Riding the Market Waves: An In-depth Analysis of the ICE and EV Used Car Market

Fuelled by demand and innovation, the automotive industry continues to evolve at a breakneck speed. In this unique playing field, dealerships need to stay smart and agile, making data-driven decisions to thrive. Our focus today is diving deep into the UK used car market. We’ll look at everything, from the internal combustion engine (ICE) cars to the rising star – the electric vehicles (EV). With a treasure trove of real-time data at our fingertips, we aim to provide automotive dealerships with the insights they need to navigate through the tricky waters of the used car market, and sail smoothly into profitability.

?Marketcheck UK: Your Navigational Beacon

Marketcheck UK is designed to provide you with the insights you need to stay ahead. We scan through every current and historical used car advertisement in the UK, using this data to provide comprehensive reports. Our tools are not about conjectures, but about detailed outlines backed by data.

You can understand market movements, price bands, ‘days on market,’ price increment and decrement, and much more in real-time. Remember that your business needs more than just loyalty, it needs intelligence. With our help, you can get an eagle-eye view of the UK car price trends.

ICE Used Car Market: An Overview

For the ICE used car market, the period between the 21st and 28th of September in the UK saw 1,0669 dealers, listing a whopping total of 907,022 cars. The average number of days these cars were listed (Days On Market or DOM) was 85, with the average price of vehicles being £18,154.

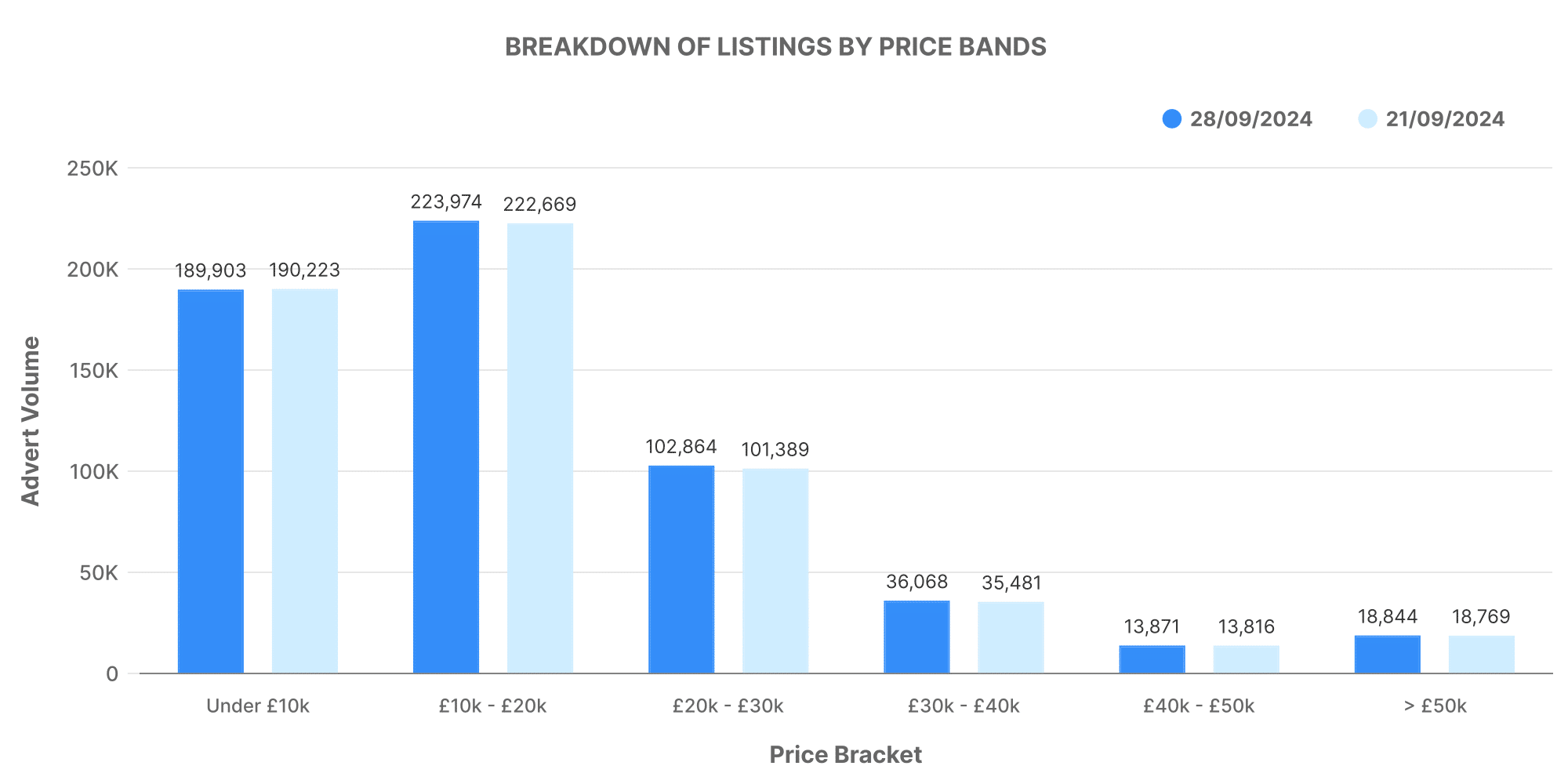

When we break down the price bands, it’s evident that a vast chunk of cars is priced within the £10-20K range, followed by the £0-10K sector. The £20-30K band is lesser and decreases significantly as the price increases.

