UK Weekly Used Car Market Data – March to April 2025

As professionals involved with the UK automotive sector, understanding the shifts and patterns in the used car market is critical for diverse sectors, from car dealers, insurance companies, and investment companies to car auction businesses, and car finance lenders and brokers.

This article provides insights on the UK used car market trends, specifically focusing on combustion engine vehicles, hereafter referred to as ICE vehicles, and electric used cars. It provides automotive market insights necessary for strategic decision making and planning.

ICE Used Car Market

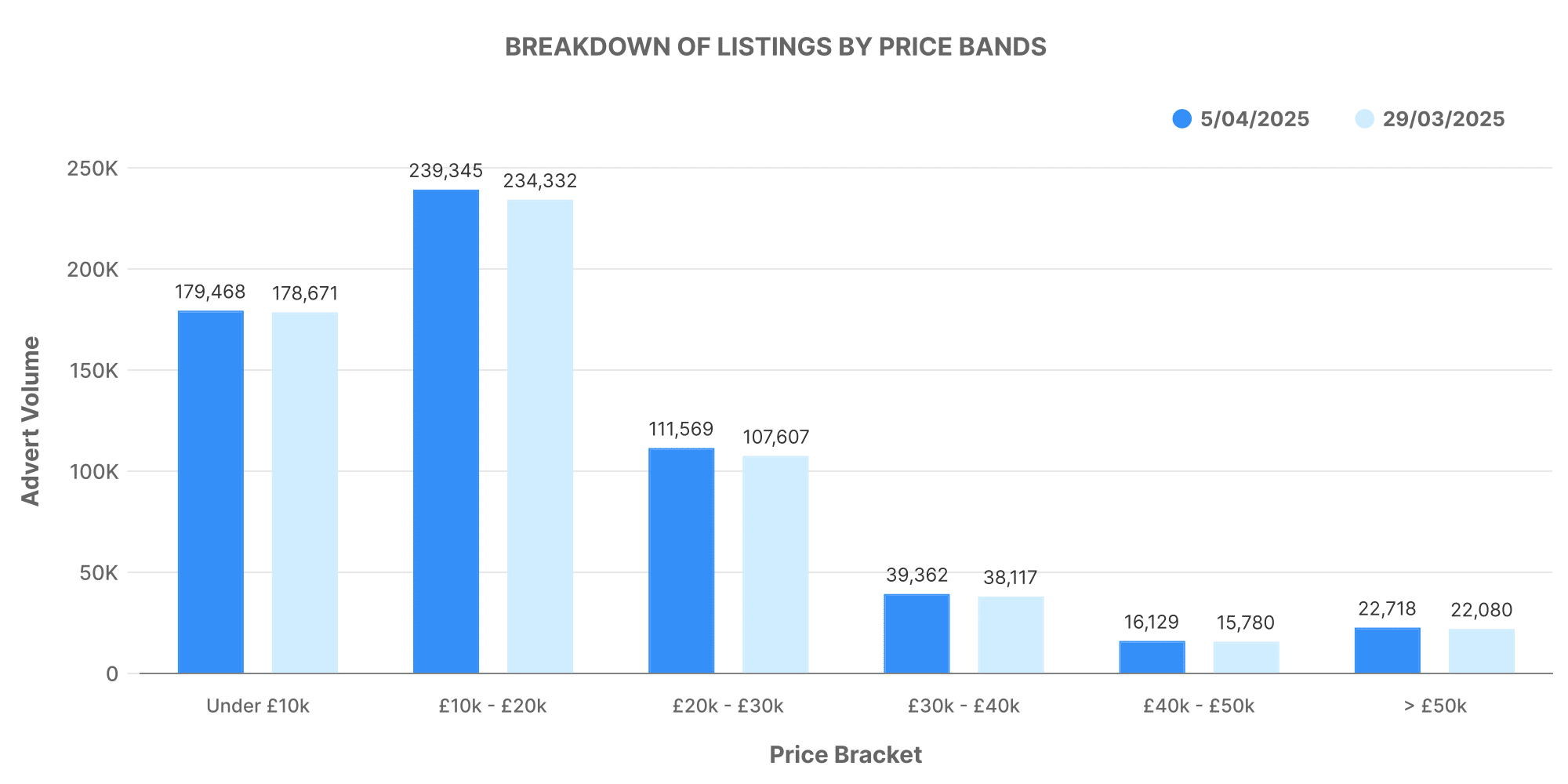

For the ICE used car market, the week ending on March 29th, showcased around 607,960 listings facilitated by 10,576 dealers. The average price for used ICE vehicles stood at £18,844.

