Introduction

Keeping abreast of the latest trends is essential for dealers looking to leverage the growing electric car segment. This week’s analysis report provides a deep dive into the used electric car market, offering detailed insights that could significantly influence your buying and selling strategies.

Overview of Current Electric Car Market

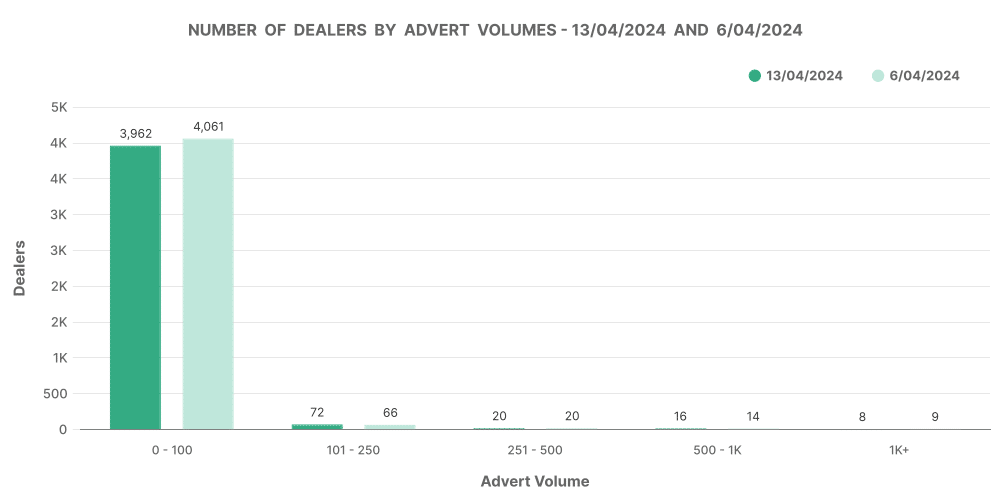

The data from the week starting 6th April 2024 shows a notable trend in electric vehicle (EV) listings and price dynamics across the UK. With a total of 4,174 dealers hosting 7,331 electric rooftops, the market saw an increase in total listings to 125,630. This suggests a growing acceptance and readiness among dealers to invest in electric vehicles. The slight decrease in average days on market (DOM) from 70 to 68 days indicates a quicker turnaround, reflecting a stronger demand for electric vehicles.

