Understanding shifts in the used car market helps automotive businesses refine strategies and make informed decisions. This report examines the latest trends in the UK’s used car sector, covering internal combustion engine (ICE) vehicles and electric vehicles (EVs).

Used Car Market Overview

December saw 766,884 used ICE vehicle listings across 10,662 dealers, with an average price of £18,169 and an average of 86 days on market. The number of dealers remained stable, while stock volumes showed a reduction compared to the previous month.

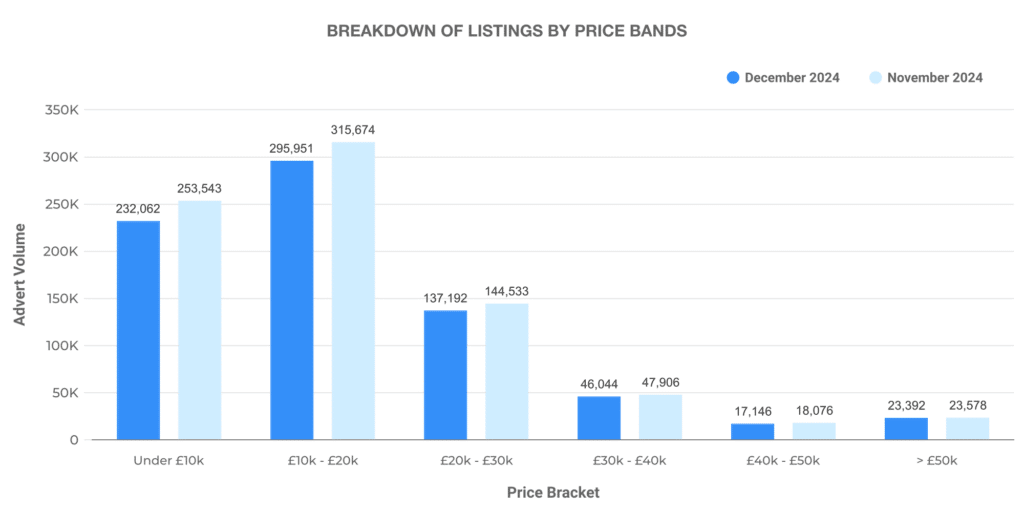

Breakdown of Listings by Price Bands

- £0 – £10,000: 232,062 vehicles

- £10,000 – £20,000: 295,951 vehicles

- £20,000 – £30,000: 137,192 vehicles

- £30,000 – £40,000: 46,044 vehicles

- £40,000 – £50,000: 17,146 vehicles

- £50,000+: 23,392 vehicles

Most ICE listings fell within the £10,000 – £20,000 range, aligning with broader UK car price trends. The premium segment (£50,000+) remained relatively stable.

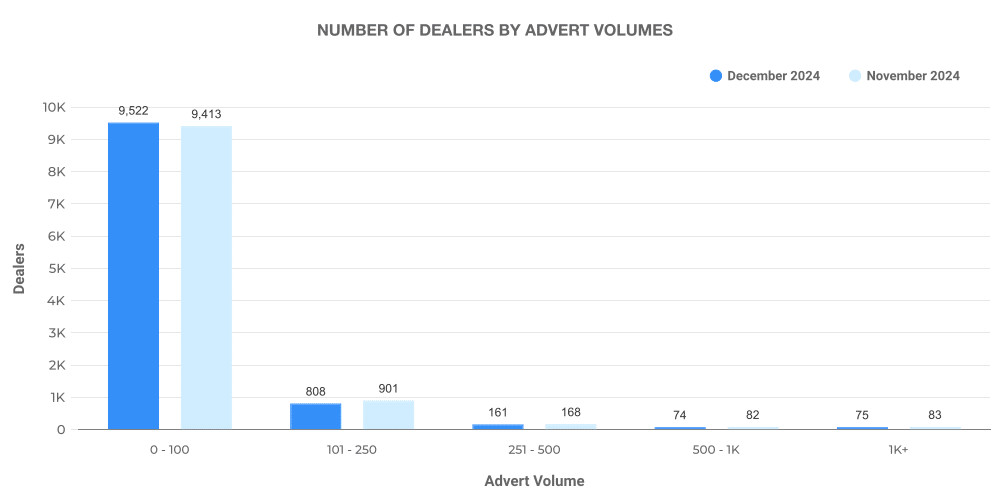

Dealer Listing Volumes

- 0 – 100 vehicles: 9,522 dealers

- 101 – 250 vehicles: 808 dealers

- 251 – 500 vehicles: 161 dealers

- 500 – 1,000 vehicles: 74 dealers

- 1,000+ vehicles: 75 dealers

The majority of dealers stocked fewer than 100 ICE vehicles, indicating a broad distribution of smaller-scale operations.

