The used car market is a hive of activity populated by a myriad of players, and to thrive in this market, understanding its nuances is key. With our granular data insights, you gain an eagle eye’s view of the market, helping you stay ahead of the curve. This week, we turn our spotlight on the recent past, unpacking the trends of the used car market, particularly the electric used car market. We identify significant trends and illustrate them with data to give you clear insights into UK car price trends and offer you automotive market insights to guide your strategies.

ICE: The Dominant Market

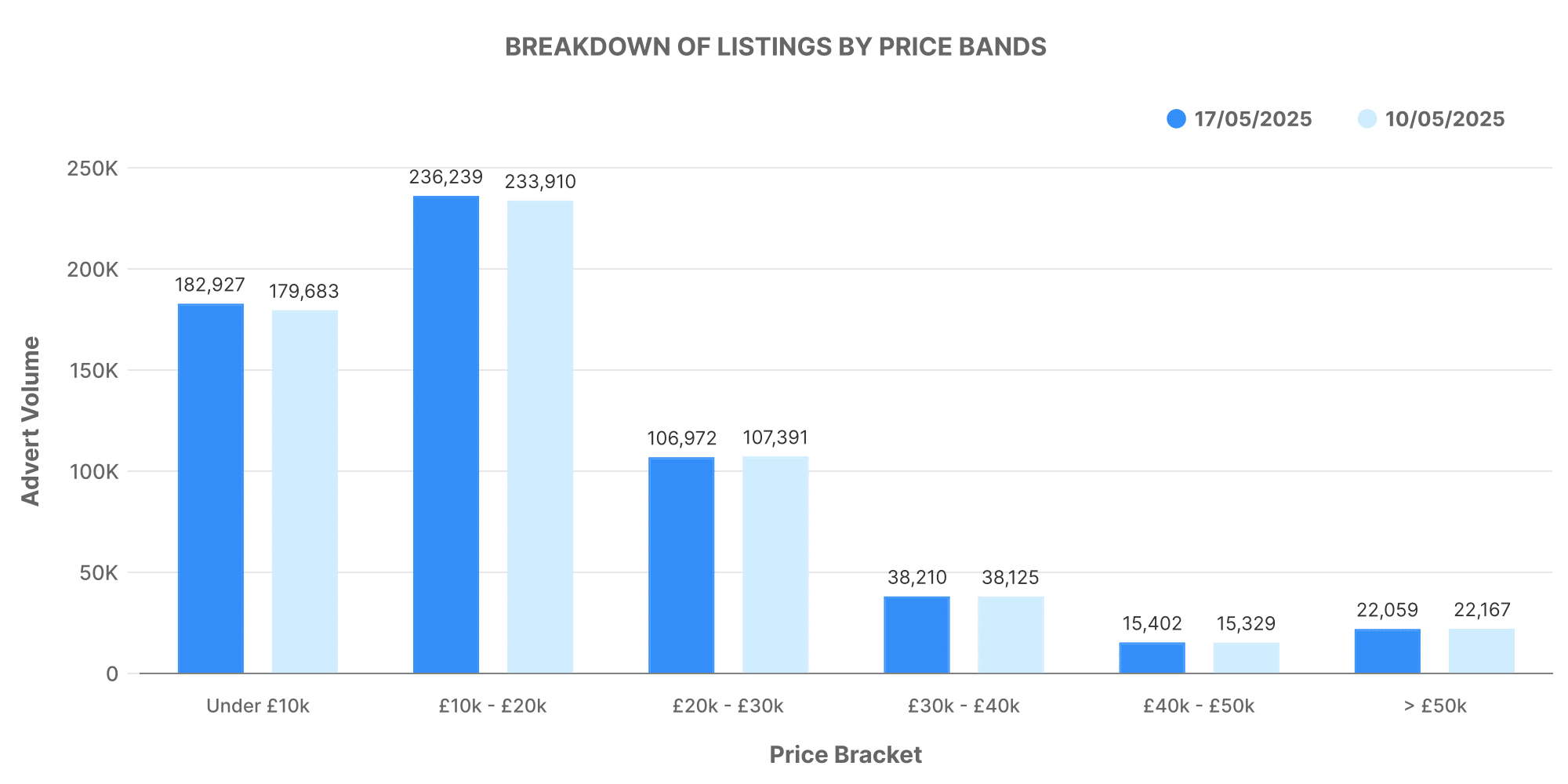

Despite the growing interest in electric vehicles, cars with internal combustion engines (ICE) still dominate total listings volume. For the week ending 17th May 2025, the market saw 616,102 used ICE vehicles listed by 10,715 dealers, a slight increase from the previous week’s total of 610,907 used ICE cars.