Analysing the price bands, the bulk of the listings fell within the £10k – £20k range, followed by vehicles within the £20k – £30k bracket. Luxury models priced above £50k constituted a smaller percentage.

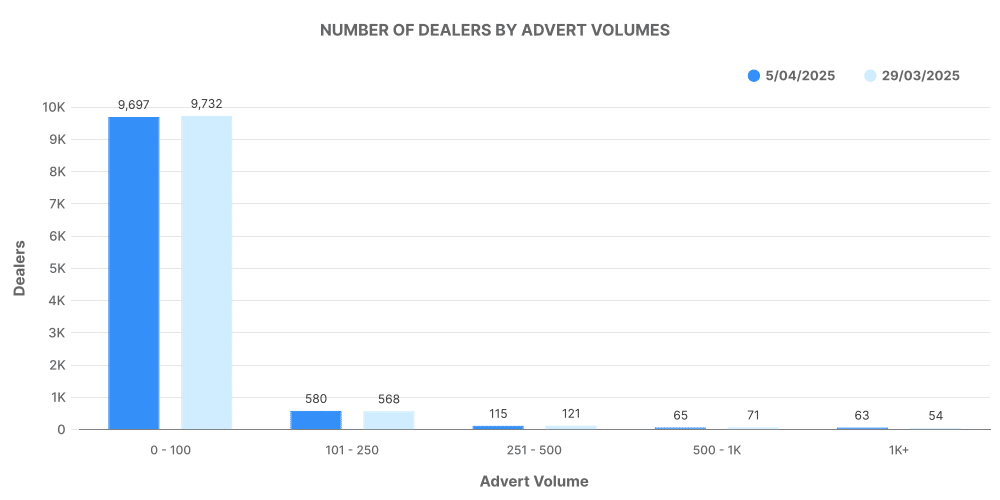

When it comes to dealer volume, the majority of dealers listed between 1 – 100 vehicles showcasing varying capacities within the ICE used car market.

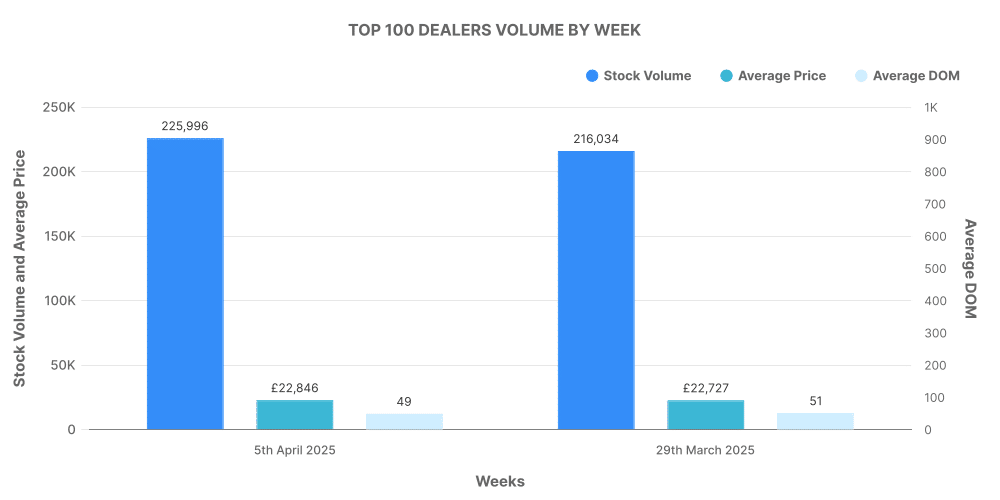

Top 100 Dealers for ICE Vehicles

Taking a deep dive into the top 100 dealerships, these accounted for approximately 36% of the listings with a slightly higher average price than the overall market average.

Electric Used Car Market

The electric used car market, also a significant player, presents a different scenario.

