UK Weekly Used Car Market Data – February 15th, 2025

The essential aspect of strategic decision making in the automotive sector lies in the understanding and tracking of market trends. Recognising these real-time fluctuations, we offer profound insights to stakeholders within the UK used car market including but not limited to car dealerships, financial institutions and insurance companies. The data for this week’s review will focus on the key differences, patterns, and trends within both the Internal Combustion Engine (ICE) and Electric Vehicle (EV) markets.

Used Car Market – ICE

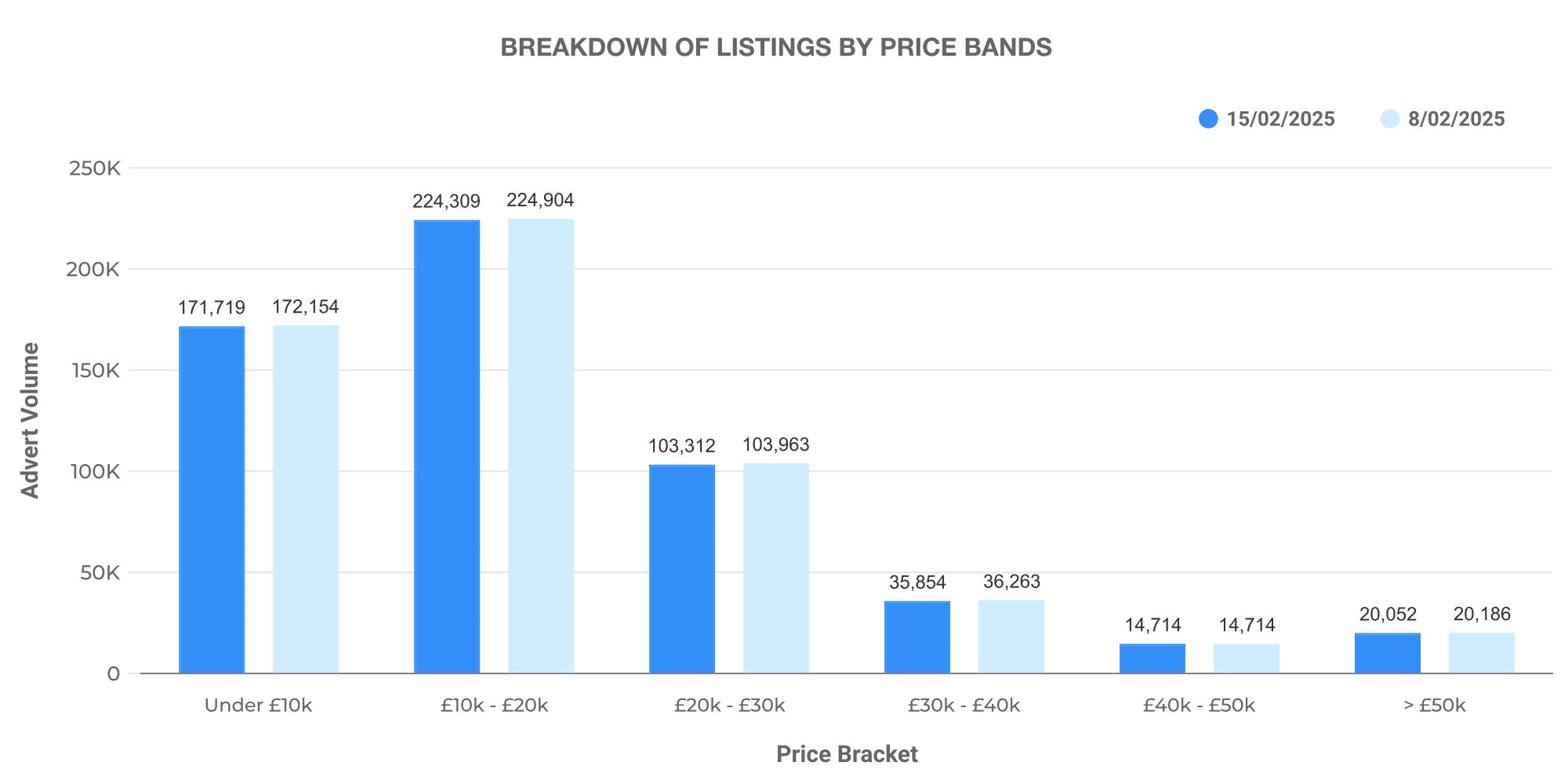

Statics from the week starting February 8th to February 15th, show 10,464 dealers listed a total of 582,437 used ICE vehicles. The mean price of these listed cars was around £18,696.