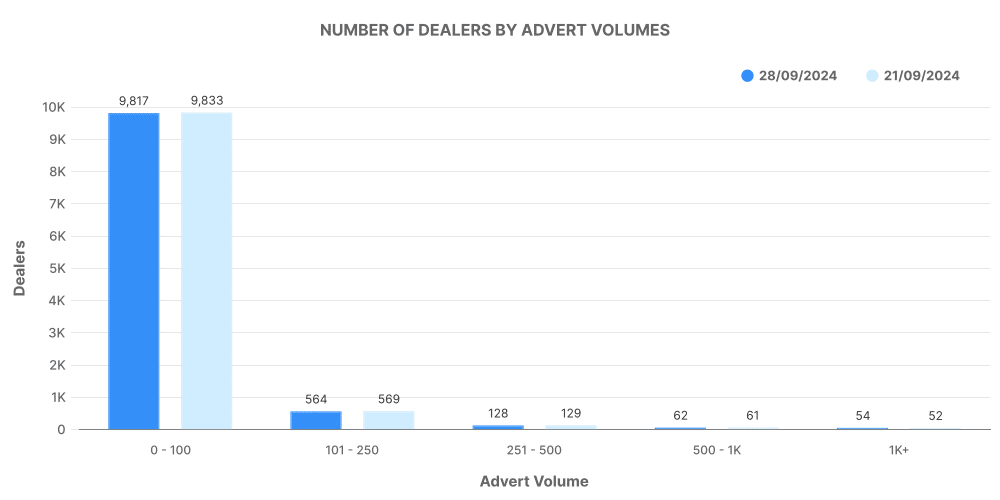

Looking at the inventory volume bands, the sector with the most extensive inventory falls into the 0-100 range. Notably, the trends remain consistent for both the top 100 dealers and the remaining dealerships—indicating a stable distribution of inventory across the dealers.

Electric used cars: A Spark in the Market

The week of the 21st to 28th of September saw 4,401 dealers dealing in electric vehicles, showcasing a total of 125,978 listings. The average price for these vehicles remained at around £27,050, and they stayed on the market for around 68 days on average.