When we examine the price band distribution of the listed ICE vehicles, most fall within the £10,000 – £20,000 bracket, slightly higher than the last week’s primary price band. The average market price for these used ICE vehicles was around £18,751.

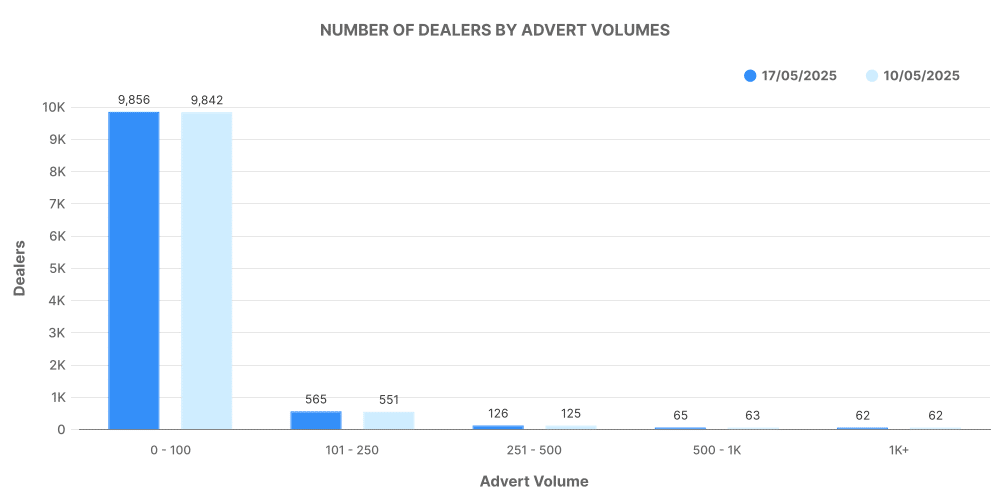

We also notice a balanced level of inventory volumes across dealers, showing the well-established roots of ICE in the industry.

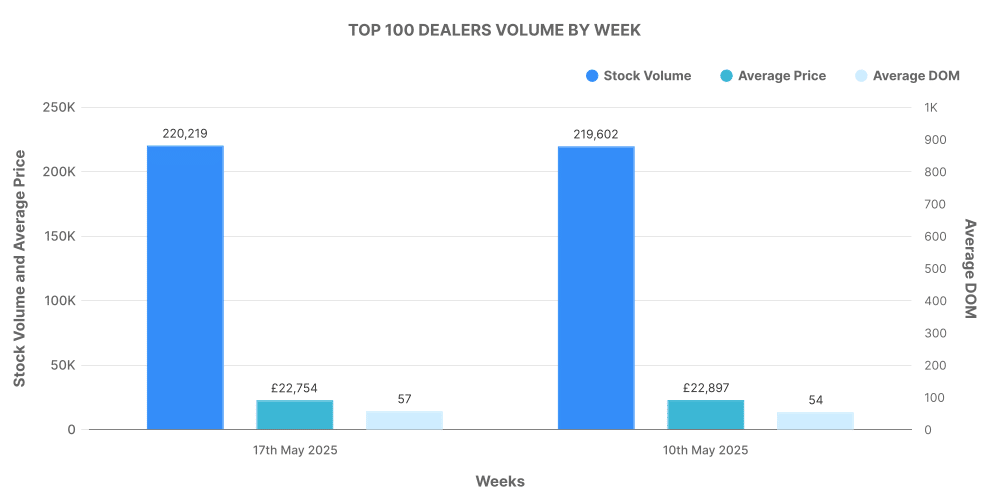

Coming down to specifics, the top 100 ICE dealers accounted for a sizable portion of listings volume, selling at a slightly higher average price than the overall market.

