In the fast-paced world of automotive dealing in the UK, understanding the current market dynamics is essential for dealers looking to make informed decisions about purchasing private cars for resale. This week’s analysis provides vital insights into the UK used car market, offering data-driven guidance to help dealers navigate this competitive landscape.

Market Overview

This week, we’ve observed a slight fluctuation in the total listings and a marginal decrease in the average days on market (DOM), indicating a slightly quicker turnover of vehicles. The number of total dealers and rooftops remained stable, suggesting a consistent market structure.

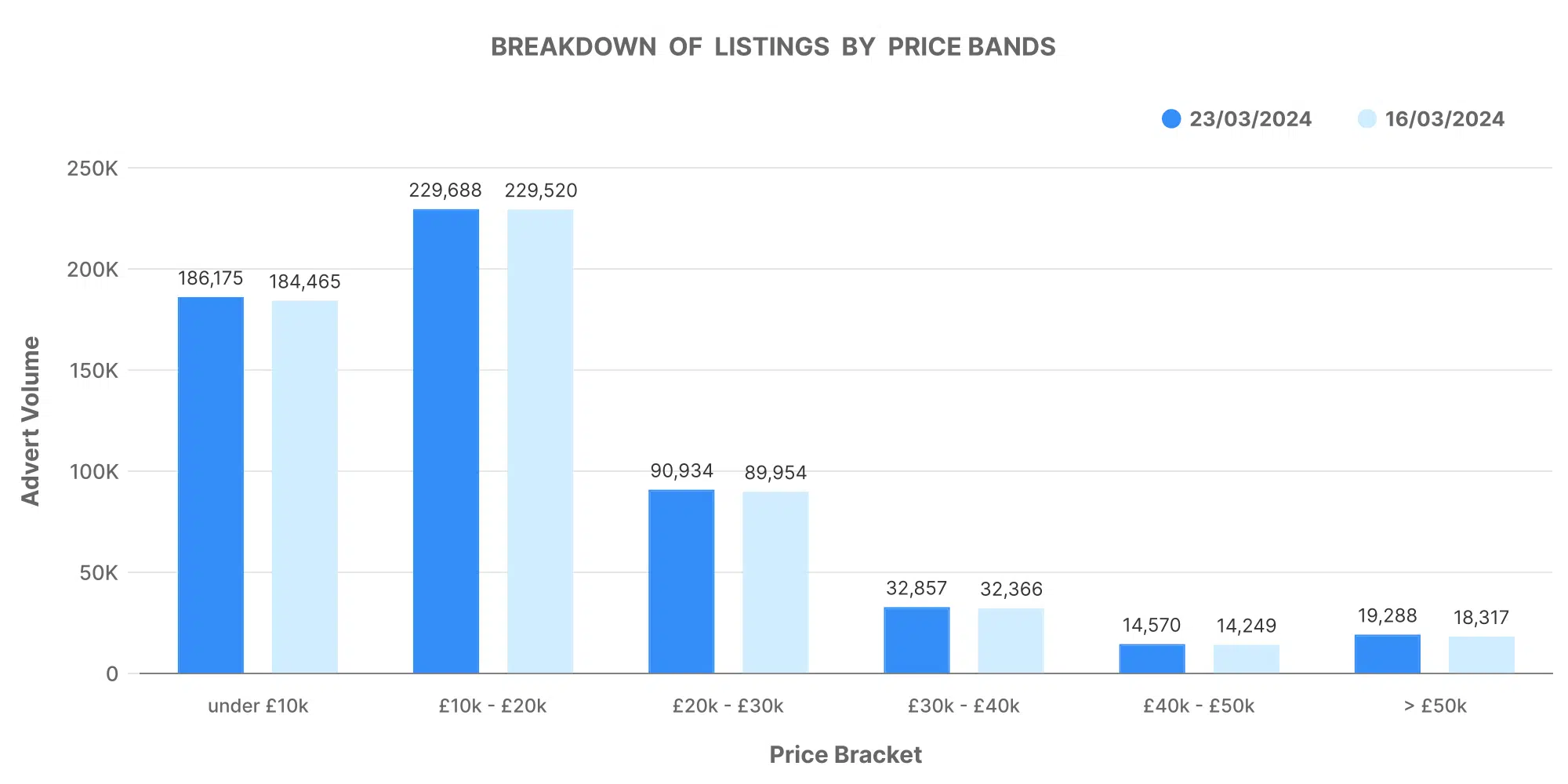

Breakdown of Listings by Price Bands

An essential part of this week’s analysis is the breakdown of listings by price bands. The data reveals that the volume of cars priced between £10,000 and £20,000 remains the largest segment, followed closely by the £0-£10,000 bracket. This trend suggests a strong market presence for affordable and mid-range vehicles, which are likely the most sought-after categories by consumers.

