UK Weekly Used Car Market Data – 3rd May 2025

Understanding shifts and patterns in the used car market is vital for the entire automotive sector. It allows businesses within these sectors to adjust strategies and prepare for growth. This article delves into the data surrounding the used car market in the UK, focusing on both combustion engine vehicles (ICE) and the steadily growing electric used car market (EV).

Data for this report was collated up until 3rd May 2025.

The Electric vs Combustion Engine Markets

In the week ending 3rd May, there were a total of 97377 used electric vehicles (EVs) listed by 4721 dealers. When we compare this to a total of 615414 ICE cars listed by 10673 dealers, we begin to see the size difference between the markets.

This information underlines the growing prominence and relative novelty of the electric used car market, while highlighting the deeply established nature of the ICE market.

Understanding Price Trends

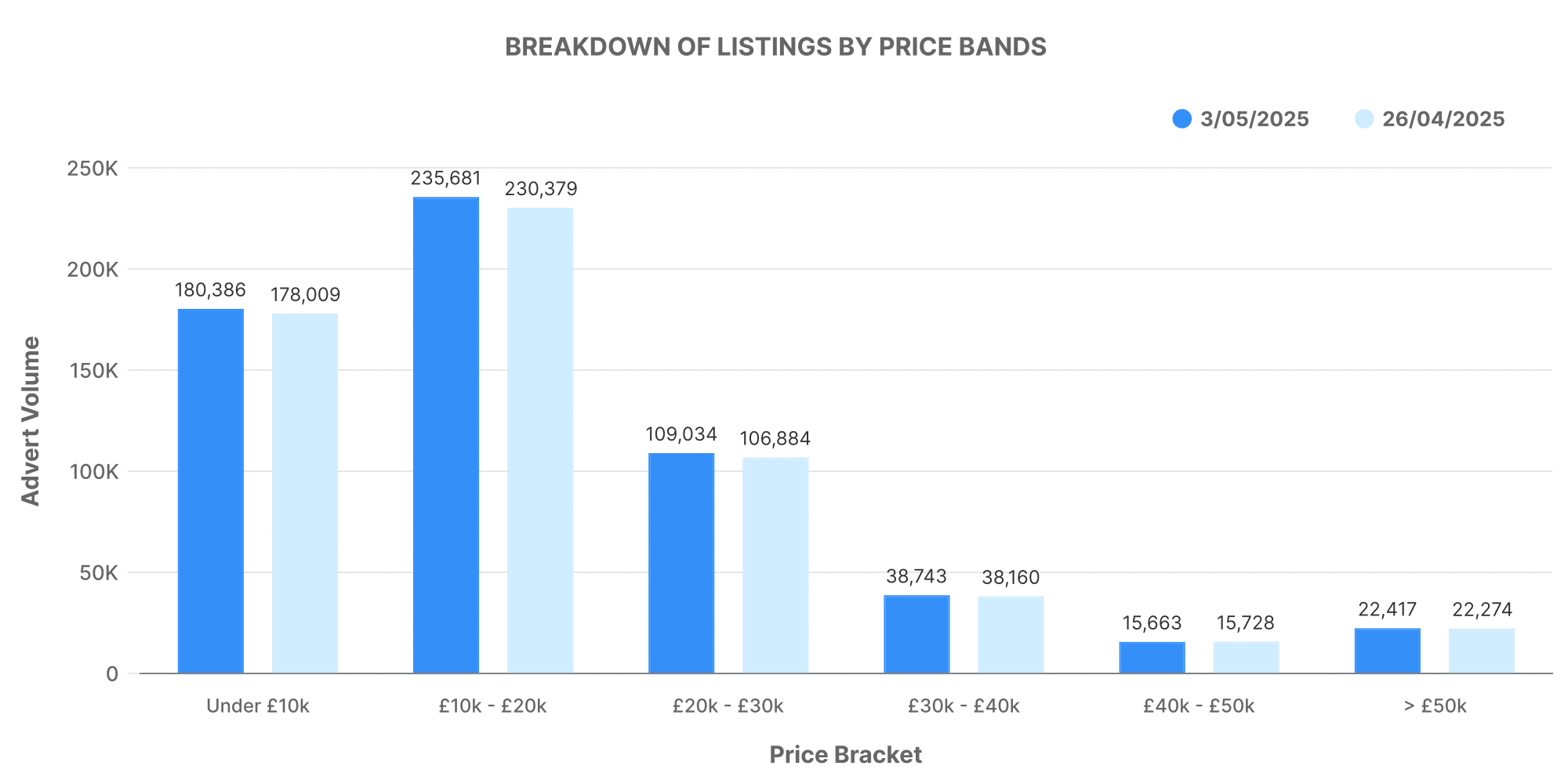

Looking at the breakdown of listings by price bands for ICE, we see that most cars fall within the £10,000 – £20,000 range, with an average price of £18,877.

