UK Weekly Used Car Market Data – 16th August – 31st August 2024

British automotive businesses consistently strive to stay abreast of the latest trends regarding used cars within the UK market. Comprehensive, accurate data is the key to staying ahead in this competitive industry. Armed with the insights derived from reliable sources such as Marketcheck UK, businesses can position themselves for optimal success. This analysis outlines some key statistics and trends in both conventional internal-combustion engine vehicles (ICE) and the burgeoning electric used car market (EV) for the weeks ending 23rd August and 30th August 2024.Internal-Combustion Engine Vehicles (ICE)

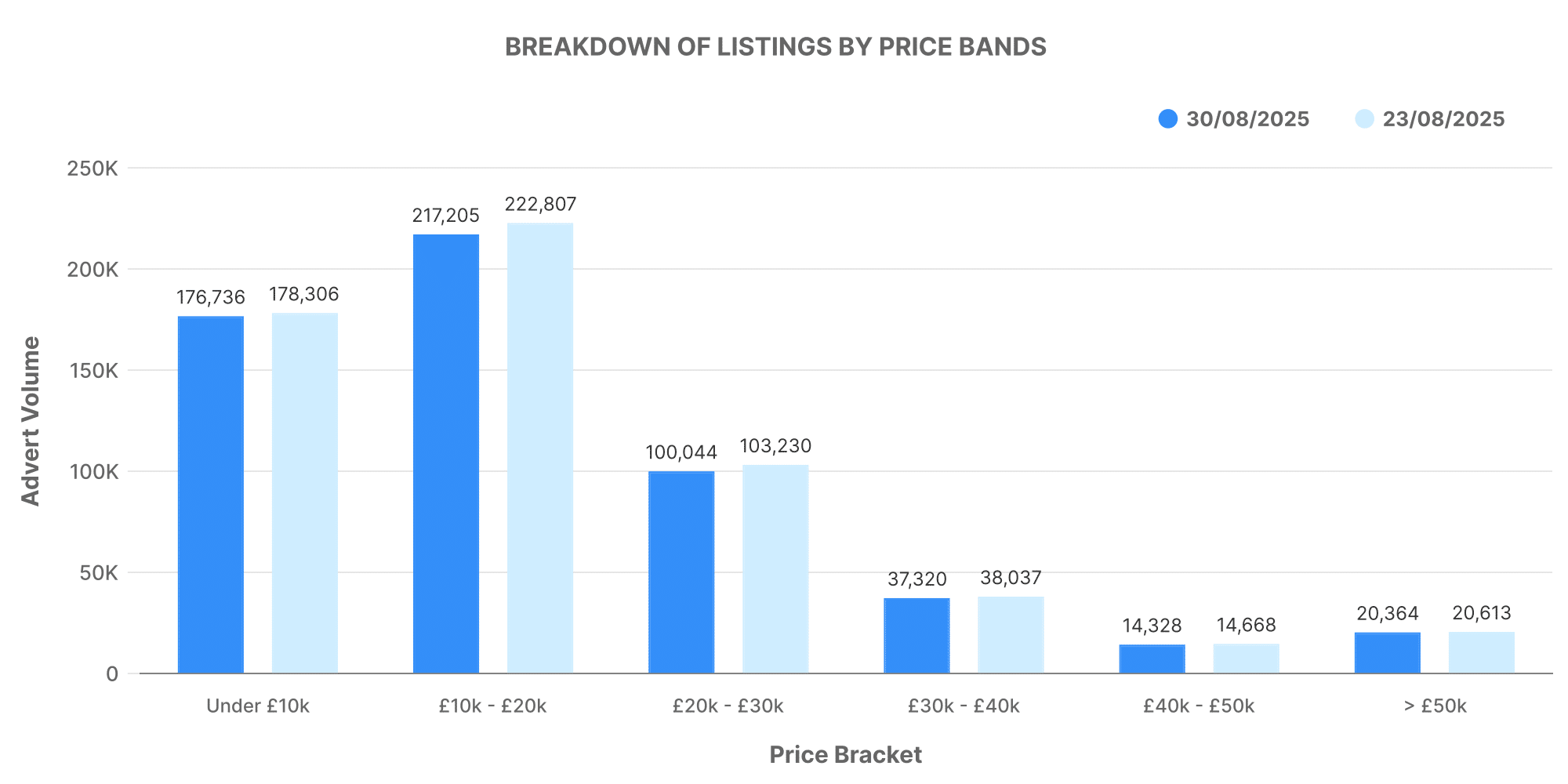

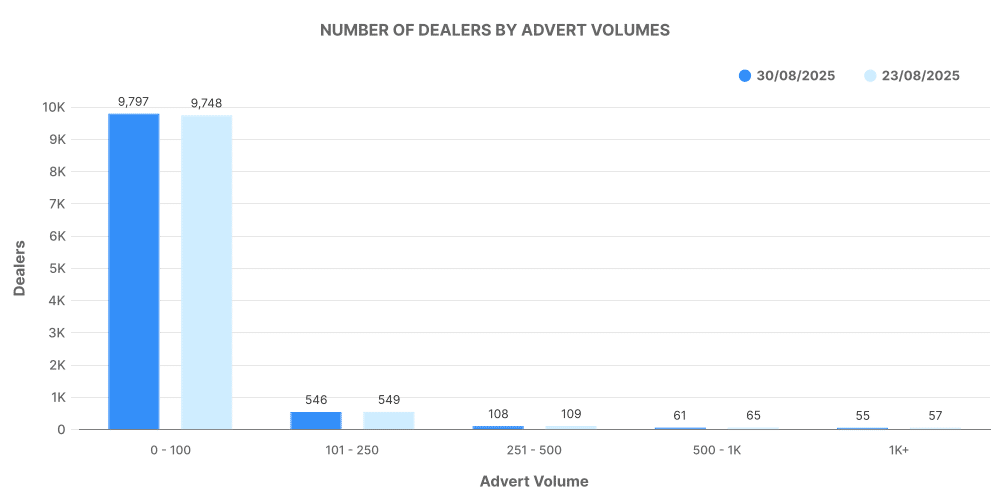

For the week ending 23rd August 2024, the used ICE car market comprised a total of 587,466 vehicles listed by 10,568 dealers. By the following week, 575,696 ICE vehicles were listed by 10,599 dealers; a marginal decrease in number but a slight increase in participation from dealers. The average price of ICE vehicles was relatively steady within these weeks, standing at £18,680 for the week of 16th August to 23rd August, and dropping slightly to £18,658 for the subsequent week. The distribution of different price bands for the week ending 23rd August showed the majority of ICE vehicles falling within the £10,000 – £20,000 range, followed closely by the £20,000 – £30,000 range. There were a significant number of listings in the £30,000 – £40,000 bracket but very few above £50,000. This distribution pattern remained consistent in the following week as shown in the graph.

Electric Used Car Market (EV)

