Overview of the Used Car Market (ICE)

Total Listings and Dealer Engagement

For the week ending 25th May 2024, the total number of listings in the used car market was 888,088, showing a slight decrease from the previous week’s 897,158. The number of dealers also saw a minimal decrease from 10,528 to 10,512. This minor dip in activity could be attributed to various market factors, including seasonal adjustments.

Average Days on Market (DOM) and Price Trends

The average days on market for ICE vehicles remained steady at 82 days, indicating consistent buyer interest and stable market conditions. The average price also held relatively constant, slightly decreasing from £18,118 to £18,070. This stability suggests a balanced supply and demand scenario.

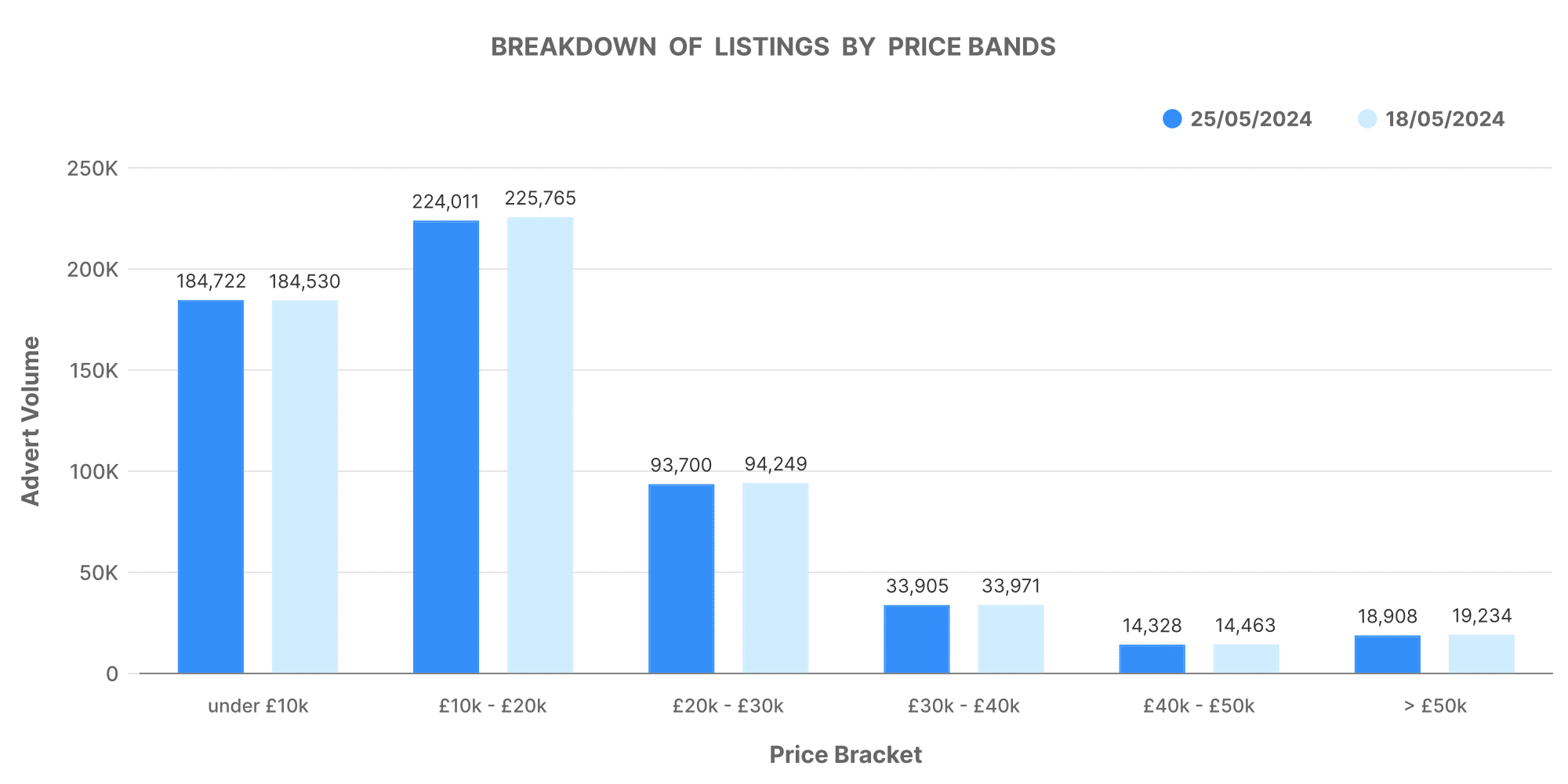

Breakdown of Listings by Price Bands

Understanding the distribution of car listings across different price bands helps dealers identify potential gaps and opportunities in the market.