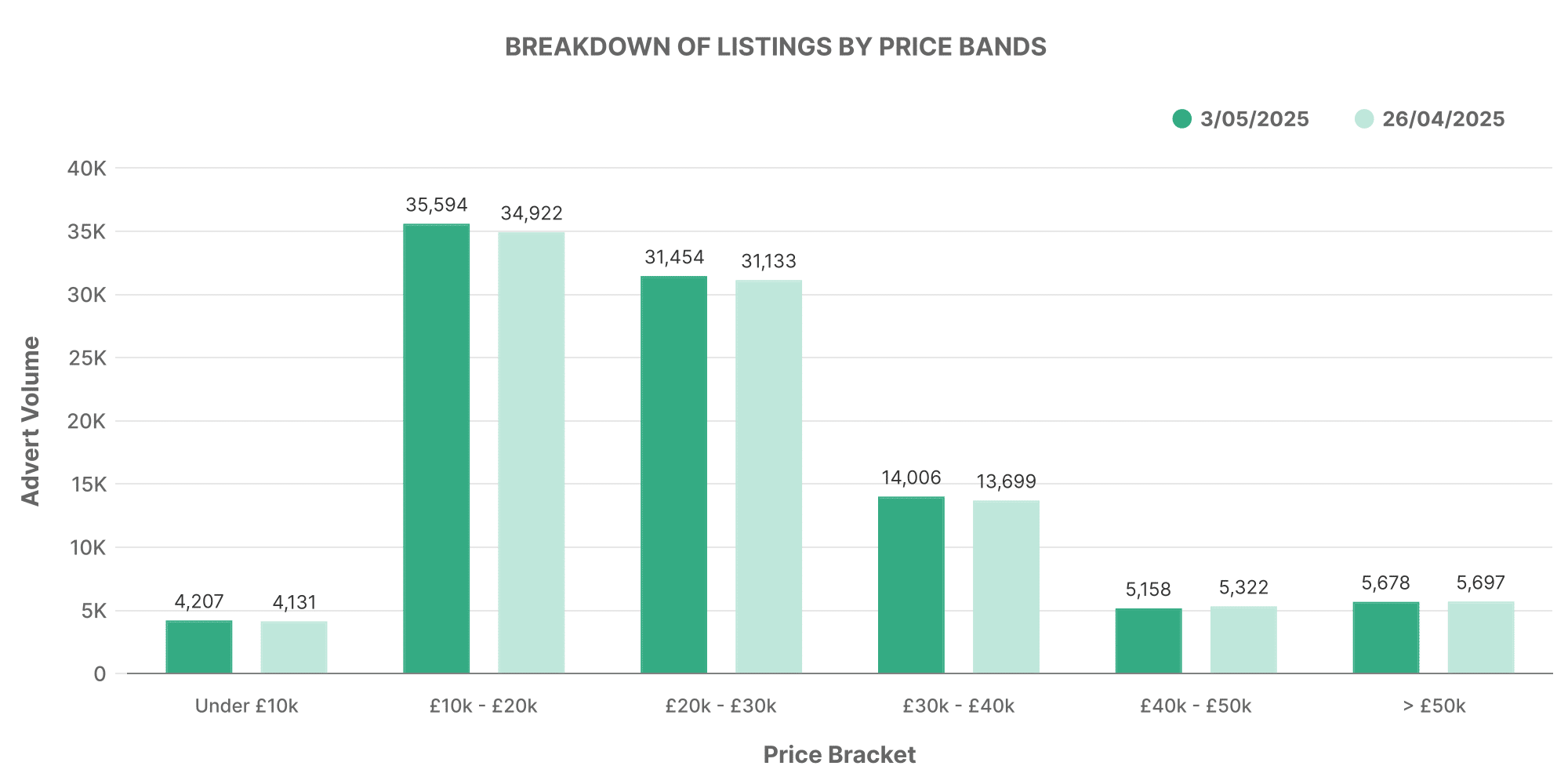

Whereas for EVs, there is a noticeable step up in price with the majority priced between £10,000 – £20,000 and a significant amount in the £20,000 – £30,000 range, giving us an average price across all listed EVs at £26,513.

