Gaining Momentum in the Used Car Markets: A Comparative Insight into ICE and EV Trends in the UK

In the diverse and competitive landscape of the UK automotive industry, staying informed is crucial for the success of dealerships. Knowledge of the latest insights, understanding price fluctuations of the UK used car market, and having an insightful perspective of the Internal Combustion Engine (ICE) and Electric Vehicle (EV) markets can provide a significant edge. With comprehensive data from Marketcheck UK, you’re in the driver’s seat, navigating the used car scene with confidence.

An Overview of the Used Car Market (ICE)

As of the week beginning 14th September 2023, the UK’s used car market saw a total of 914,852 listings, which is a slight increase from the previous week’s 905,638. This suggests a steady flow of vehicles coming into the market, ensuring ample choice for potential buyers.

The average Days On Market (DOM) metric for these vehicles sits at 86, meaning on average, vehicles are sold just shy of three months. This piece of automotive market insight is vital for dealers wanting to optimise their selling strategies (and avoid cars gathering dust on their lots!).

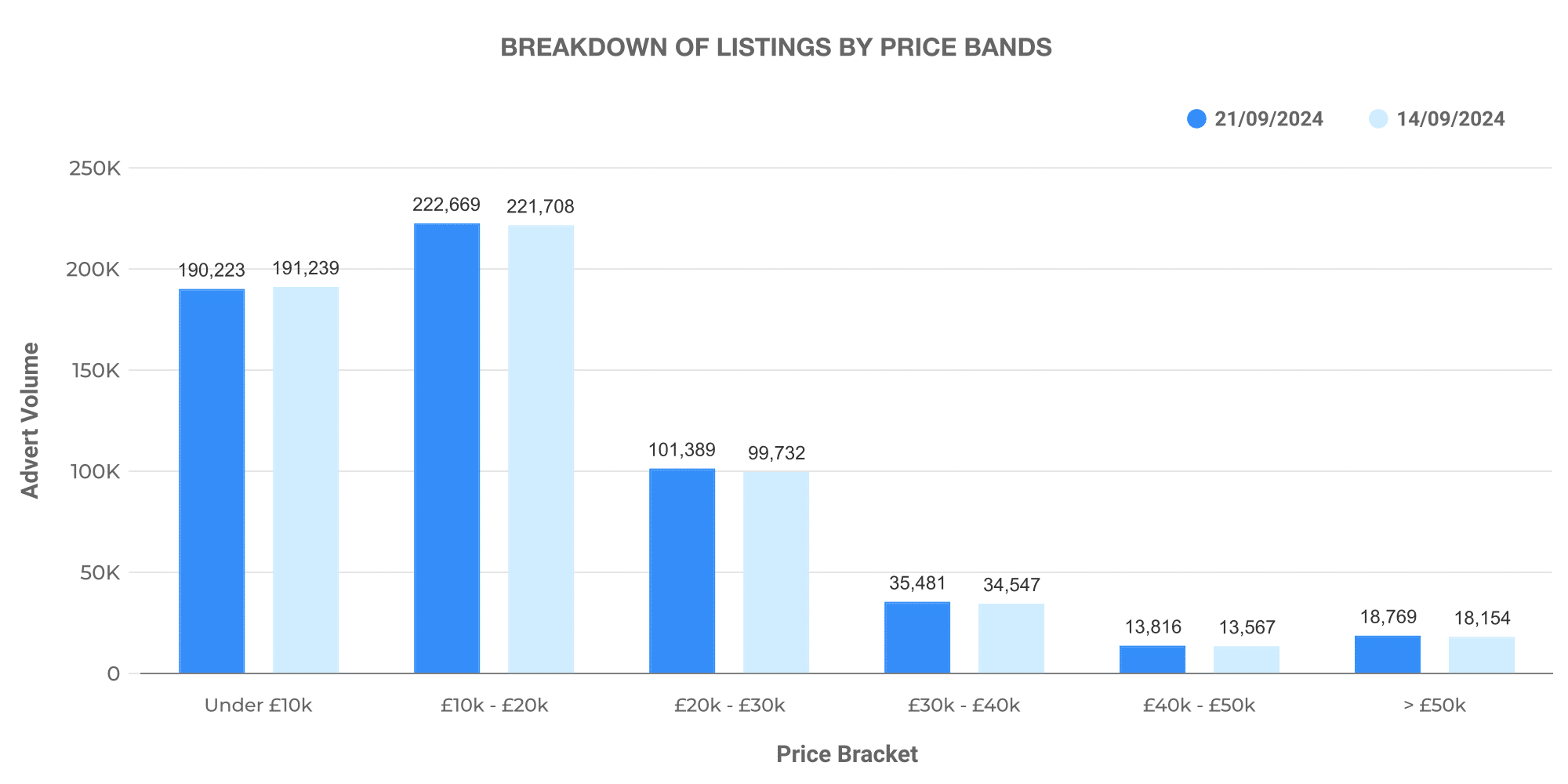

When looking at vehicle pricing across the market, our data highlights an array of price bands, with the £10k-20k range holding the majority of listings followed by the £0-10K.