- £0-10K: Approximately 184,722 vehicles fell into this category, showing a marginal increase from the previous week.

- £10-20K: This segment saw a small decrease, with 224,011 listings compared to 225,765.

- £20-30K: The number of listings remained stable at around 93,700.

- £30-40K: A slight decrease to 33,905 from 33,971.

- £40-50K: This category remained almost unchanged with 14,328 listings.

- £50K+: Listings in this high-end category slightly decreased to 18,908 from 19,234.

These trends suggest a steady demand across all price ranges, with a particular focus on the more affordable segments.

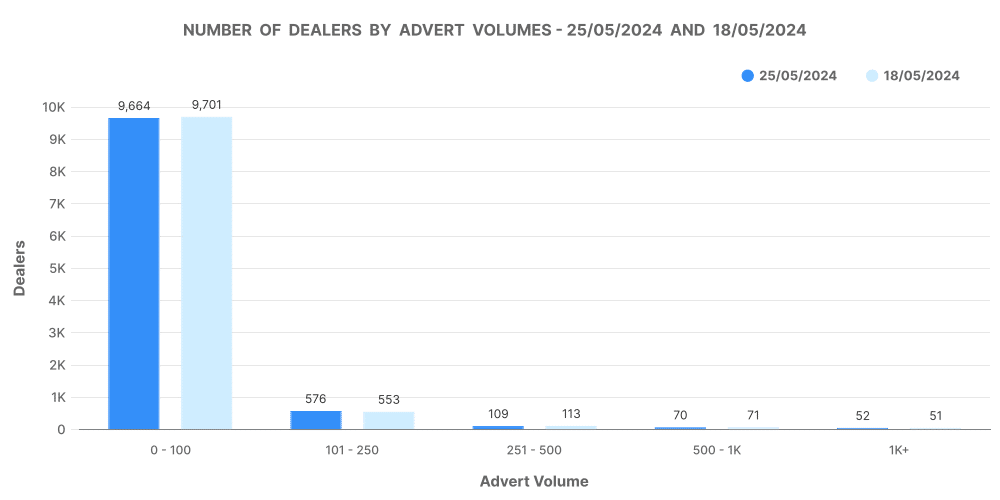

Number of Dealers by Advert Volumes

The distribution of inventory among dealers provides insights into market concentration and competition.

- 0-100 Vehicles: There were 9,664 dealers in this category, showing a slight decrease.

- 101-250 Vehicles: Increased to 576 dealers.

- 251-500 Vehicles: Slightly decreased to 109 dealers.

- 500-1K Vehicles: Remained steady at 70 dealers.

- 1K+ Vehicles: Increased marginally to 52 dealers.

This data indicates that the majority of dealers maintain a relatively small inventory, suggesting a highly competitive market with numerous small players.

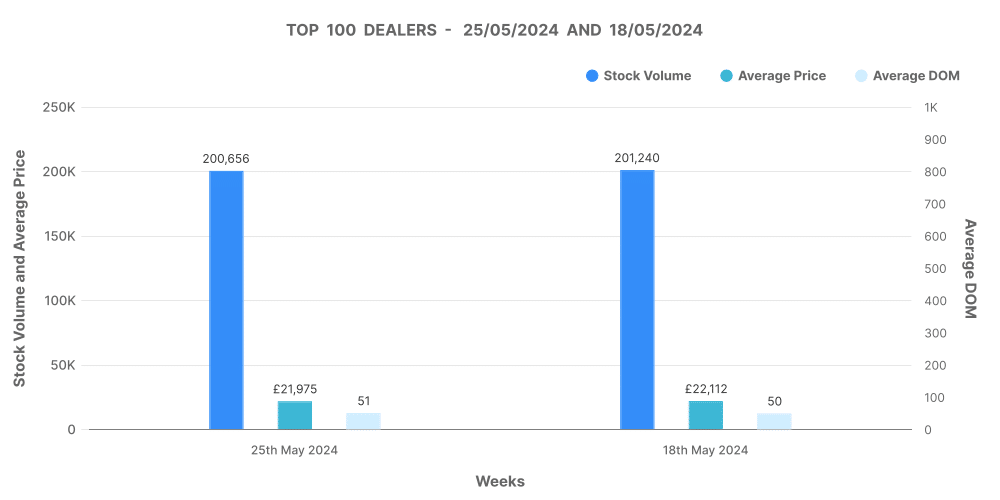

Analysis of Top 100 Dealers by Volume

Focusing on the top 100 dealers provides a clearer picture of market leaders and their strategies.

