Unlocking Insights into the UK Used Car Market

Navigating the UK’s used car market is like being a detective on a trail—you need clues, analysis, and up-to-date information to make the right decisions. At Marketcheck UK, we understand this challenge and provide comprehensive data that shines a light on market dynamics, helping automotive dealers maximise their business potential.

Overview of the Current Market

The latest data analysis from the week ending on 13th April 2024 presents some fascinating trends in the used car market that dealers can leverage. This week, we’ve noticed a slight dip in the total number of dealers but an uptick in the overall listings. Here’s a deeper look into what this means for you:

Total Listings and Dealer Activity

This week saw the total number of listings reach 844,216, a small increase from last week’s 843,815. Although the total number of dealers decreased from 10,407 to 10,336, the slight increase in listings suggests that remaining dealers are listing more vehicles, perhaps in anticipation of increased buyer activity as we move deeper into spring.

Price Trends and Volume

The average price of used cars has seen an increase, moving from £18,261 to £18,544. This could indicate a rise in higher-value vehicles entering the market, or perhaps a general increase in pricing strategies across the board. The breakdown of listings by price bands shows significant volumes in the £10K-£20K range, maintaining a strong preference for moderately priced vehicles.

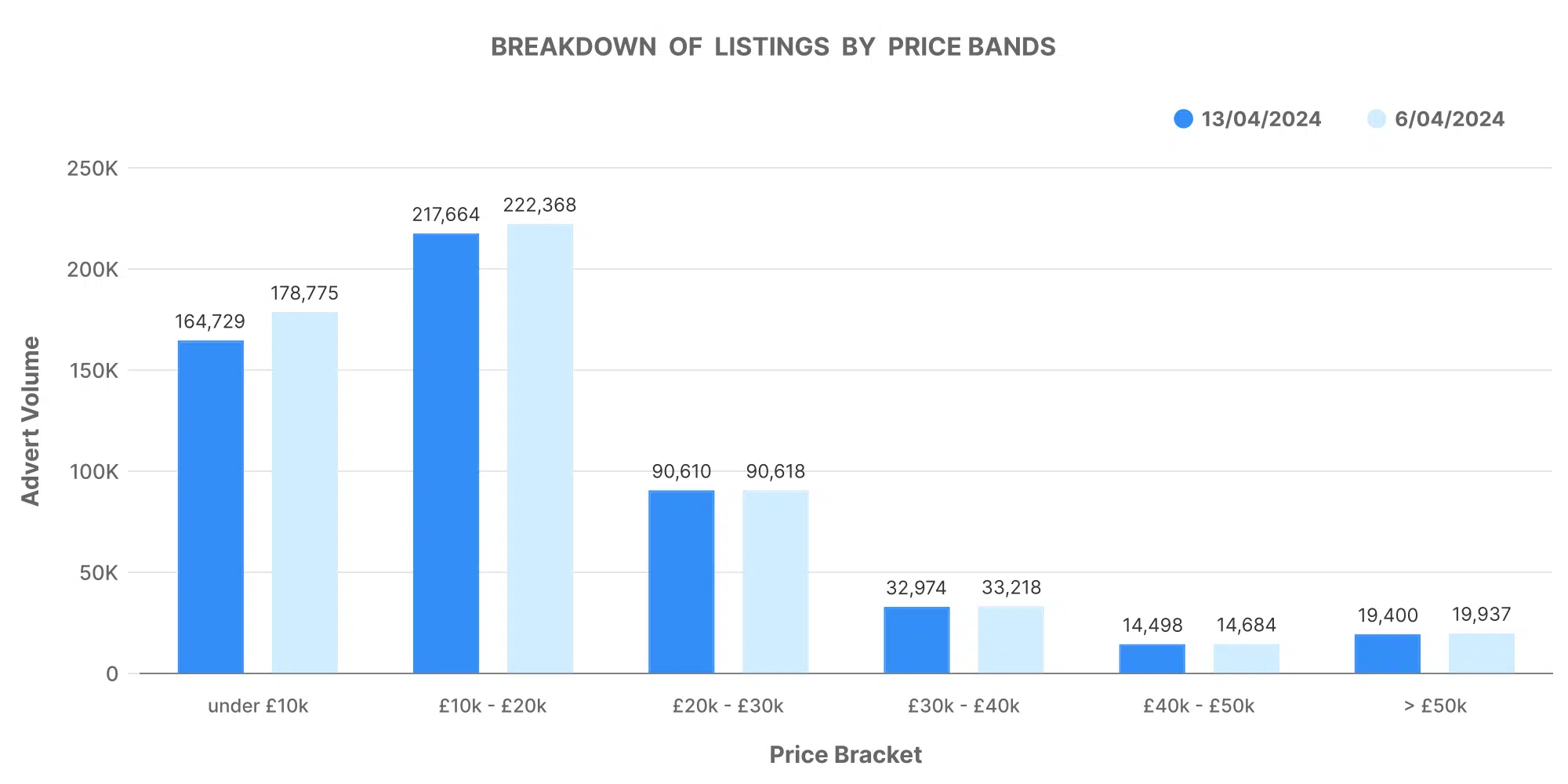

Breakdown of Listings by Price Bands

Understanding the segmentation of car prices can help dealers identify which price bands are most saturated and which offer more room for profit. Here’s a brief analysis of the current landscape:

- The £0-£10K band has decreased slightly in volume, suggesting a possible shift towards higher-priced vehicles.