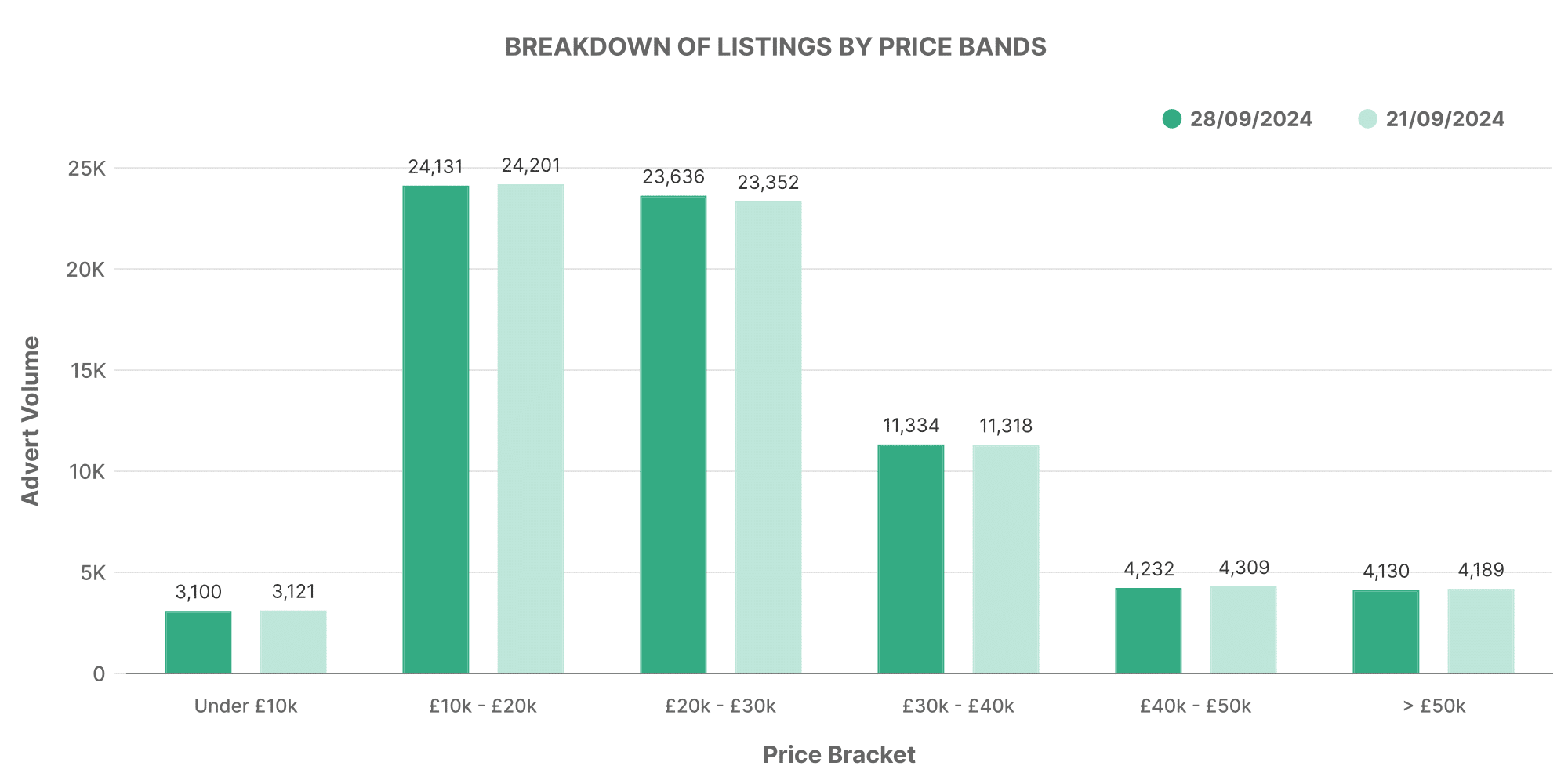

Unlike ICE cars, the largest contributing price band for EV was the £10-20K range followed closely by the £20-30K sector—indicating a higher average price point for used EVs compared to their ICE equivalent.

In terms of volume bands, again, the largest inventory falls in the 0-100 range, both for the top 100 dealers and others. Interestingly, the popular makes and models include the Toyota Yaris, Toyota C-HR, Toyota Corolla, KIA Niro, and BMW 3 series.

The Top 100: A Snapshot

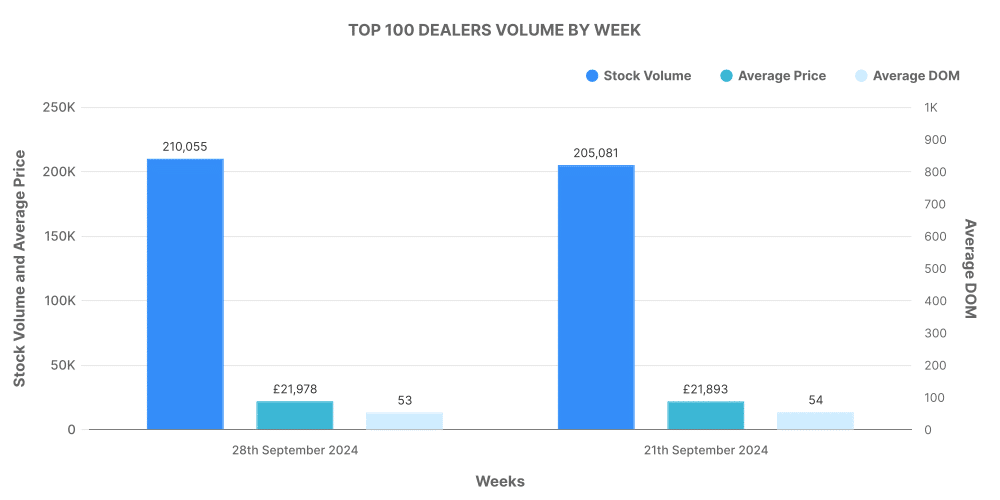

A glance at the top 100 dealers in both markets reveals that for the ICE market, the average DOM remained fairly constant at around 53-54 days in the week. The average price of their cars hovered around the £21,978 – £21,893 mark. Similarly, in the EV market, the Top 100 dealers had their vehicles listed for an average of 53 days and the average car price was around £27,620.

EV vs ICE: Key Comparisons

Comparing the two markets, it’s apparent that a shift is slowly but surely happening. The percentage share of electric vehicles is at 11.96%, which, while smaller than the 88.04% share of non-electric vehicles, is a promising sign of the growth of green mobility. The average price of EVs is also significantly higher at £27,050 compared to the £16,934 for ICE vehicles—indicating a fruitful market for dealerships specialising in used EVs.

Marketcheck UK’s Role in the Automotive Industry

It’s clear; understanding the UK used car market requires detailed insights that come from a comprehensive analysis of real-time data. Marketcheck UK is your data partner in this complex but exciting industry. Whether you are an automotive dealer or a potential investor, our in-depth analysis tools will provide you with the insights you need to make informed decisions. Navigate the dynamic UK car price trends with precision and confidence using our data!

At Marketcheck UK, we believe in empowering our users by offering them access to this world of data in the most user-friendly ways. Whether your preference goes towards CSV feeds, APIs, website tools, or spreadsheet and Looker analysis tools; we’re here to deliver both the data and insights you need to fuel your growth.

Monthly report: September 2024 | Previous week: 21st September