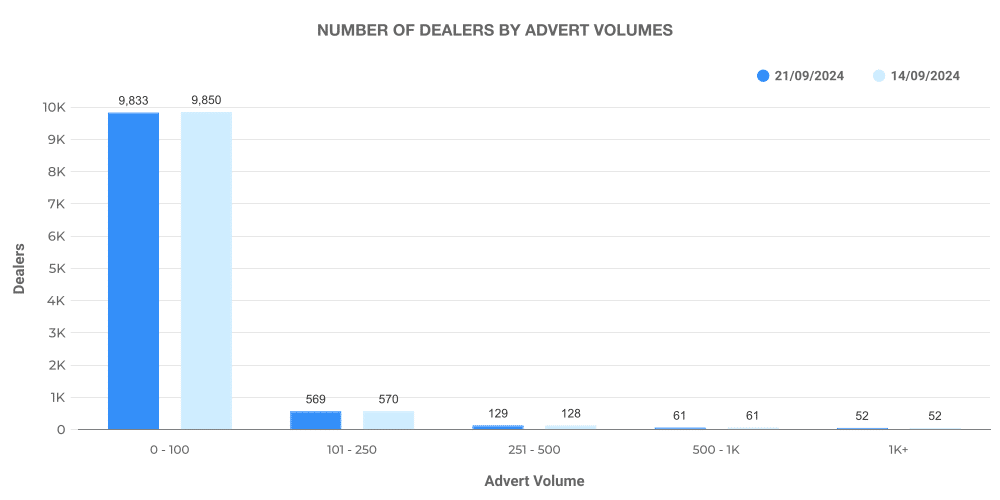

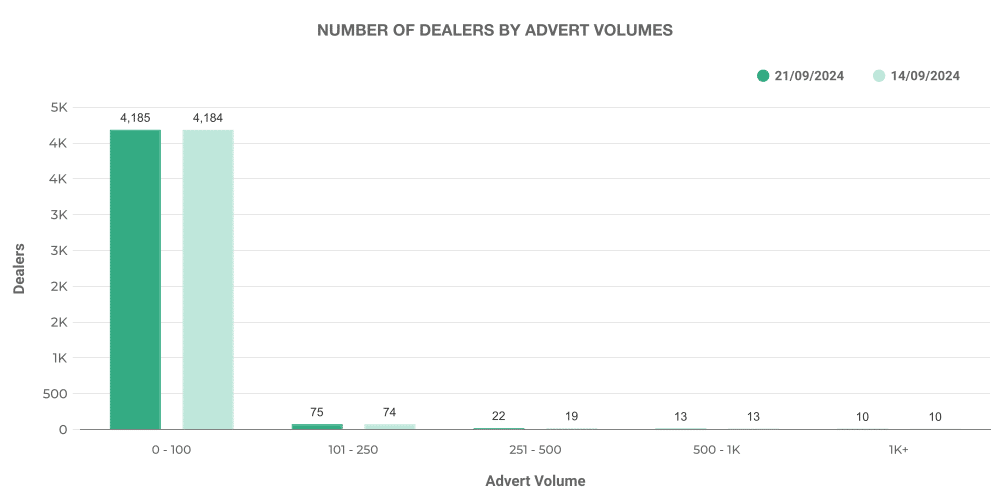

While majority of the dealerships have less than 100 listings in their inventory, a small number (52 dealerships) have a substantial inventory of more than 1,000 vehicles. For comparison, dealerships with 101-250 vehicles in their inventory only totalled 129 in the same period.