A vast majority of these ICE vehicles fell within the £10,000-£20,000 price bracket. Following this, was the £20,000-£30,000 range, with an average listing price of ~ £17,788.

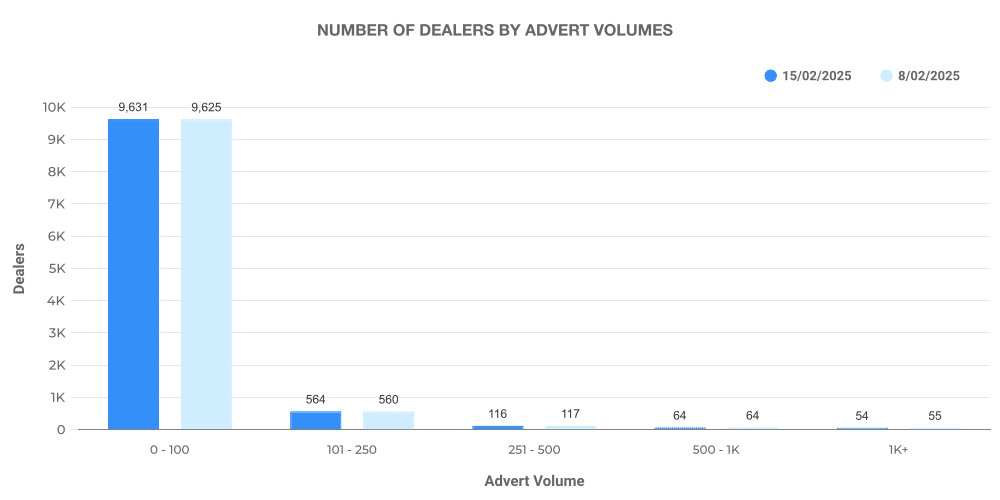

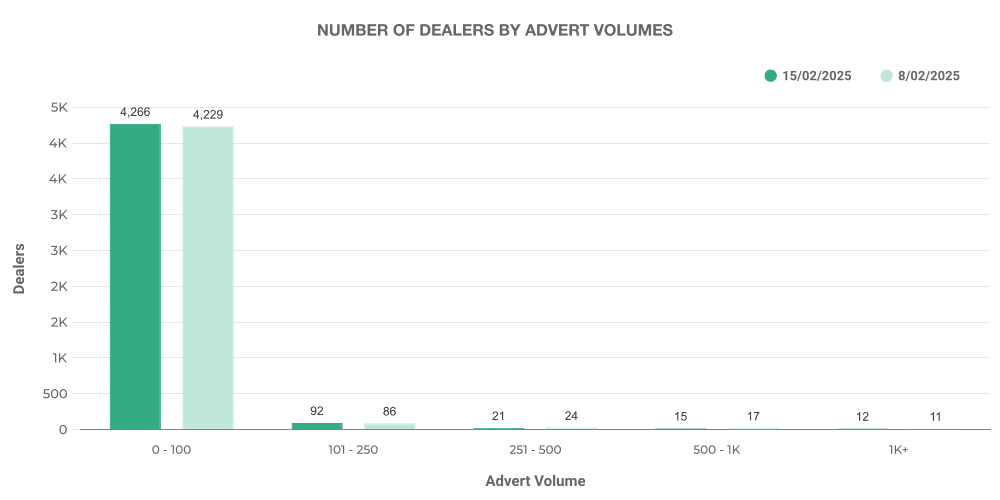

Looking at the dealer volume data, we witness a more balanced participation with far greater counts for the 0-100 vehicle range.