This pricing gap, along with the number of listings, provides us a clear view of how the electric used car market is shaping up against the traditional ICE market.

Analyzing Dealer Volume

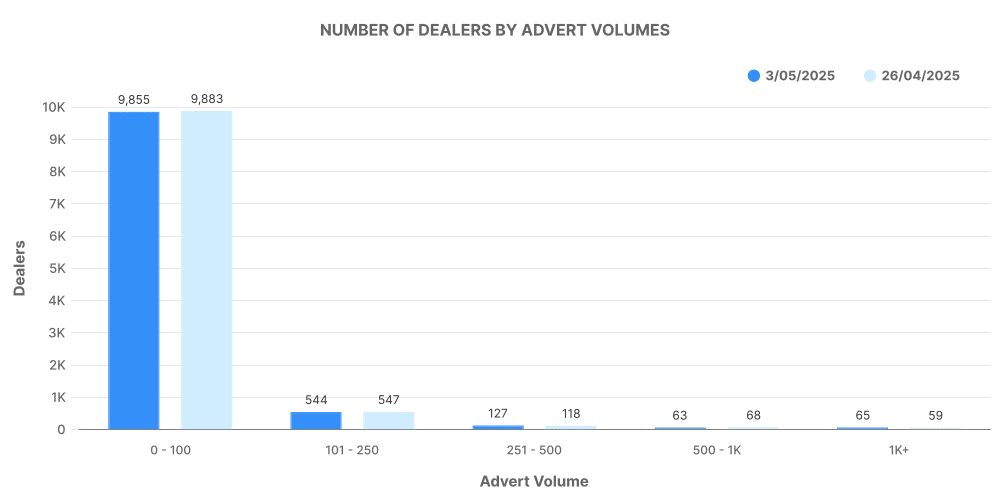

Looking at the dealership volumes for ICE cars, we find a balance among dealers with varying capacities – a clear reflection of a mature and established market.

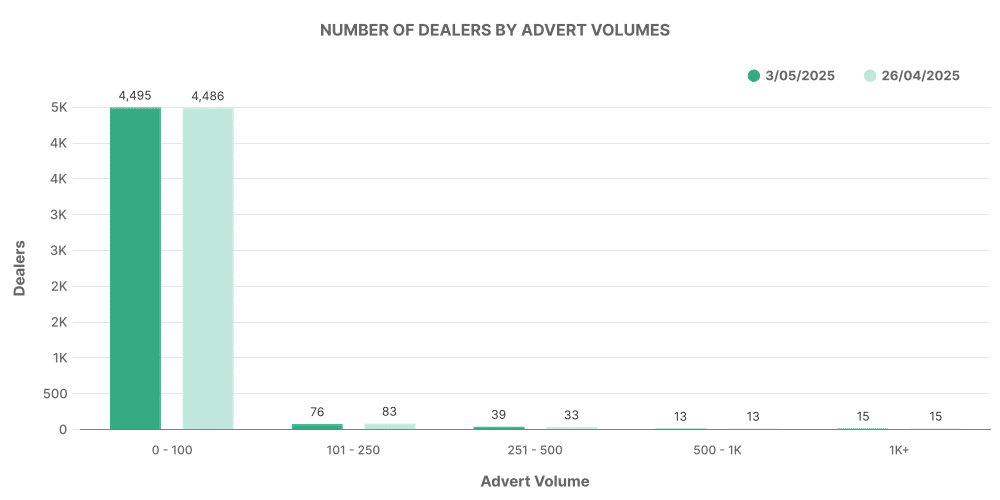

When it comes to EVs, most dealers listed between 0-100 vehicles. This indicates that the EV market in the UK is still in its relative infancy when compared with the ICE market.