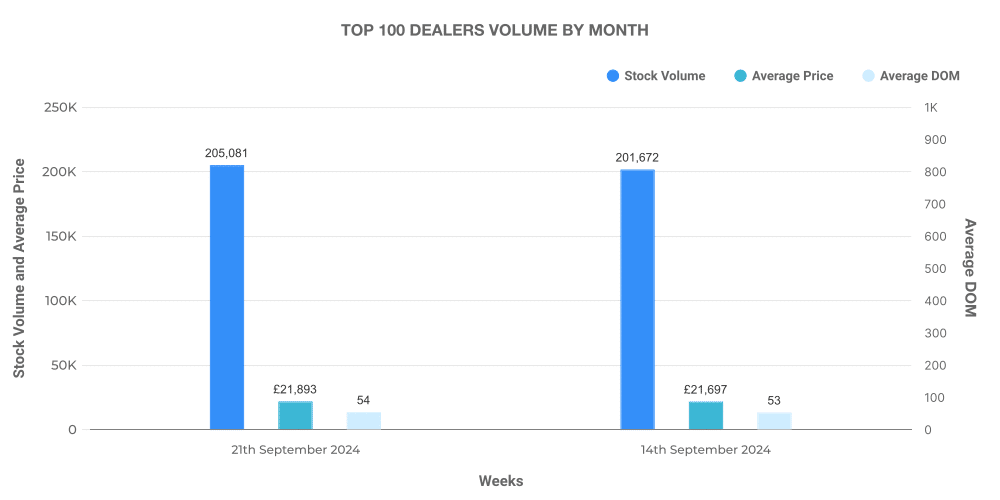

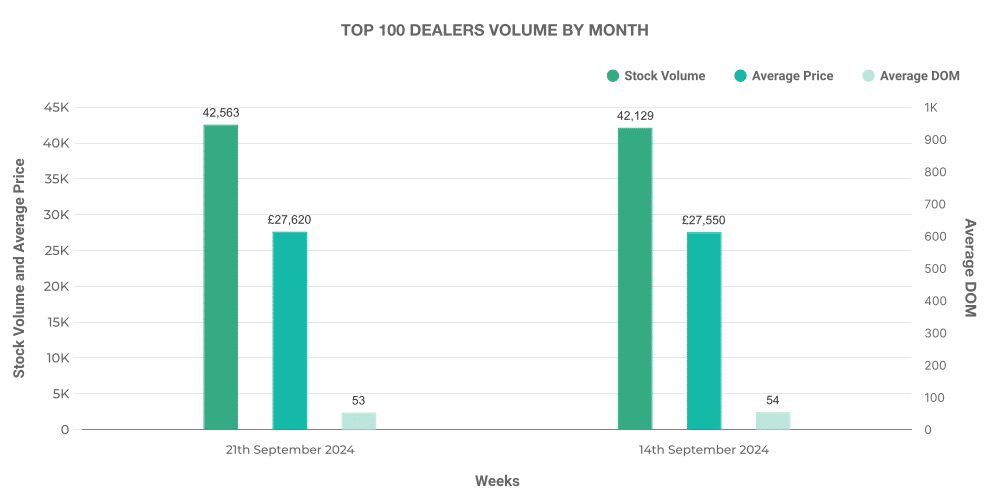

In terms of top dealers, the highest volume of used cars can be found within the 100 largest dealerships. This underscores the market dominance of these dealerships and hints at the possibility of high sales volumes attributable to their wide variety of options.

Shifting Gears to Electric – The EV Market

An increasing environmental consciousness coupled with technological advances has driven momentum in the Electric Vehicle (EV) market. As of the week beginning 14th September 2023, the UK used electric car market saw a total of 127,787 listings – a slight jump from the prior week’s 125,809 listings.

The average DOM for these electric vehicles stands at 68 days, significantly shorter than ICE vehicles. This could suggest a swiftly rising demand for EVs in the UK used car market, a promising sign for dealers looking to tap into this burgeoning segment.