Price Trends and Volume Analysis

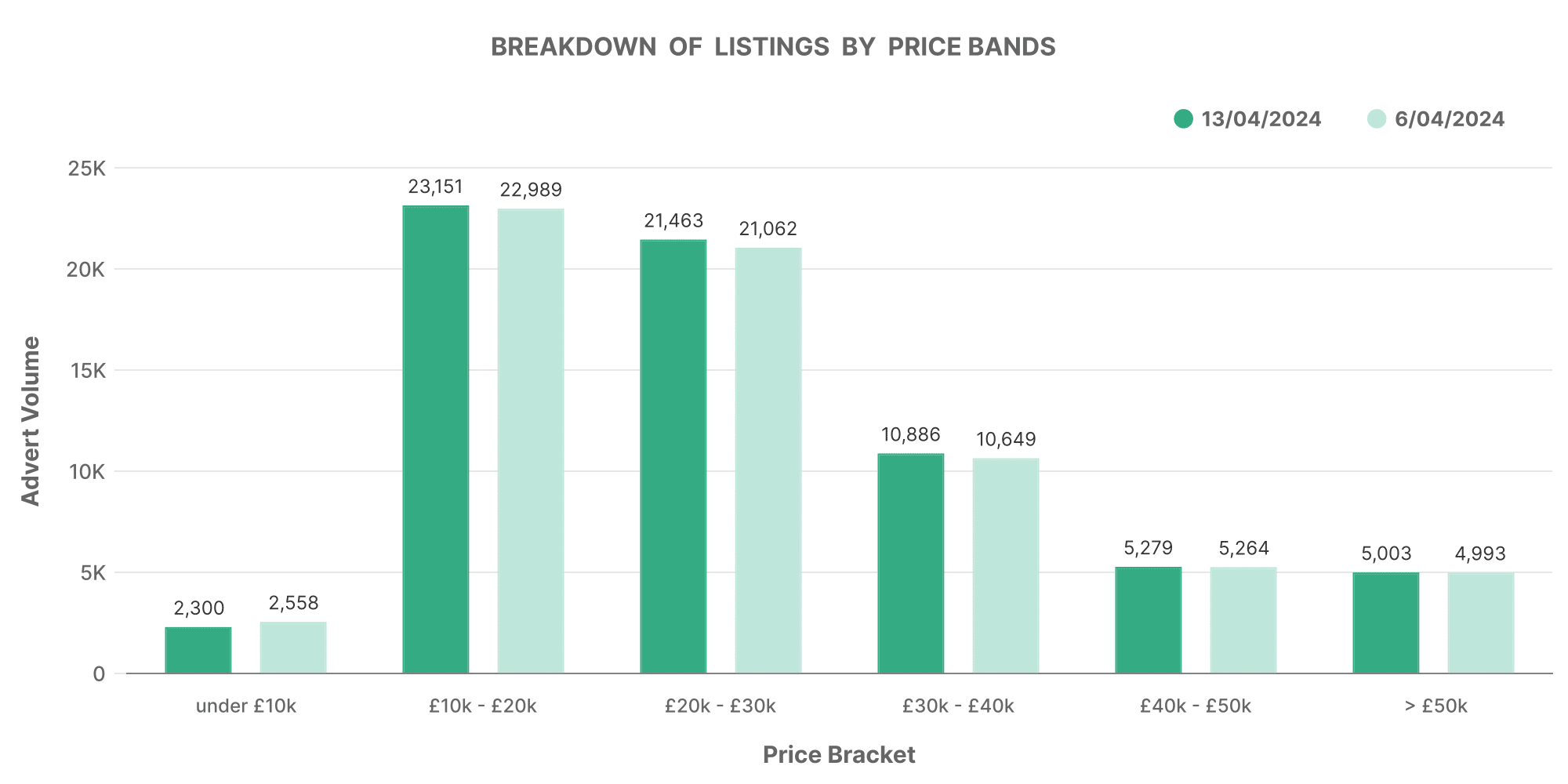

The average price of electric cars has seen a modest uptick this week, climbing to £28,344 from £28,295. This price increase is accompanied by shifts across various price bands:

- The volume in the lower price band (£0-10K) saw a small decrease, suggesting a possible shift in consumer preference towards mid-priced electric vehicles.

- The £10-20K and £20-30K bands experienced increases, indicating heightened activity in these segments, likely due to a blend of affordability and feature-rich models appealing to a broader audience.

- The higher price bands (£30K+) remained relatively stable with a slight decrease in the highest band (£50K+), possibly due to market corrections or lessened interest in premium models this week.

This nuanced understanding of price changes can help dealers pinpoint which segments to target for stock adjustments or marketing focuses.

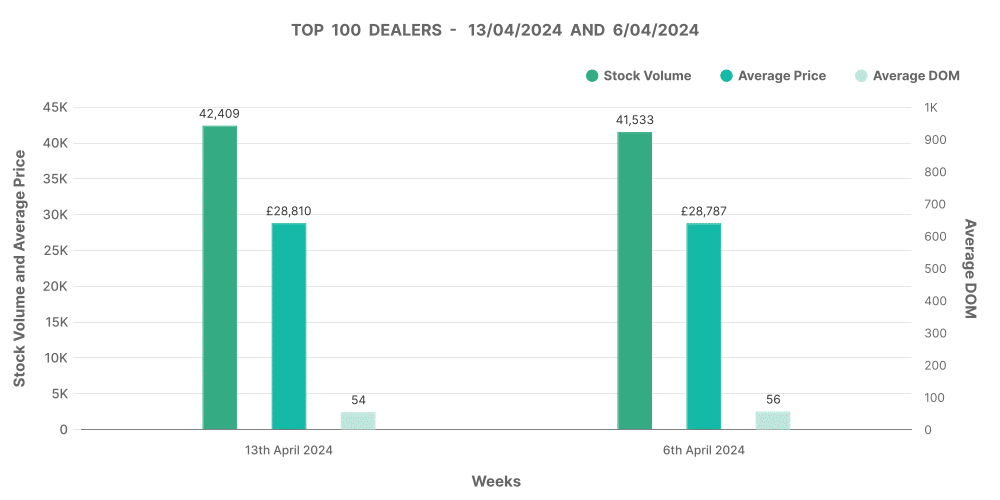

Insights from Top 100 Dealers by Volume

The top 100 dealers, holding significant sway in the market, showed an impressive average DOM of 54 days, which is better than the broader market average of 68 days. This efficiency in moving stock highlights the effectiveness of their pricing and marketing strategies. Their average price was slightly above the market average at £28,810, which could indicate a focus on higher-spec models or a more premium clientele.

Interestingly, there were 2,261 price increases and a substantial 14,540 price decreases among these top dealers. This active price management suggests a dynamic approach to optimise sales and adapt to market feedback.

Dealers Outside the Top 100

For dealers not within the top 100, the stock volume was substantial, but the average DOM was slightly higher at 90 days. This disparity underscores the challenges smaller dealers might face in pricing or marketing. The average price for these dealers was lower at £27,588, pointing towards a different strategic approach, possibly prioritising volume over margin.

Marketcheck UK: Tailoring Insights to Your Needs

At Marketcheck UK, our tools and data feeds, including APIs and spreadsheet analysis, are designed to help you understand such detailed market dynamics easily. Whether you’re adjusting your inventory based on price band trends or strategising based on the performance of top dealers, our real-time data equips you with the insights needed to make informed decisions.

How You Can Use This Data

- Pricing Strategy: Adjust your pricing to stay competitive within the observed trends of price increases and decreases.

- Inventory Management: Focus on stocking vehicles from segments showing increased activity and demand, such as the £10-20K price band.

- Marketing Focus: Tailor your promotions and marketing to highlight the faster-moving models, possibly leveraging the popular Toyota Yaris as shown in our top advertised make/model analysis.

Conclusion

This week’s analysis of the UK used electric car market reveals a landscape of opportunities for automotive dealers. By staying informed with comprehensive, up-to-date data from Marketcheck UK, you can enhance your competitive edge, optimise your stock levels, and refine your sales strategies to meet the evolving demands of the electric vehicle market. Our commitment is to provide you with the insights that not only reflect market trends but also drive your business growth.