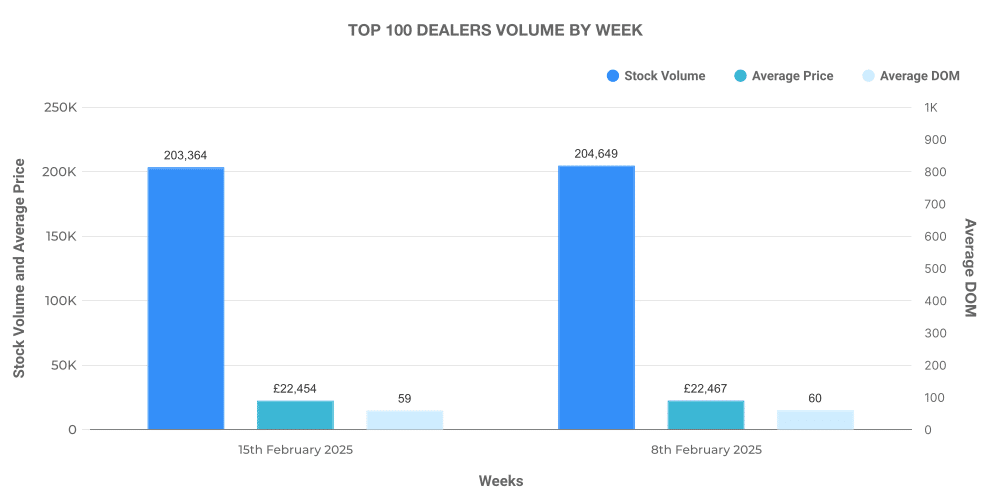

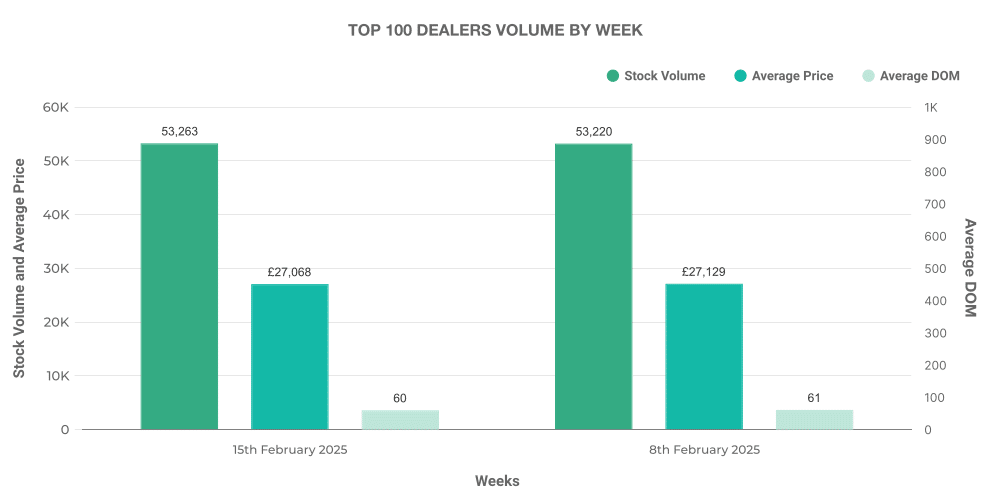

Notably, the top 100 dealers provided 15.5% of total listings, with a higher-than-average market price.