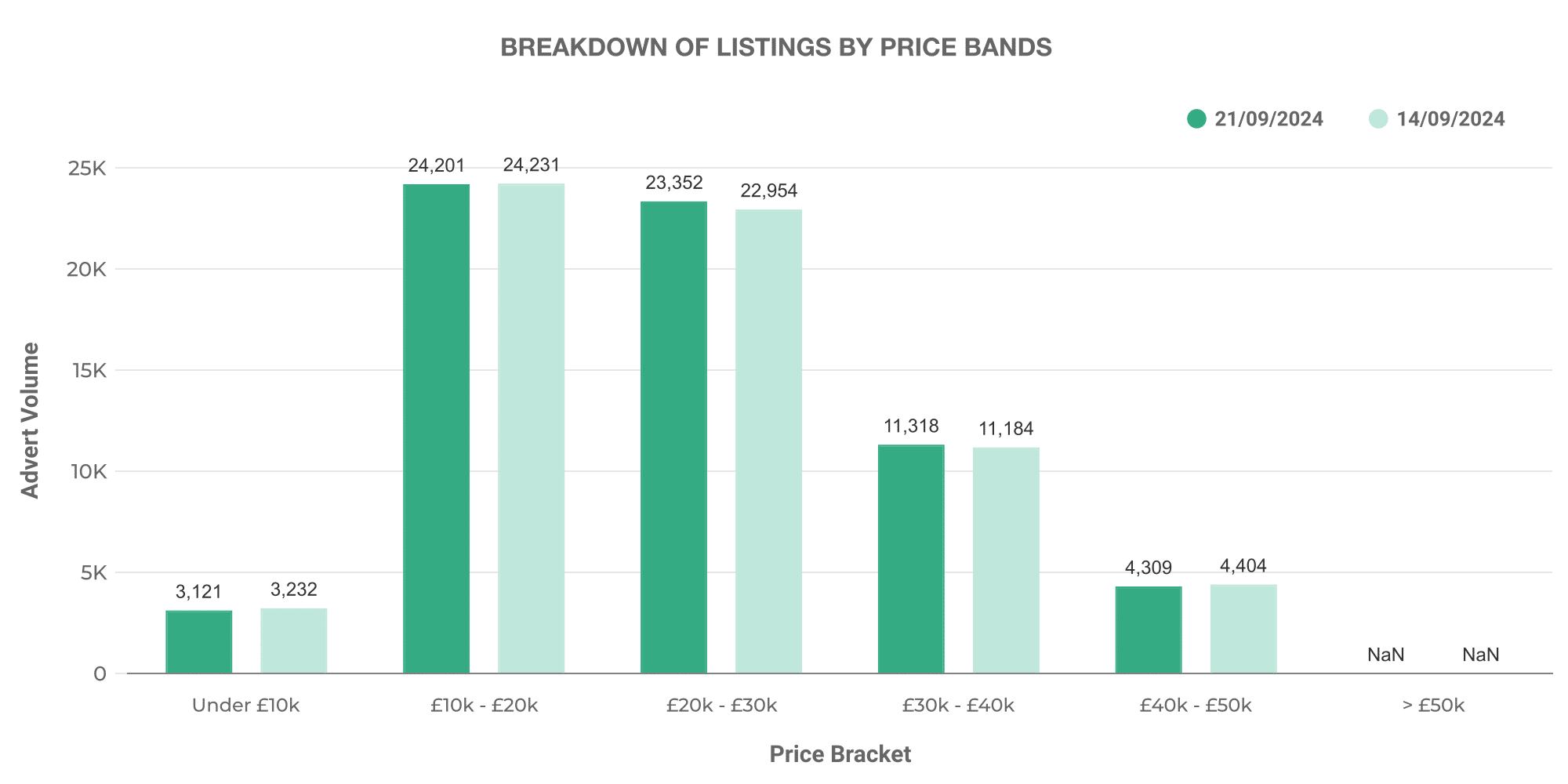

In terms of pricing, the majority of used EVs fall into the £10k-20K range, similar to ICE vehicles. However, there’s a considerably higher proportion of used EVs that fall into the more expensive £20K-£50K price band.

With respect to inventory, there is a striking concentration of EVs being held by a select number of dealerships. 10 dealerships hold an inventory of over 1000 used EVs, whereas the majority have fewer than 100.

The Top 100 dealers also make a significant contribution to the EV listings. Dealers looking to branch into EVs may find it beneficial to survey these top performers for insights into customer preferences and successful sales strategies.

ICE vs EV: Key Comparisons

Examining the overarching trends in both the ICE and EV car markets, one key difference stands out: the average DOM metric. In this regard, EVs have a clear edge with an average 18 days less on the market compared to ICE vehicles. This shorter sales cycle could be indicative of the increasing consumer trend toward environmentally-friendly vehicle options. The higher average price for EVs also supports this, as consumers appear willing to pay a premium for these greener options.

Marketcheck UK’s Role in the Automotive Industry

In a market that thrives on competitiveness and dynamic changes, ensuring you have the most up-to-date insights can be a gamechanger. Marketcheck UK specialises in providing data on every current and historical used car advert in the UK, equipping you with valuable tools to understand market dynamics, track ‘days on market’, and assess sales strategy effectiveness.

Whether you’re trying to understand inventory patterns or trying to forecast the potential success of an electric conversion, Marketcheck UK has you covered. By leveraging our comprehensive data, your dealership can stay ahead of trends and make informed strategic decisions that can drive your business forward.

Armed with these insights, UK car dealerships and automotive businesses can navigate the complexities of the used car market with utmost confidence. Interested in learning more? Feel free to get in touch with us at Marketcheck UK – we’re here to keep you in the driver’s seat when it comes to automotive data.

Next week: 28th September | Previous week: 14th September