UK Weekly Used Car Market Data – Week Commencing 1st February 2025

It’s crucial for any successful business within the automotive industry to be aware of changes, trends, and key data points in the used car market. This week we’ll be examining data from the conventional Internal-combustion engine (ICE) used cars and the Electric Used Car Market (EV) to offer you invaluable automotive market insights, based on our proprietary data here at Marketcheck UK.

Changes in the ICE Used Car Market

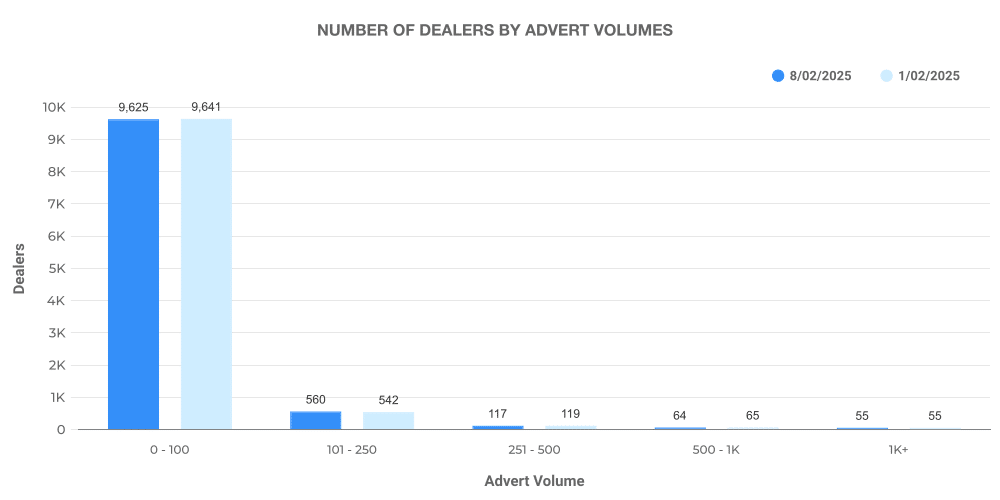

The total number of used ICE car listings this past week reached just over 584,000 units across 10,466 dealers. This indicates a minor decrease in the total number of listings from the previous week, which was at the 586,000 mark.