Electric Vehicles: The Emerging Force

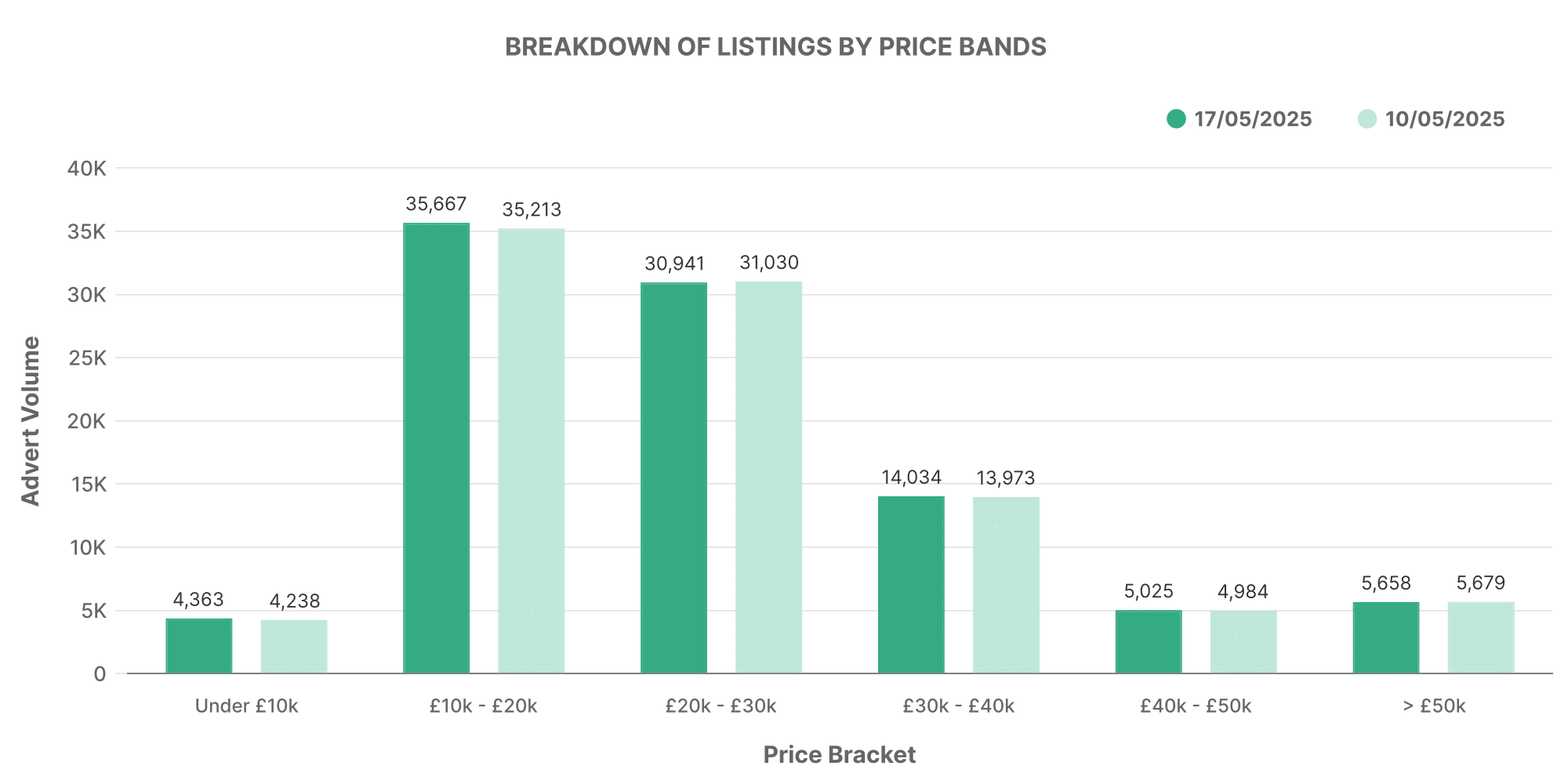

The electric used car market, although still smaller in size, is trending upwards. The market recorded a total of 97,088 used EVs listed by 4,753 dealers for the week ending 17th May 2025. This is a slight increase from the 96,487 listings posted in the previous week.