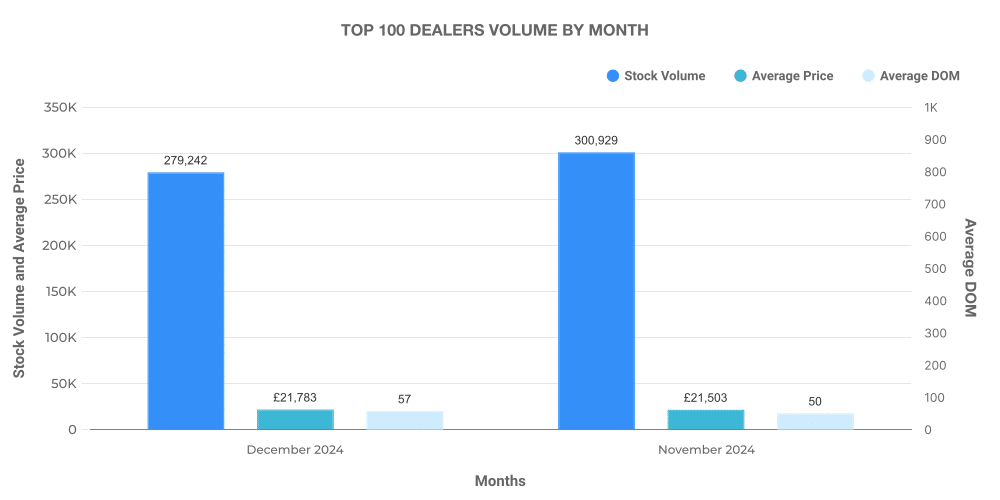

Top 100 Dealer Insights

The top 100 dealers accounted for 279,242 ICE listings, with an average price of £21,783 and an average of 57 days on market. These dealerships saw 64,601 price increases and 328,279 price reductions, reflecting ongoing adjustments in response to market conditions.

Electric Used Car Market Performance

The electric used car market maintained its upward trajectory, with 103,920 EVs listed by 4,712 dealers. The average price rose slightly to £26,339, with an average of 69 days on market.

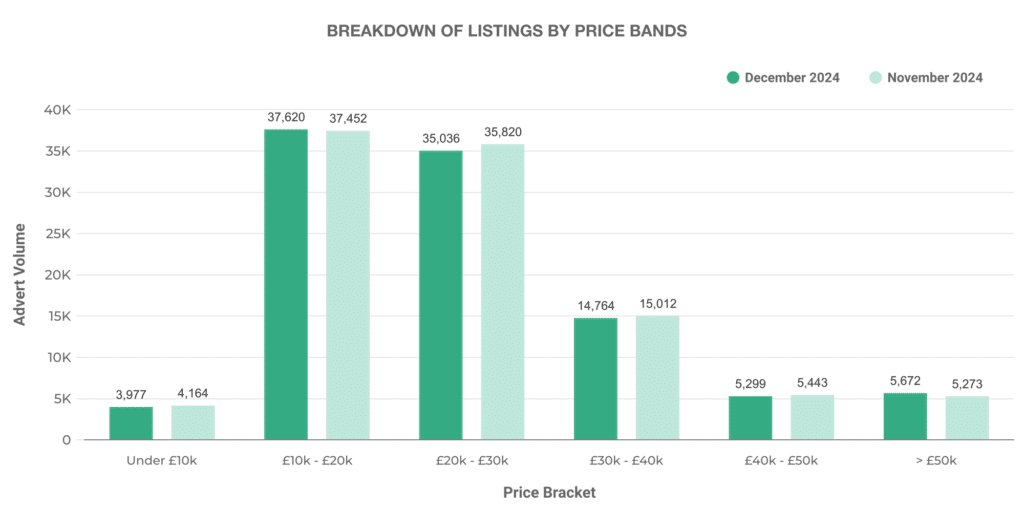

Breakdown of EV Listings by Price Bands

- £0 – £10,000: 3,977 vehicles

- £10,000 – £20,000: 37,620 vehicles

- £20,000 – £30,000: 35,036 vehicles

- £30,000 – £40,000: 14,764 vehicles

- £40,000 – £50,000: 5,299 vehicles

- £50,000+: 5,672 vehicles

Mid-range EVs priced between £10,000 and £30,000 dominated the listings. The presence of higher-end EVs remained stable, demonstrating continued demand for premium electric options.