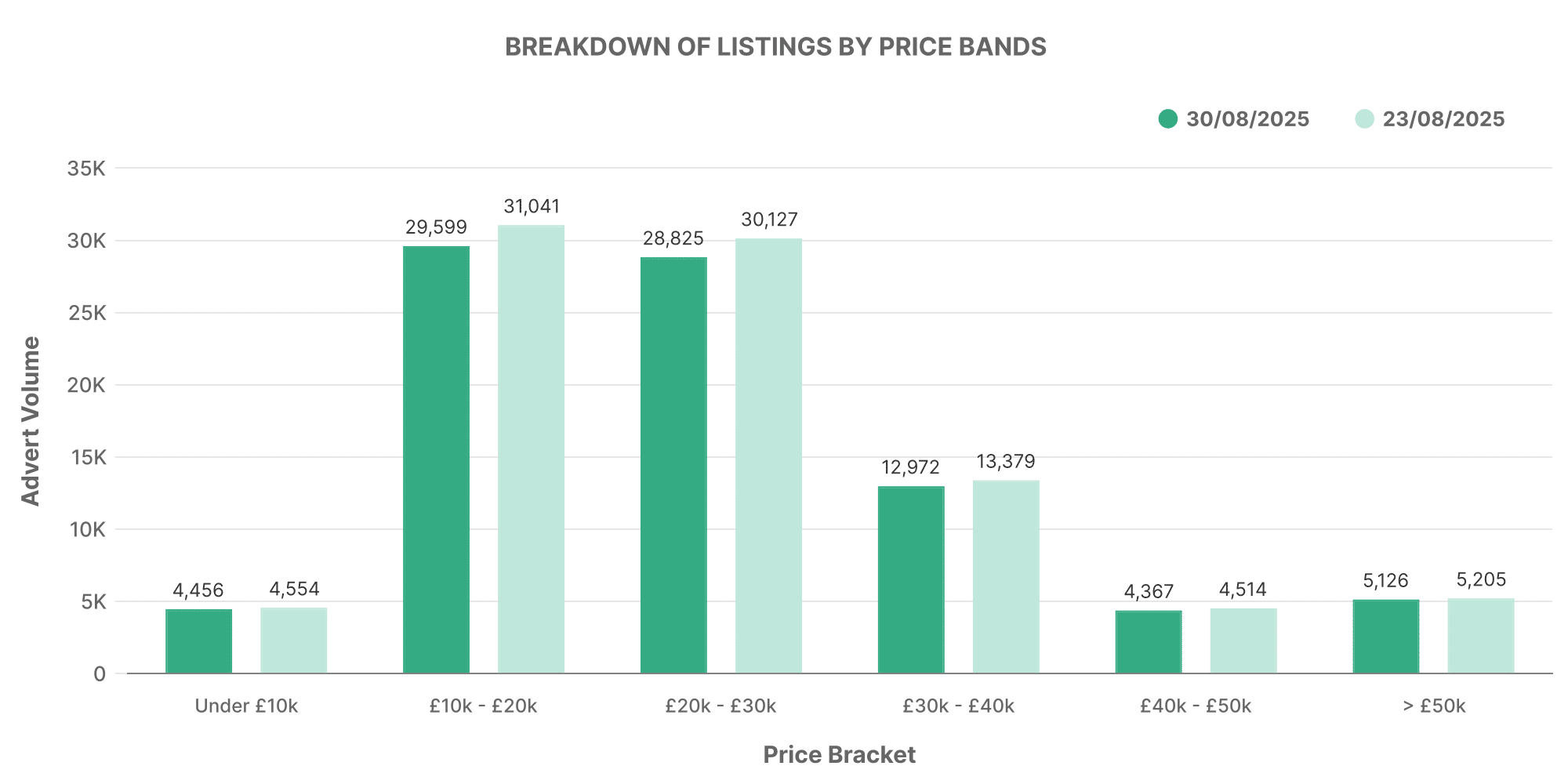

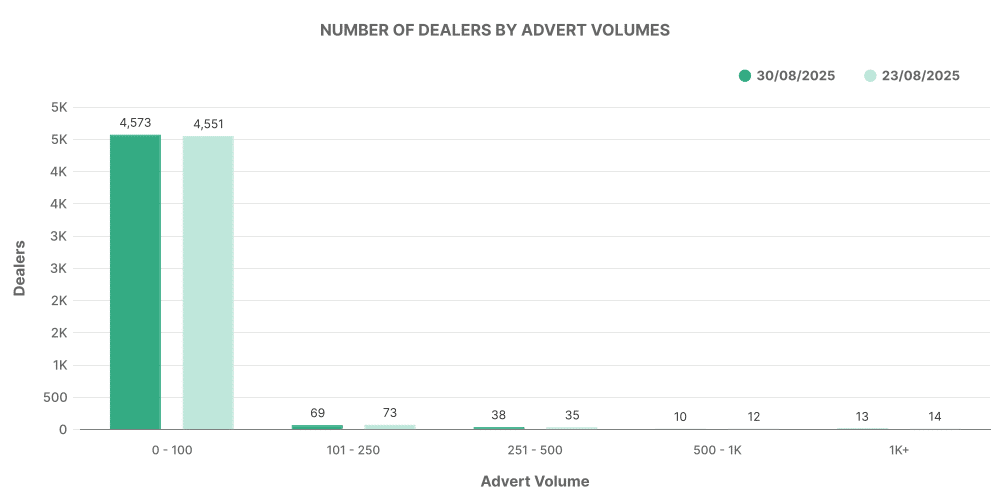

There continues to be steadfast growth in the electric car market (EV). In the week ending on 23rd August, a total of 89,447 used electric vehicles were listed by 4,767 dealers. This dropped slightly to 85,944 listings by 4,787 dealers in the week that followed. The average prices for EVs stood at £26,528 for the week ending 23rd August and rose to £26,662 for the following week, indicating a consistent demand for electric cars. Similar to ICE vehicles, the majority of EVs fell within the £10,000 – £20,000 price band, with a significant number in the £20,000 – £30,000 range. Notably, the number of EVs above the £50,000 mark was low but persevering, proving the existence of a luxury sub-category within the used EV car market.

