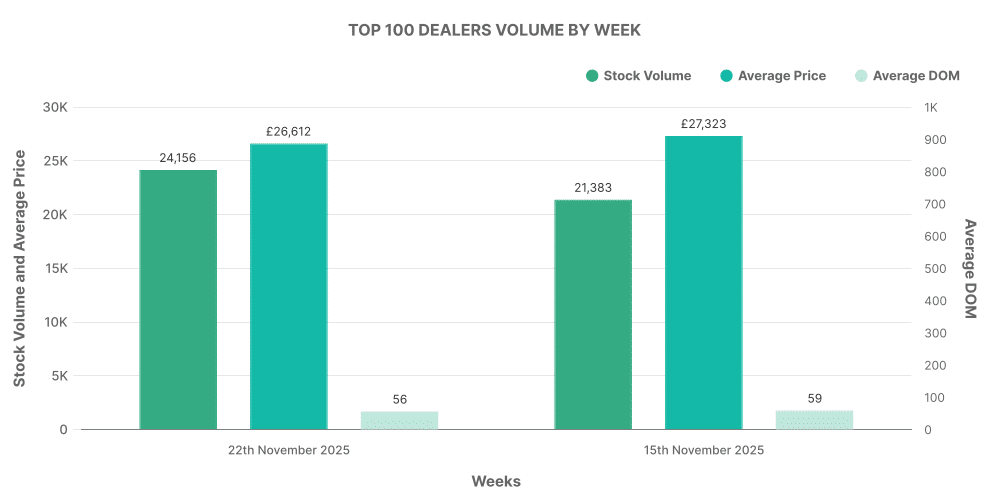

Another metric of interest is the listings contribution by the top 100 dealers in both used ICE and EV markets.

In the ICE sector, the top 100 dealers contributed 15.5% to total listings, chiefly featuring vehicles with above-average market prices.

On the EV side, the top 100 dealers accounted for a larger share – 18.7% of total EV listings. These dealerships listed vehicles at prices slightly higher than the market average, indicative of the range’s appeal for premium buyers.