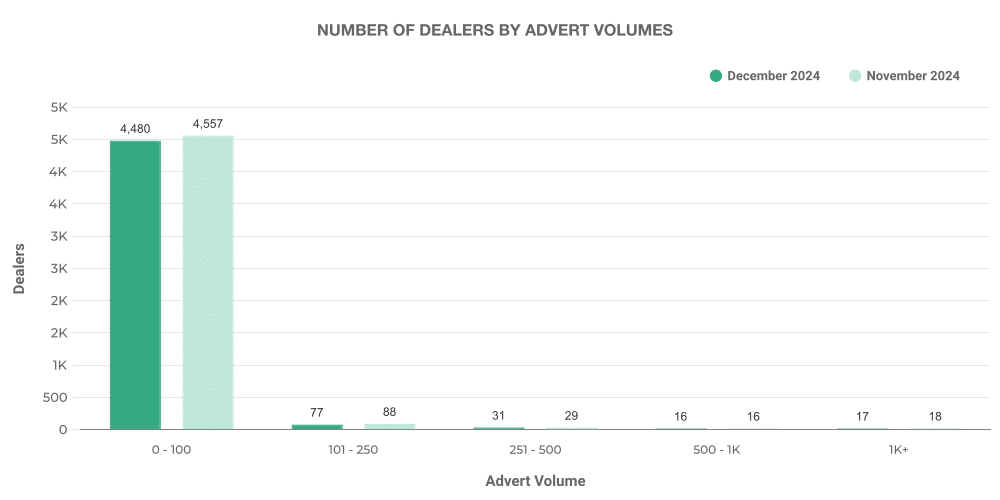

Dealer Listing Volumes

- 0 – 100 vehicles: 4,480 dealers

- 101 – 250 vehicles: 77 dealers

- 251 – 500 vehicles: 31 dealers

- 500 – 1,000 vehicles: 16 dealers

- 1,000+ vehicles: 17 dealers

Compared to ICE vehicles, fewer dealers stocked higher volumes of EVs, reflecting a more fragmented market with smaller inventories.

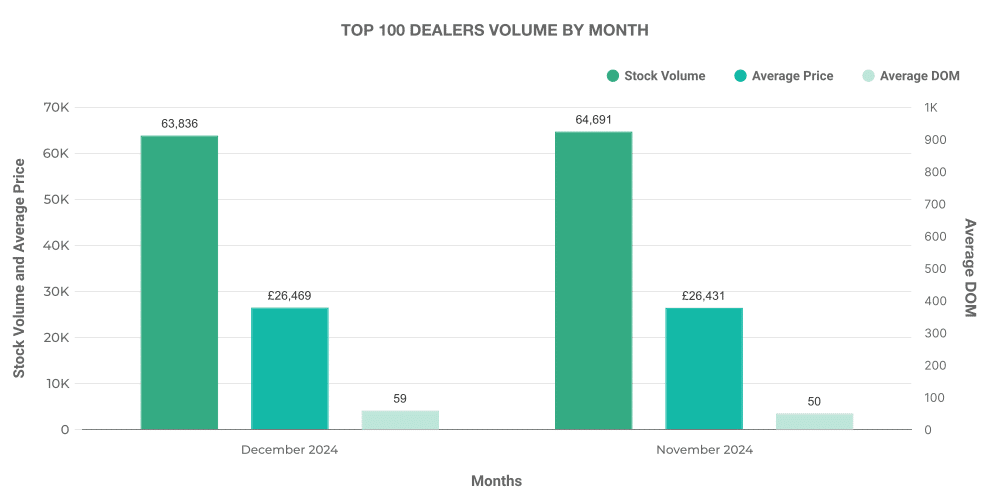

Top 100 Dealer Insights

The top 100 dealers accounted for 63,836 EV listings, with an average price of £26,469 and an average of 59 days on market. Price increases reached 15,573, while 78,302 listings saw reductions.

EV vs ICE Market Share

EVs represented 13.55% of the total used car market in December, up from 12.79% in November. ICE vehicles continued to dominate at 86.45%, but the rising share of EVs signals a gradual shift in buying preferences.

Average Prices

- EVs: £26,339

- ICE vehicles: £18,169

EVs continued to command higher average prices than ICE vehicles, partly due to demand for newer models and their higher initial cost.

Most Advertised EV Models

The most listed EVs in December included:

- Toyota Yaris – 5,259 listings

- Toyota C-HR – 3,797 listings

- Kia Niro – 3,658 listings

- Toyota Corolla – 3,295 listings

- Tesla Model 3 – 2,518 listings

- BMW 3 Series – 2,496 listings

- Ford Kuga – 2,305 listings

- Hyundai Kona – 2,203 listings

- Toyota RAV4 – 2,078 listings

- Hyundai Tucson – 1,985 listings

Toyota models remained dominant, with strong representation across the Yaris, C-HR, and Corolla. Tesla’s Model 3 retained a notable presence, alongside established hybrid and electric models from Hyundai, Kia, and BMW.

Next month: January 2025 | Previous month: November 2024