- Stock Volume: Slightly decreased to 200,656 from 201,240.

- Average DOM: Increased marginally to 51 days.

- Average Price: Decreased to £21,975 from £22,112.

- Price Increases: Noted a significant rise to 13,052 instances.

- Price Decreases: Dropped to 71,249 instances from 75,557.

These fluctuations highlight the strategic adjustments top dealers make to remain competitive, with a notable increase in price adjustments to attract buyers.

Electric Used Car Market Insights

Total Listings and Dealer Engagement

The electric used car market saw a slight decrease in total listings, from 132,021 to 130,715, and a minimal reduction in the number of dealers from 4,349 to 4,326. This stable activity reflects the growing interest and investment in electric vehicles (EVs).

Average Days on Market (DOM) and Price Trends

The average DOM for EVs remained consistent at 69 days, indicating a strong and stable demand. The average price of EVs saw a negligible decrease from £27,655 to £27,615, maintaining their position as a higher-end market segment compared to ICE vehicles.

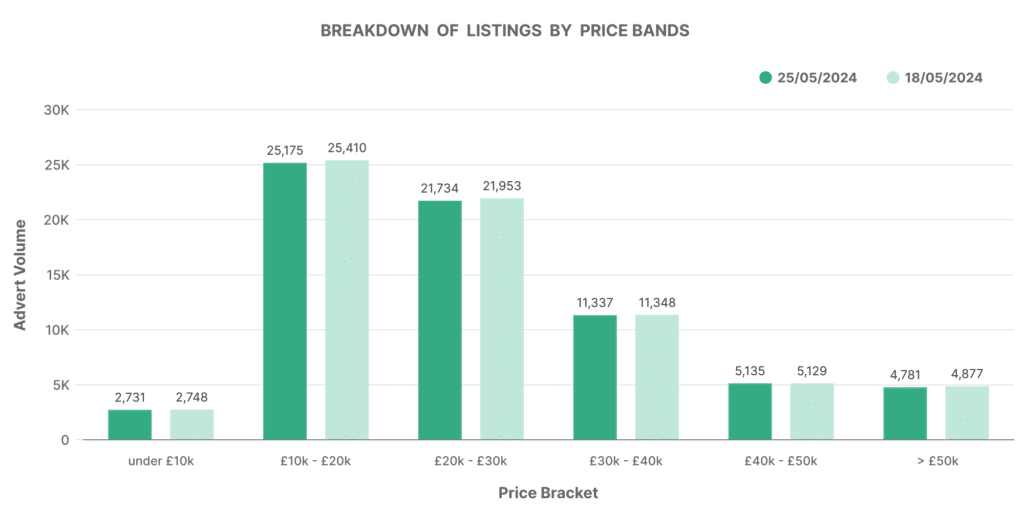

Breakdown of Listings by Price Bands (EV)

- £0-10K: Listings slightly decreased to 2,731 from 2,748.

- £10-20K: Decreased to 25,175 from 25,410.

- £20-30K: Decreased to 21,734 from 21,953.

- £30-40K: Decreased marginally to 11,337.

- £40-50K: Listings remained stable at 5,135.

- £50K+: Slightly decreased to 4,781 from 4,877.

This distribution shows a balanced interest across various price ranges, with a significant number of listings in the mid-range (£20-30K).

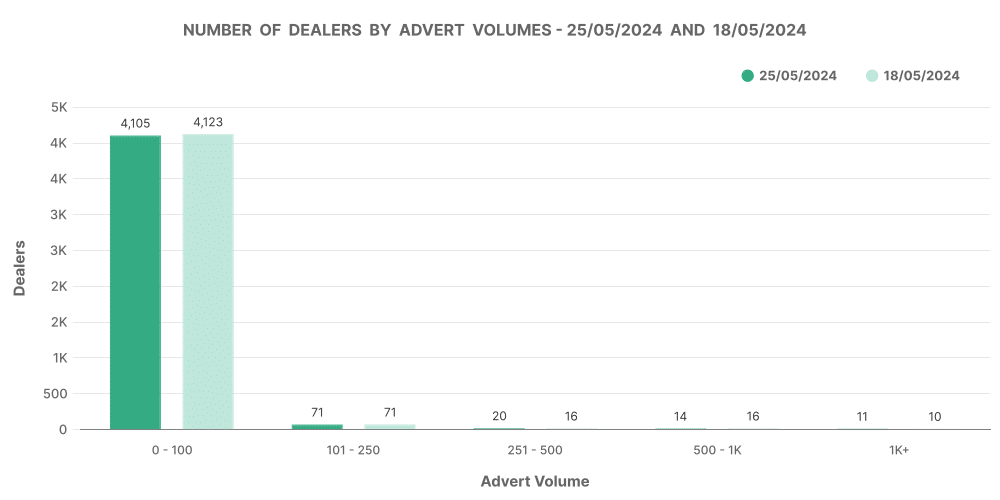

Number of Dealers by Advert Volumes (EV)

- 0-100 Vehicles: Remained almost steady at 4,781 dealers.