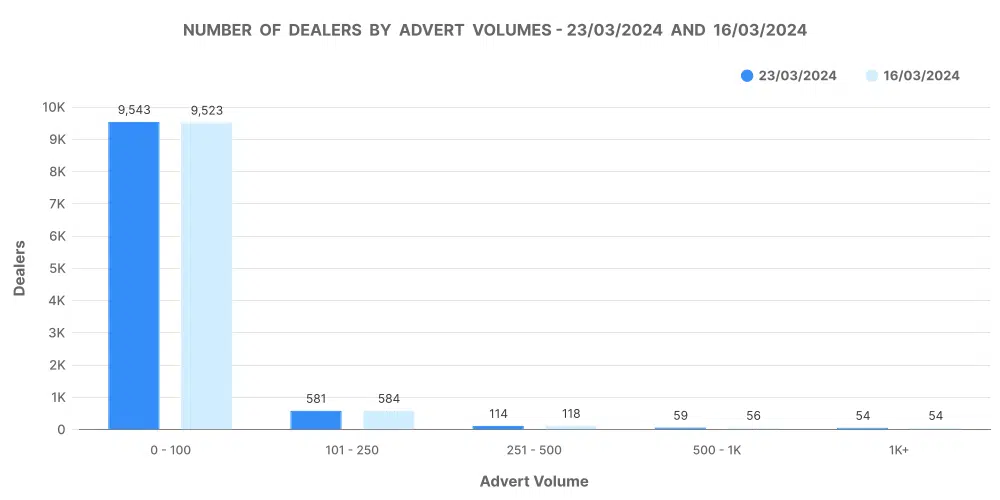

Number of Dealers by Advert Volumes

The distribution of advert volumes across dealers provides insight into market activity. A significant number of dealers fall into the lower inventory volume bands, with few dealers holding large inventories. This indicates a market dominated by smaller dealerships or those that prefer to maintain a selective inventory, potentially to minimise overheads or focus on specific market segments.

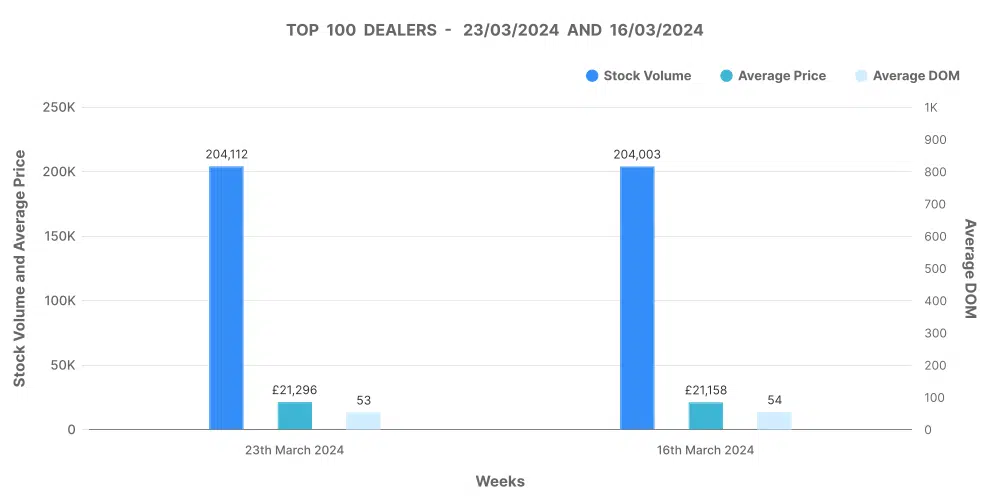

Analysis of Top 100 Dealers by Volume

Focusing on the top 100 dealers by volume offers a glimpse into the strategies of the market’s key players. These dealers have a shorter average DOM compared to the broader market, suggesting effective pricing and sales strategies that resonate with buyers. Their ability to adjust prices dynamically, as evidenced by the number of price increases and decreases, showcases the agility needed to stay competitive in this industry.

Marketcheck UK’s Relevance

For UK automotive dealers, Marketcheck UK stands as an indispensable resource, providing detailed and comprehensive data through various tools such as CSV feeds, APIs, and analysis tools. This wealth of information empowers dealers to make data-driven decisions, enhancing their ability to buy wisely, price competitively, and sell efficiently.

Conclusion

In conclusion, staying informed with the latest data and trends is crucial for UK automotive dealers aiming to capitalise on the current market conditions.