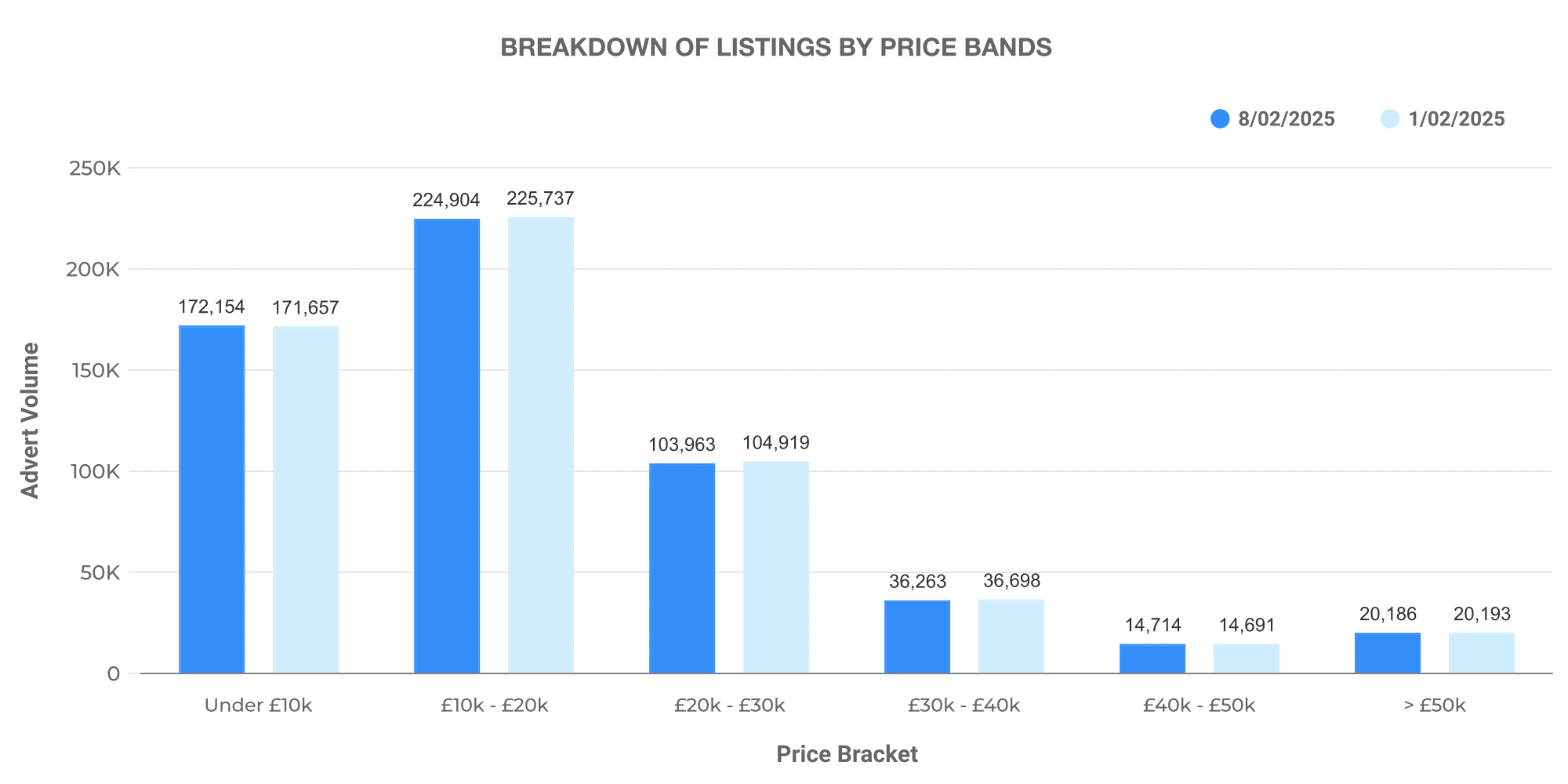

Looking at the breakdown of listed cars by price bands, most fall into the £10,000 – £20,000 range, reflecting the previous week’s trend. Notably, the average price for these cars has marginally decreased, down by £24 to an average of £18,712.

When analysing data on dealership volumes, the majority of dealers are listing between 0-100 vehicles, pointing towards a robust and dispersed marketplace.

The Steady Evolution of the Electric Used Car Market

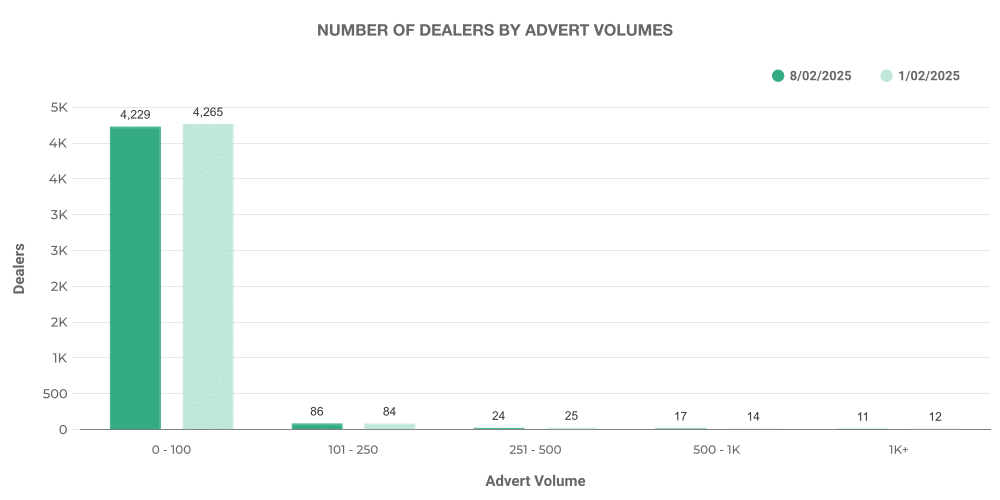

The electric used car market has shown a promising consistency this past week with 88,145 used EVs listed across 4,472 dealerships. This marks a minor increase from the prior week.

