Exploring the Current Landscape of the UK’s Electric Car Market

As we delve into the latest trends within the UK electric car market, it becomes clear that understanding these shifts is essential for automotive dealers looking to capitalise on the growing segment of electric vehicles (EVs). This week’s data, spanning from the 20th to the 27th of April 2024, provides detailed insights into price trends, dealer activities, and market dynamics.

Insights into Electric Car Price Trends and Dealer Activities

The total number of dealers involved in electric car sales has seen a slight increase, indicating a growing interest among automotive dealers to include EVs in their offerings. With 4321 dealers active this week compared to 4203 the previous week, the expansion in the dealer network is a positive sign for the market’s vitality.

The average price of electric cars has shown a slight decline from £28,252 to £27,816. This adjustment in pricing can be attributed to various factors including market saturation in certain price bands and perhaps a strategic pricing adjustment by dealers aiming to increase the turnover rate of their inventory.

Market Segmentation by Price Bands

This week’s data highlights a significant distribution across different price bands:

- £0-10K: 2,590 listings

- £10-20K: 25,394 listings

- £20-30K: 22,507 listings

- £30-40K: 11,577 listings

- £40-50K: 5,314 listings

- £50K+: 4,981 listings

The bulk of the inventory falls within the £10-20K and £20-30K price bands, which are traditionally popular segments offering a balance of affordability and advanced features. This concentration suggests a market preference that dealers should note, particularly when considering stock adjustments or promotional strategies.

Breakdown of Dealers by Advert Volumes

The distribution of electric vehicle inventory across different dealer volumes this week shows a diverse landscape of dealer engagement:

This distribution indicates a significant concentration of electric vehicle stocks in larger dealerships or dealer groups, which manage inventories exceeding 1,000 units. Such dealers are pivotal in shaping market perceptions and trends due to their substantial market share and influence. On the other hand, a considerable number of dealers operate on a smaller scale, with 4,100 dealers managing between 0 and 100 vehicles. These smaller dealers often cater to niche markets or specific geographical areas, providing tailored services and fostering customer loyalty on a more personal level.

Strategic Implications for Dealers

For automotive dealers analysing this data, it’s crucial to identify where they stand in this spectrum and adapt their business strategies accordingly. Larger dealers might focus on leveraging economies of scale, optimising inventory turnover, and utilising aggressive marketing strategies. In contrast, smaller dealers could benefit from focusing on niche markets, offering specialised services, or emphasising a unique selling proposition such as sustainability or exclusive electric vehicle brands.

Top 100 Dealers vs. The Broader Market

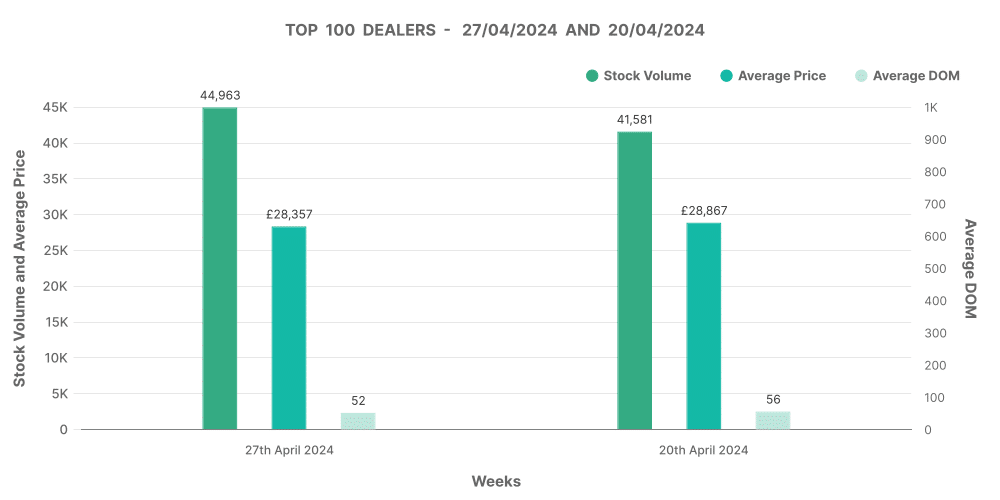

The performance of the top 100 dealers, often a bellwether for the overall market health, shows that these dealers are managing a quicker turnaround with an average ‘days on market’ (DOM) for electric vehicles at 52 days compared to 66 days across all dealers. This efficiency in sales can serve as a benchmark for other dealers aiming to optimise their sales strategies.

Moreover, the average price for electric vehicles among the top 100 dealers stands at £28,357, slightly higher than the market average, which is likely reflective of a premium product mix or a more effective pricing strategy.

Analytical Insights from Marketcheck UK

Using Marketcheck UK’s tools, dealers can gain access to these insights in real time, allowing them to make informed decisions on pricing, stock levels, and marketing approaches. Marketcheck UK’s API and data services provide a comprehensive view of the market, enabling dealers to track changes in demand and adjust their strategies accordingly.