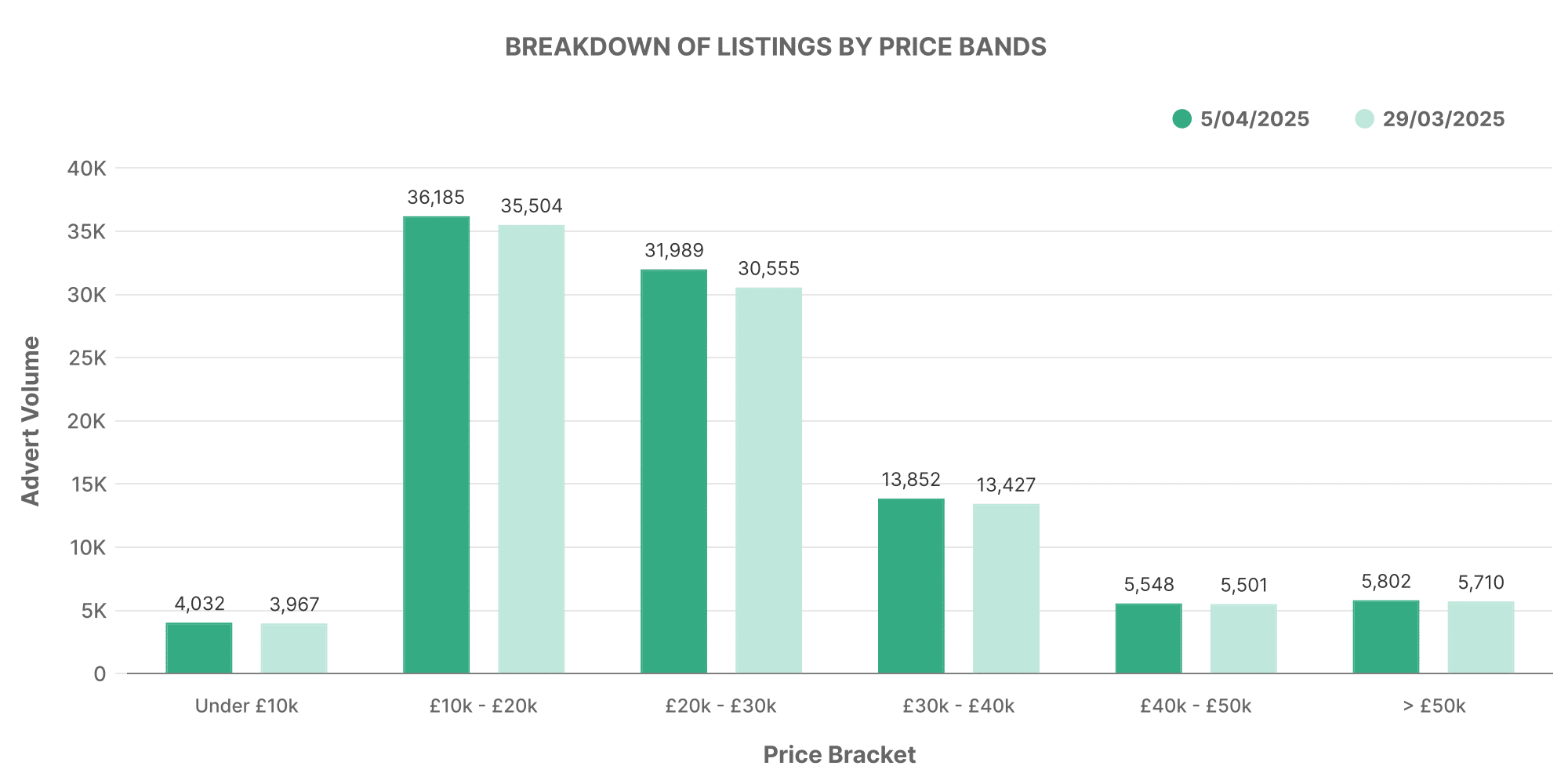

For the week ending March 29th, the market noted a total of 95,840 used electric vehicle listings advertised by 4,662 dealers. Electric vehicles showcased an average price of £26,590.

The highest number of listed EVs fell within the £10k – £20k price band, followed closely by the £20k – £30k bracket. The market also showed some listings above the £50k mark, hinting at a range of offerings skewed towards affordability.