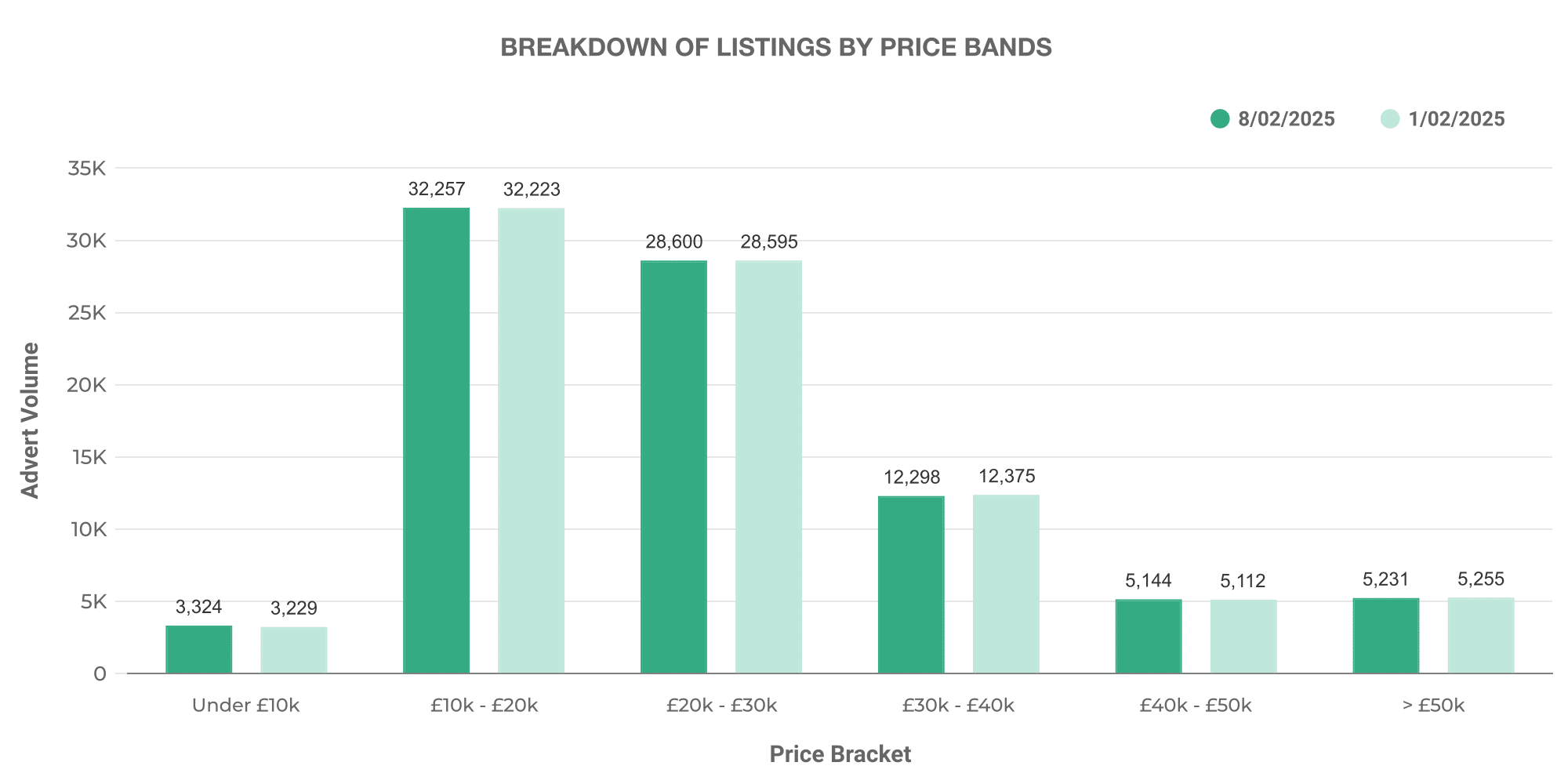

Analysis of the price bands of listed EVs shows the majority fall within the £10,000 – £20,000 range, mirroring the trends seen in the ICE market. However, the average price of used EVs (£26,697) remains significantly higher than their ICE counterparts.

Looking at dealer volumes, the majority of dealerships listed between 0-100 EVs. This spread suggests that many dealers are testing the waters in the EV market, an encouraging sign for the growing demand and mainstream adoption of these vehicles.