Electric Used Car Market – EV

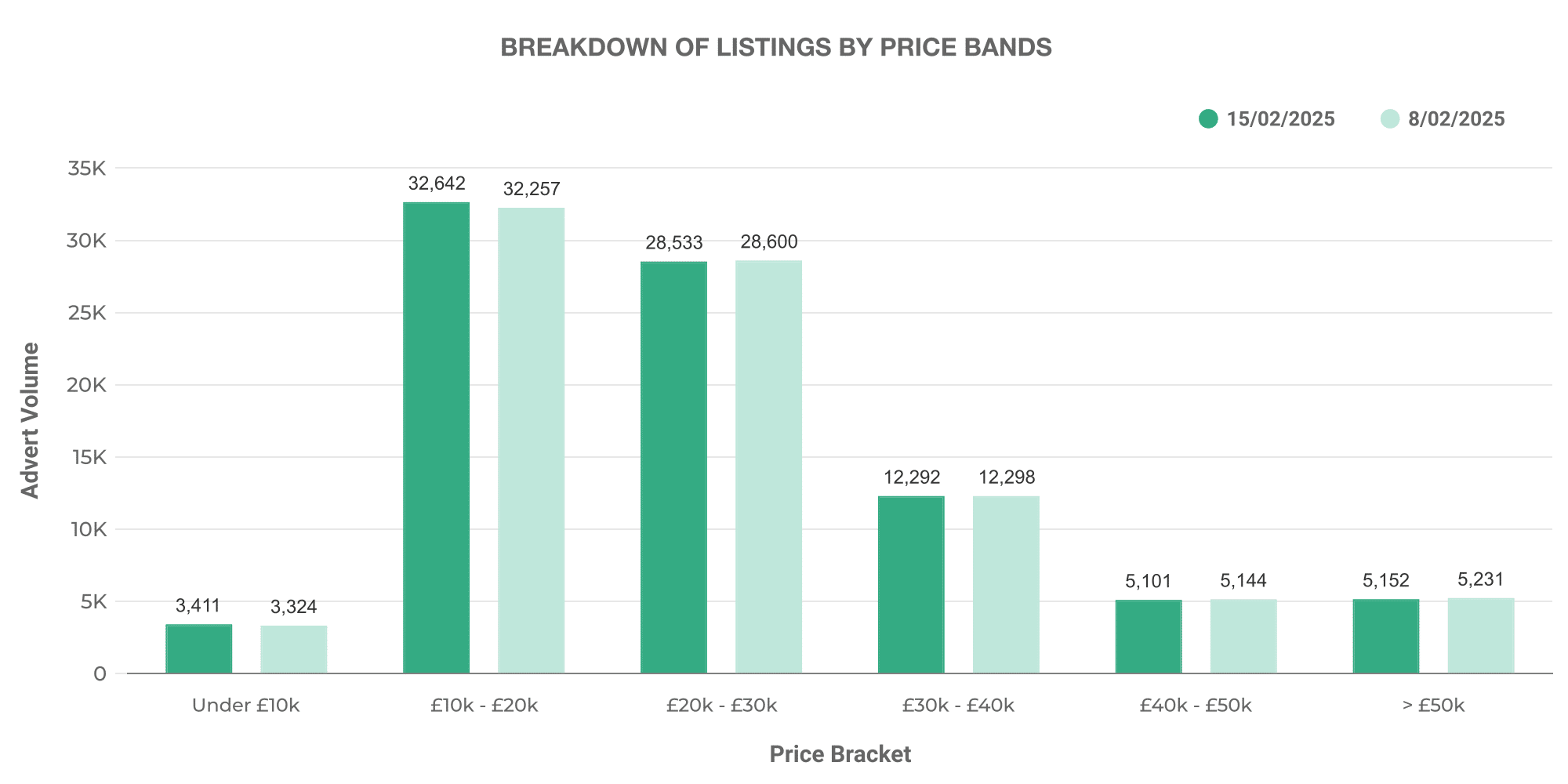

On the other hand, the electric used car market shows a total of 4497 dealers listed 88,450 used EVs within the same timeframe. The Average selling price of these EVs amounted to ~£26,596.

By and large, the majority of EVs were listed within the £10,000-£20,000 price range, although a significant volume also fitted the £20,000-£30,000 category. This suggests a diversified and growing market catering to various customer preferences.

Compared to the ICE market, EV dealer volumes were overwhelmingly concentrated in the 0 – 100 vehicle range. This distribution indicates a more reserved market, but the steady growth we’ve seen suggests an evolution may be in progress.

Interestingly, the top 100 EV dealers account for an even larger percentage than ICE, totalling 18.7% of all EV vehicle listings. The trend of selling at a more premium price than market average is echoed here again.

Comparison: ICE vs EV

When comparing the ICE and EV market, we observe a notable trend favouring the rise of EVs. With the ICE listings, we see stable participation spread across dealerships, reflected in a higher ratio of all vehicle listings.

However, the EV arena shows considerable promise. Although they currently represent a smaller percentage of overall sales, their percentage increase from the previous week denotes a positive and rapid growth trajectory. Moreover, the majority of dealerships are focusing on the lower price bands, implying an attempt to make these more sustainable options accessible across wider socio-economic strata.

In summary, the UK used car market continues to display dynamic shifts in buying patterns. There is a clear theme of sustainable choices gaining popularity, presenting potential growth opportunities for automotive businesses.

To gain a competitive edge, players within the sector must closely monitor these patterns and strategise accordingly. At Marketcheck UK, we provide the robust data and detailed analytics you need to make proficient, data-driven decisions that shape the future of your business. Contact us today to find out how we can assist you in your quest for market excellence.

Next week: 22nd February | Previous week: 8th February