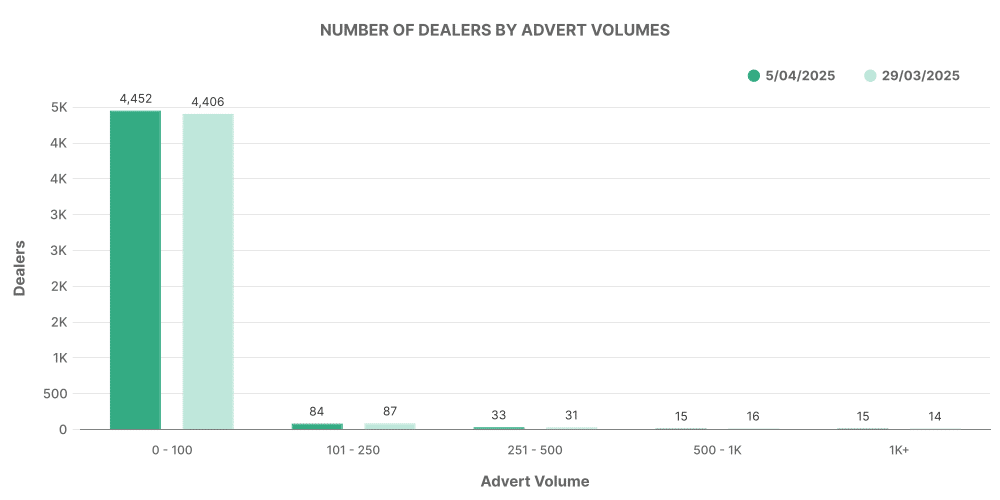

On the dealer front, the market showed a mixture of dealerships, most of which listed between 1-100 vehicles, reflecting the relative novelty of this market.

Top 100 Dealers for Electric Vehicles

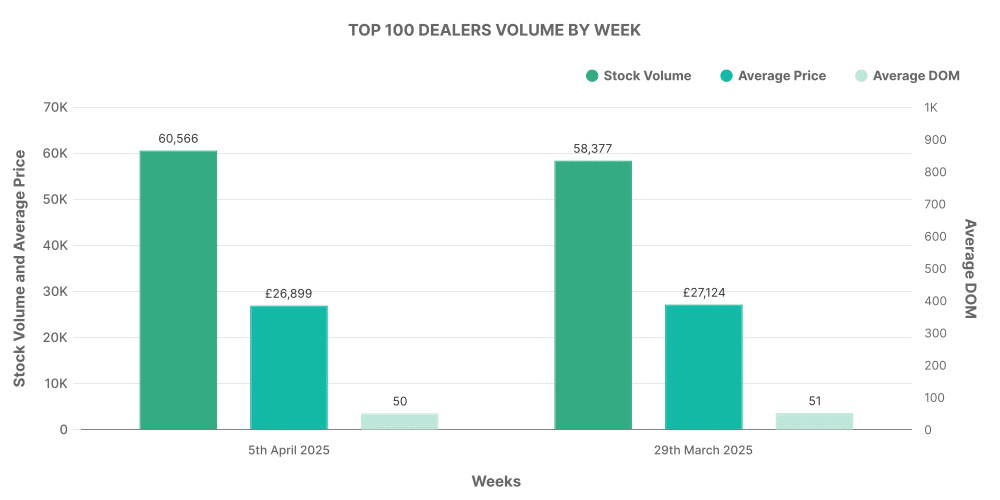

Analysing the top 100 electric used car dealerships, they accounted for roughly 61% of listings, with an average price slightly higher than the general market average.

Comparison: ICE vs EV

A comparison of ICE and EV used car markets paints a visual picture of the evolving automotive sector. While ICE vehicles continue to dominate the overall marketplace, the used EV marketplace shows considerable growth and dynamism, a promising prospect for the future of sustainability within the automotive industry.

In summary, the used car market in the UK presents a multifaceted picture with different trends within the ICE and electric vehicle sectors. These insights go a long way in tailoring business strategies in line with the shifting landscape of the automotive industry. For a deeper exploration of automotive inventory data, reach out to Marketcheck UK, your trusted provider of comprehensive data on every used car listing in the UK.