A Closer Look at the Top 100 Dealers

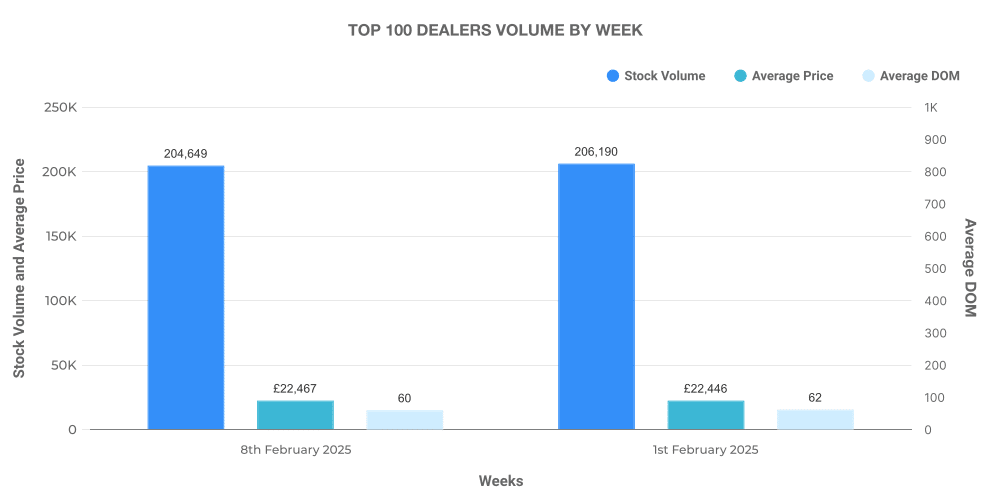

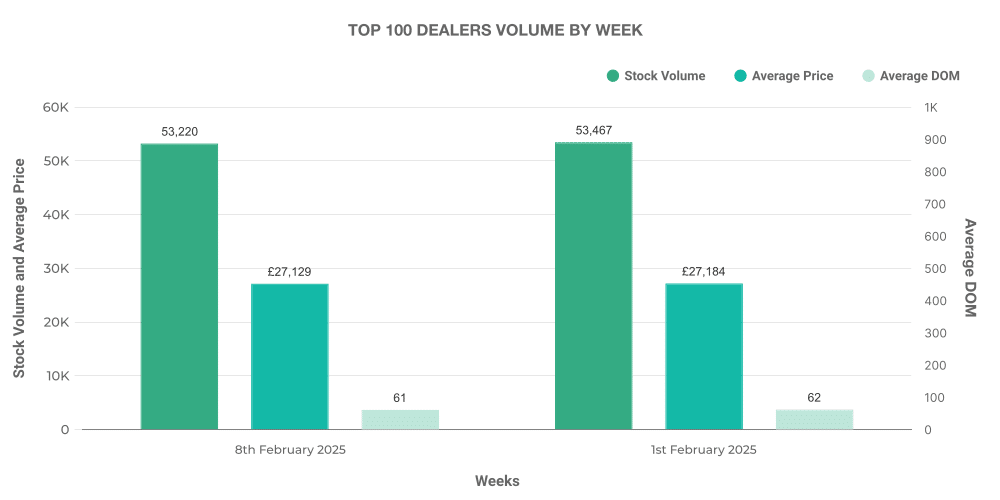

Examining the top 100 dealerships by listing volume can offer interesting insights into the shifts within the market.

In the ICE used car market, the top 100 dealers accounted for nearly 35% of total listings. They offered vehicles at prices slightly higher than the market average, indicating their focus on premium cars.

The data for the electric used car market shows that the top 100 dealers account for around 60% of total EV listings. The average price of their offerings is also marginally higher than the overall market average.

Comparison: ICE vs EV

EVs represent a considerable 15.07% of the total used car market, showing an increase from 15.02% the previous week. This trend is likely to continue as the UK moves towards its 2030 ban on the sale of new ICE vehicles.

Overall, these findings suggest a healthy competition and steady growth in the UK used car market, in both ICE and EV categories. As these trends continue, enabling your business to move with the shifts in demand will be key to maintaining competitiveness within the industry.

Remember, to be the first to receive our latest data insights, analysis, and UK car price trends, simply contact Marketcheck UK for more information.

Next week: 15th February | Previous week: 1st February