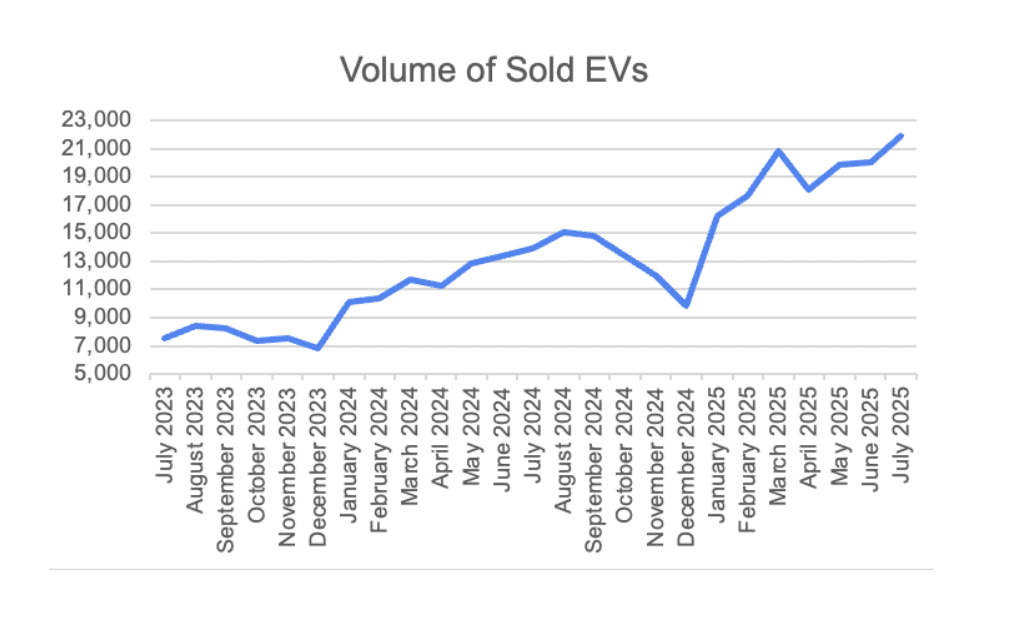

Today, Marketcheck – the UK’s most significant source of used car market insights – published figures tracking the performance of the used EV market over the last two years. The analysis revealed that more used EVs have been sold than ever, at the lowest ever price.

A total of 21,902 used EVs were sold in July 2025, a 14,390 increase when compared with the same month in 2023. Marketcheck’s study showed significant growth this year. In January 2025, a total of 16,227 used EVs were sold throughout the UK. July this year therefore, saw a 39.97% increase in volume sold.

| Month | Volume of Sold EVs |

|---|---|

| July 2023 | 7,512 |

| January 2025 | 16,227 |

| July 2025 | 21,902 |

Looking at the average last-listed price of all used EVs sold each month between July 2023 and 2025, Marketcheck reveals that the average cost of a used EV has fallen by £5,214.59 over those two years. In July 2023, the average last listed price was £27,762.00. By July 2025, this had fallen to £22,547.41.

Prices have continued to fall this year. In January 2025, the average last listed price was £24,352.41, representing a 7.41% decrease in cost this year.

| Month | Average Last Listed Price |

|---|---|

| July 2023 | £27,762.00 |

| January 2025 | £24,352.59 |

| July 2025 | £22,547.41 |

Alastair Campbell, Marketcheck UK, commented:

“The used EV market is clearly hitting its stride. July saw the highest number of used EVs ever sold in a single month, and at the lowest average price we’ve recorded.

In just two years, prices have dropped by more than £5,000, while sales volumes have surged.

That combination of falling prices and rising demand shows the market is becoming both more accessible and more mature. For many UK buyers, a used EV is now a realistic and attractive alternative to petrol and diesel.”

ENDS

Notes to Editor:

| Month | Volume of Sold EVs | % Change | Average last listed price | % Change |

|---|---|---|---|---|

| July 2023 | 7,512 | 27,762 | ||

| August 2023 | 8,458 | 12.59% | 27,766 | 0.01% |

| September 2023 | 8,248 | -2.48% | 27,801 | 0.13% |

| October 2023 | 7,396 | -10.33% | 28,542 | 2.67% |

| November 2023 | 7,514 | 1.60% | 28,076 | -1.63% |

| December 2023 | 6,792 | -9.61% | 29,710 | 5.82% |

| January 2024 | 10,135 | 49.22% | 26,535 | -10.69% |

| February 2024 | 10,343 | 2.05% | 25,588 | -3.57% |

| March 2024 | 11,683 | 12.96% | 25,410 | -0.70% |

| April 2024 | 11,225 | -3.92% | 25,664 | 1.00% |

| May 2024 | 12,889 | 14.82% | 24,857 | -3.14% |

| June 2024 | 13,421 | 4.13% | 24,378 | -1.93% |

| July 2024 | 13,939 | 3.86% | 23,783 | -2.44% |

| August 2024 | 15,082 | 8.20% | 24,577 | 3.34% |

| September 2024 | 14,839 | -1.61% | 23,818 | -3.09% |

| October 2024 | 13,405 | -9.66% | 23,929 | 0.47% |

| November 2024 | 11,962 | -10.76% | 24,511 | 2.43% |

| December 2024 | 9,856 | -17.61% | 25,030 | 2.12% |

| January 2025 | 16,227 | 64.64% | 24,353 | -2.71% |

| February 2025 | 17,689 | 9.01% | 24,210 | -0.58% |

| March 2025 | 20,882 | 18.05% | 24,374 | 0.68% |

| April 2025 | 18,114 | -13.26% | 23,405 | -3.97% |

| May 2025 | 19,836 | 9.51% | 23,030 | -1.61% |

| June 2025 | 20,081 | 1.24% | 22,806 | -0.97% |

| July 2025 | 21,902 | 9.07% | 22,547 | -1.13% |

About Marketcheck:

We are the leading source of UK automotive data. We collate, enhance and manage more data on the UK used car sector than any other provider. For automotive businesses we bring unprecedented access to live data to power analysis, pricing, reporting and AI agents on the UK used car market.

We track over 650,000 cars and 11500 dealers across 16k locations daily.

Contact:

Alistair Harrison

[email protected]