- The £10K-£20K range remains the most populated. Consistency in this range might be due to a steady demand for mid-range vehicles, which are often popular among consumers looking for a balance between affordability and features.

- Higher price bands (£30K+) have seen slight fluctuations but remain less saturated, potentially offering lucrative opportunities for dealers focusing on premium models.

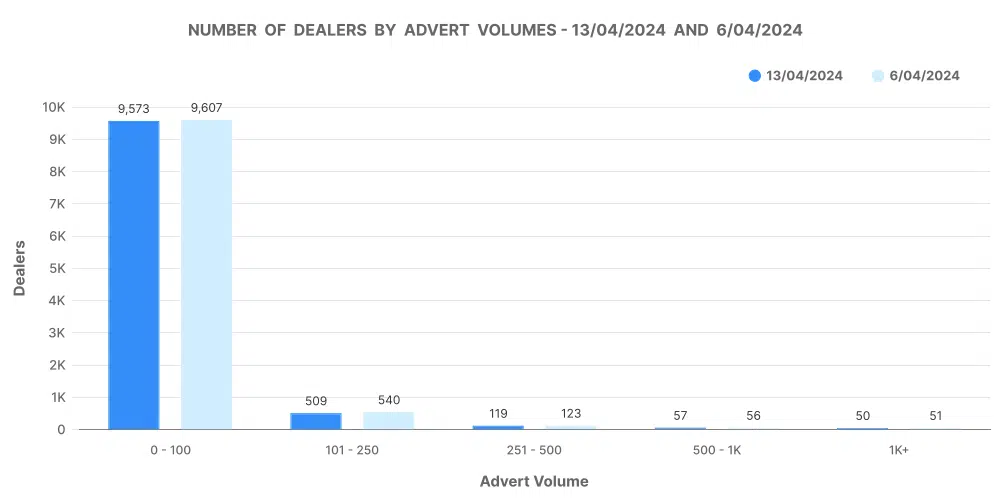

Number of Dealers by Advert Volumes

A key aspect of the market is understanding how many dealers are listing what volumes of cars. Our data shows:

- A significant number of dealers continue to operate within the 0-100 inventory volume band, suggesting a market dominated by smaller or specialised dealers.

- There is a noticeable presence of dealers with larger inventories (500-1K and 1K+), which aligns with well-established dealerships capable of maintaining extensive stock.

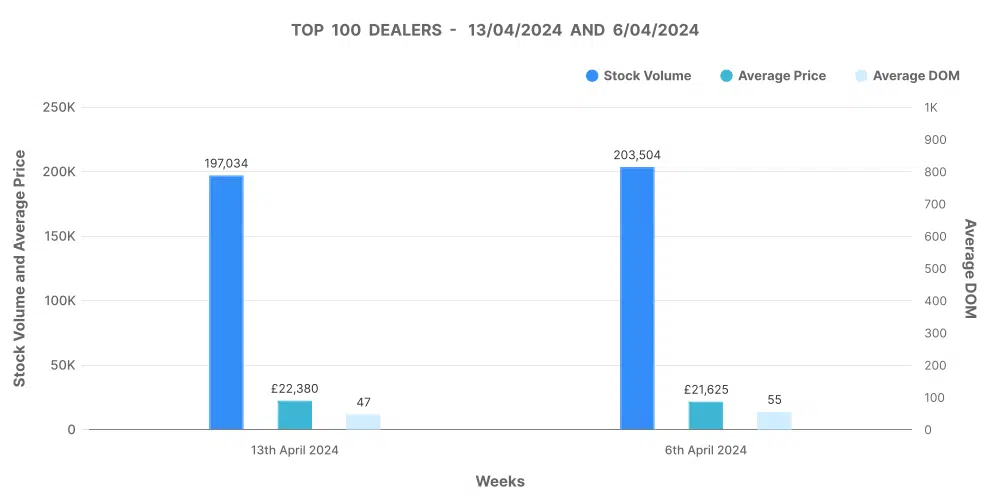

Analysis of Top 100 Dealers by Volume

The top 100 dealers are setting the pace in the market. They have a lower average ‘days on market’ (DOM) at 47 days compared to last week’s 55, indicating quicker sales processes and possibly more effective marketing strategies. Their average price is also higher at £22,380, reflecting a focus on premium vehicles which may be contributing to faster sales cycles.

Market Movements and Dealer Strategies

Dealers outside the top 100 are experiencing longer DOM (100 days), which could signal inefficiencies or a lack of alignment with market demands. This contrast highlights the importance of strategic pricing and inventory management to compete effectively.

How Marketcheck UK Supports Your Goals

At Marketcheck UK, our tools—ranging from API services to comprehensive data analysis platforms—are designed to equip you with the insights needed to understand these trends deeply and act upon them. Whether you are assessing price adjustments, stocking new inventory, or analysing competitor movements, our data helps you stay informed and competitive.

Conclusion: Staying Ahead in a Dynamic Market

In summary, the UK used car market is vibrant and filled with opportunities for dealers who are equipped with the right information and analysis. By utilising the detailed market insights provided by Marketcheck UK, you can enhance your decision-making process, optimise your inventory, and ultimately drive your dealership towards greater profitability and success.

Stay ahead of the curve by making data-driven decisions that not only keep you competitive but also anticipate future market movements.