Comparison: ICE vs EV

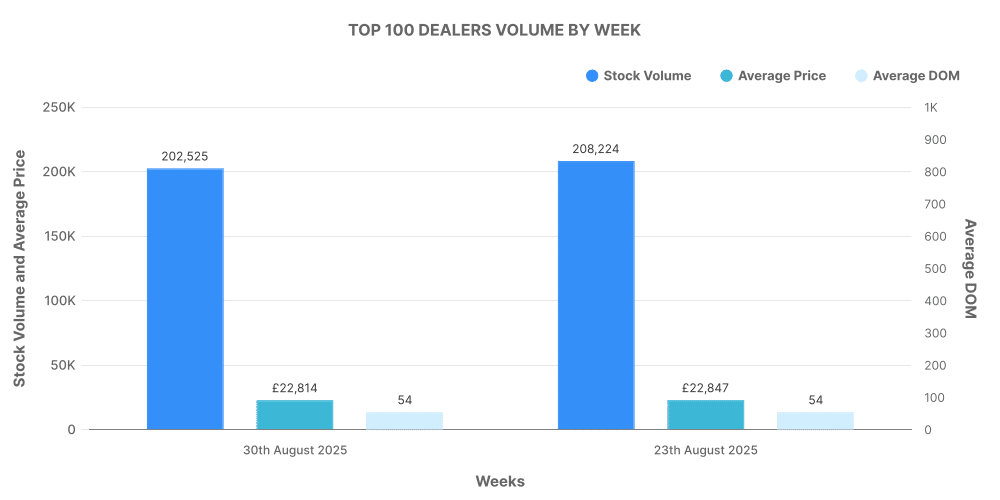

To highlight the contrast between the two categories, let’s consider the top 100 dealerships within the used ICE and EV markets. For the weeks ending on 23rd August and 30th August, the top 100 dealers accounted for a marginal, yet significant share of total listings in both the ICE and EV markets.Top 100 Dealers: ICE Vehicles

For the week ending 23rd August, the top 100 ICE vehicle dealers accounted for an impressive 15.5% of total listings with an average price of £22,847. The following week this group’s contribution remained consistent at 15.5%, with a slight decrease in average price.

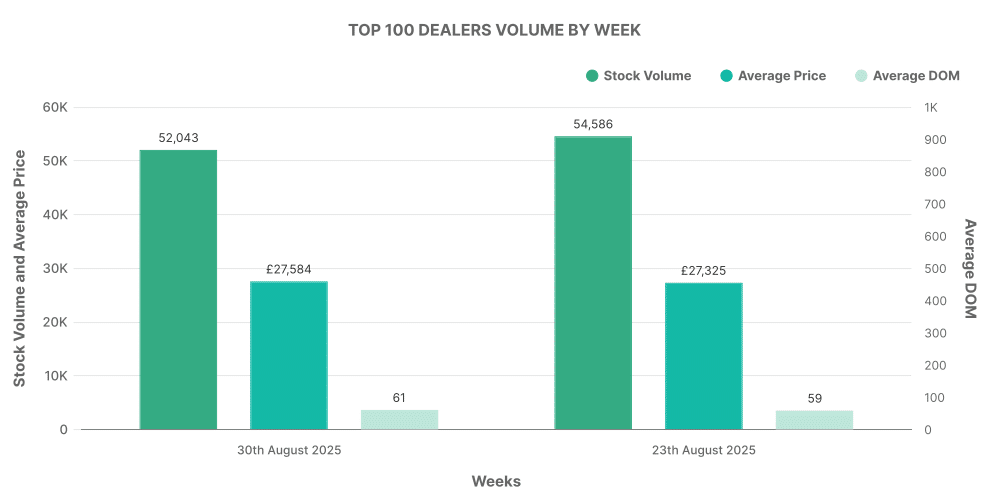

Top 100 Dealers: EV

The top 100 dealers in the EV market portrayed a unique situation. In the week ending 23rd August, these dealers accounted for 18.7% of total EV listings. The average price of the electric cars they sold was also higher than the market average at £27,325. In the following week, this same group were responsible for 14.93% of total listings and an increased average price.

*includes electric vehicles, petrol hybrids and diesel hybrids.