Top 100 Dealers: ICE vs EV

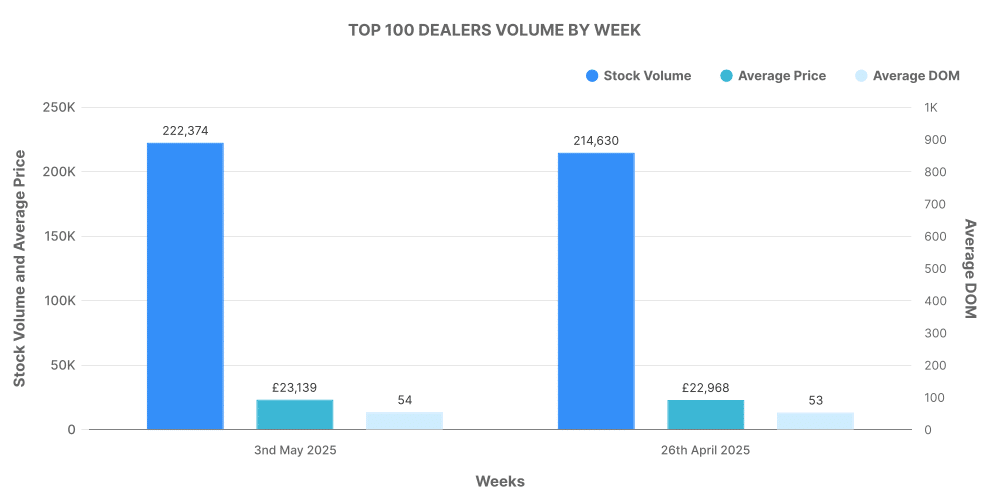

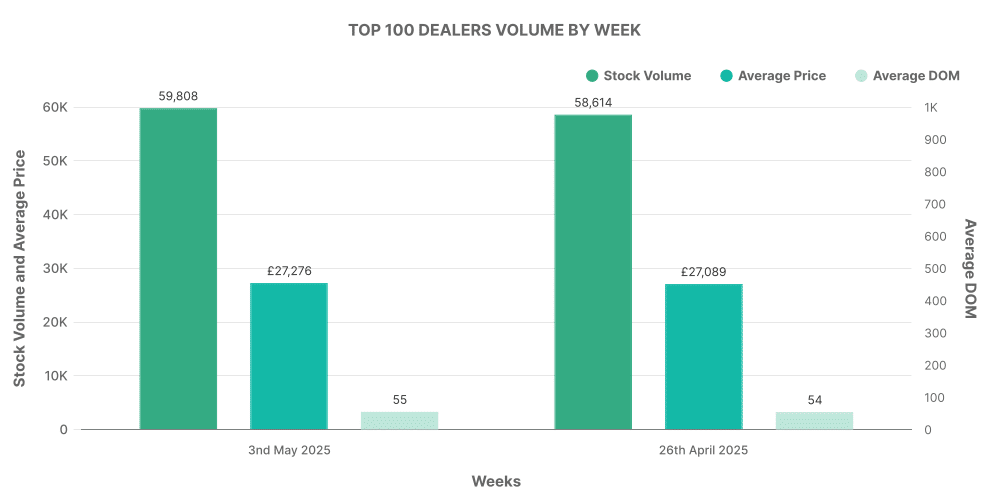

Analyzing the top 100 dealerships by listing volume for both EVs and ICE cars offers some valuable insights.

For ICE cars, the top 100 dealers accounted for 36% of total listings, with cars selling at an above-average market price.

Meanwhile, the top 100 dealers in the EV market accounted for a slightly lower proportion at 30% of total listings. Just like their ICE counterparts, these vehicles also had an above-average market price.

EVs in the Spotlight: Top 10 by Make & Model

- Toyota Yaris

- KIA Niro

- Toyota C-HR

- Toyota Corolla

- Tesla Model 3

- Honda Jazz

- Hyundai Tucson

- Hyundai Kona

- KIA Sportage

- Ford Kuga

All these key metrics underline just how dynamic the used car market, both electric and ICE, is in the UK. To remain competitive in such a complex and rapidly evolving market, dealerships must make use of tailored and updated automotive market insights like the ones Marketcheck UK provides. Please do not hesitate to contact Marketcheck UK for further information and bespoke analysis.