When we dissect the pricing bands for EVs, it’s worth noting that most vehicles are within the £10,000 – £20,000 range. The average market price for EVs was slightly higher than that for ICE, at approximately £26,416.

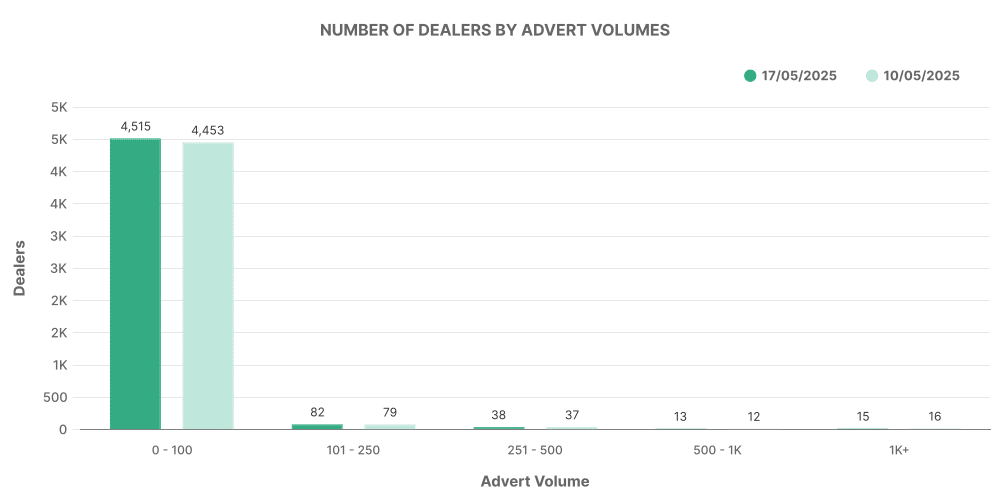

Interestingly, most dealers listed less than 100 electric vehicles, delineating the emerging market for electric cars in the UK.

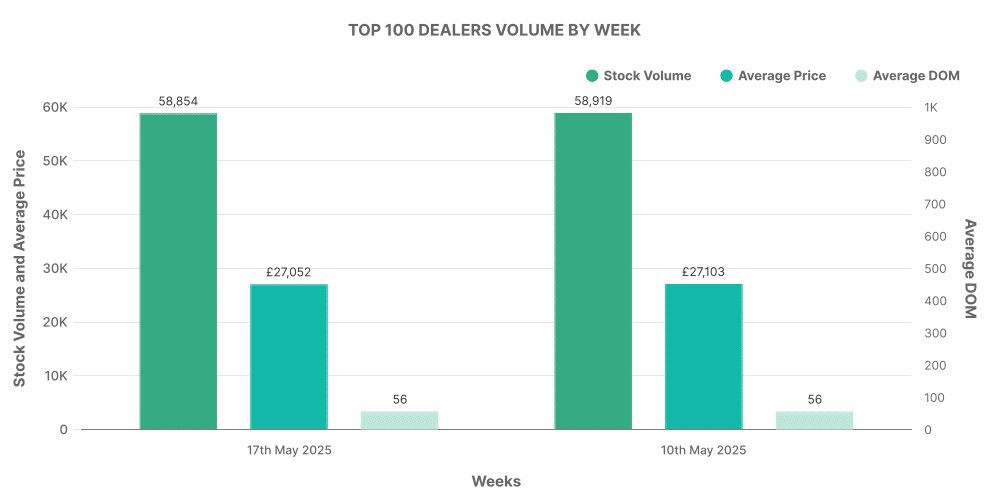

Taking a closer look at dealerships, the top 100 represented around 18% of total EV listings, selling at an average price slightly higher than the market average.

Comparison: ICE vs EV

Looking at both ICE and EV markets together, EVs made up about 16.24%, up from 14.79% from the previous week, with ICE cars taking 84.24% of the listings. The average price for EVs was higher than ICE cars, reflecting the higher initial costs associated with EV technologies.

For the week, popular EV models listed include the Toyota Yaris, KIA Niro, Toyota C-HR, and the Tesla Model 3, whose presence in the top ten reinforces the market perception of these models as value-driven and reliable.