- 101-250 Vehicles: Decreased slightly to 4105.

- 251-500 Vehicles: Stable at 71 dealers.

- 500-1K Vehicles: Increased marginally to 20 dealers.

- 1K+ Vehicles: Slight increase to 11 dealers.

The data suggests a stable market with a majority of dealers managing smaller inventories.

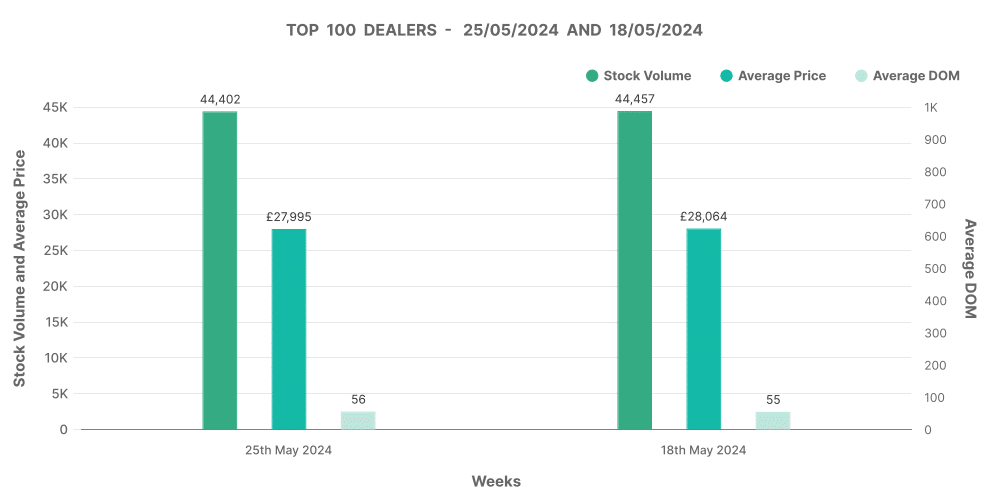

Analysis of Top 100 Dealers by Volume (EV)

- Stock Volume: Decreased slightly to 44,402.

- Average DOM: Increased marginally to 56 days.

- Average Price: Decreased to £27,995 from £28,064.

- Price Increases: Rose to 2,393 instances.

- Price Decreases: Decreased to 17,576 instances.

These changes reflect strategic pricing adjustments among the top dealers to maintain competitiveness in a growing market segment.

Comparative Analysis of ICE and EV Markets

Market Share

The percentage share of EVs in the used car market was 12.46%, a slight increase from the previous week. ICE vehicles continued to dominate with 87.54%. This steady growth in EV share highlights the increasing consumer interest and market shift towards electric vehicles.

Average Prices

The average price of EVs (£27,614.90) remains significantly higher than that of ICE vehicles (£16,712.70). This price disparity underscores the premium value associated with electric cars, likely due to their newer technology and environmental benefits.

Market Dynamics

The consistent DOM for both ICE and EVs suggests stable market conditions, with no significant changes in buyer behaviour. However, the slight increase in price adjustments, particularly among the top dealers, indicates a competitive market environment where strategic pricing is crucial.

Conclusion

The UK used car market remains robust, with consistent activity across both ICE and EV segments. The slight increases and decreases in listings and dealer engagement reflect a stable yet competitive environment. For automotive dealers, understanding these trends and leveraging Marketcheck UK’s comprehensive data can provide a significant advantage. By accessing real-time insights and detailed market analysis, dealers can make informed decisions, optimise their inventory, and ultimately enhance their profitability.

Marketcheck UK offers the tools and data necessary to navigate this dynamic market. Whether it’s understanding price trends, tracking days on market, or analysing dealer performance, Marketcheck UK’s solutions are tailored to meet the needs of automotive professionals. Stay ahead in the competitive used car market by partnering with Marketcheck UK and leveraging our cutting-edge data solutions.